- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: Why do the boxes on my 1099 -R form not match the turbotax form?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do the boxes on my 1099 -R form not match the turbotax form?

my 2021 1099-R from Office of Personal Managment is not matching Turbo tax

e.g. it is putting insurance premiums inthe total employee contributions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do the boxes on my 1099 -R form not match the turbotax form?

Please clarify what box number you are referring to. Insurance premiums are not reported on a 1099-R. What state are you in? Office of Personnel Management does not help to figure out the problem. Could you please provide more information so that I can give you the correct guidance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do the boxes on my 1099 -R form not match the turbotax form?

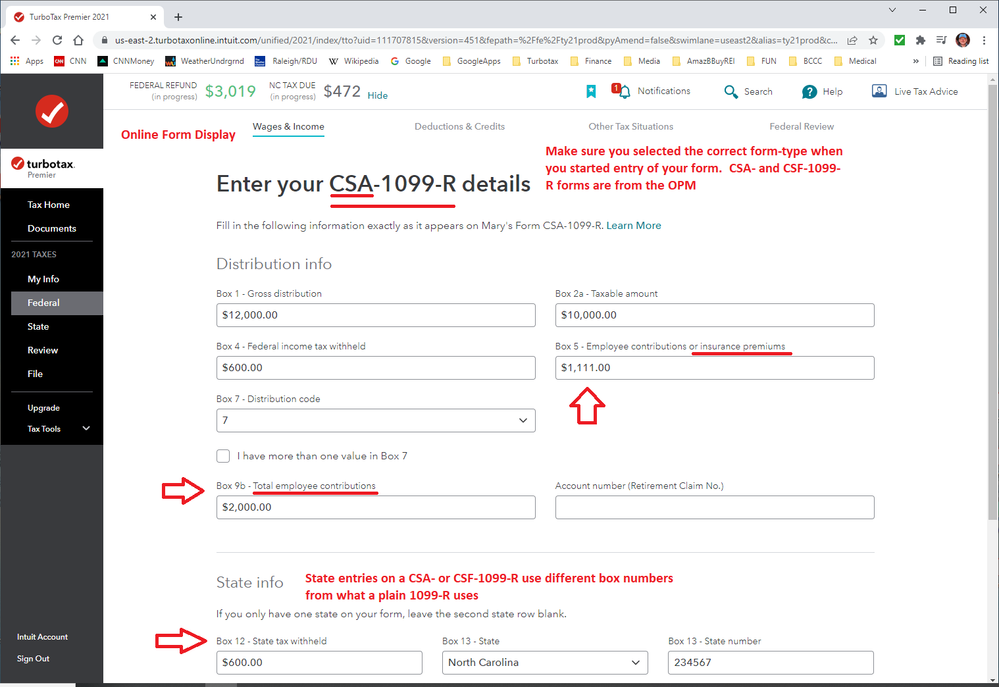

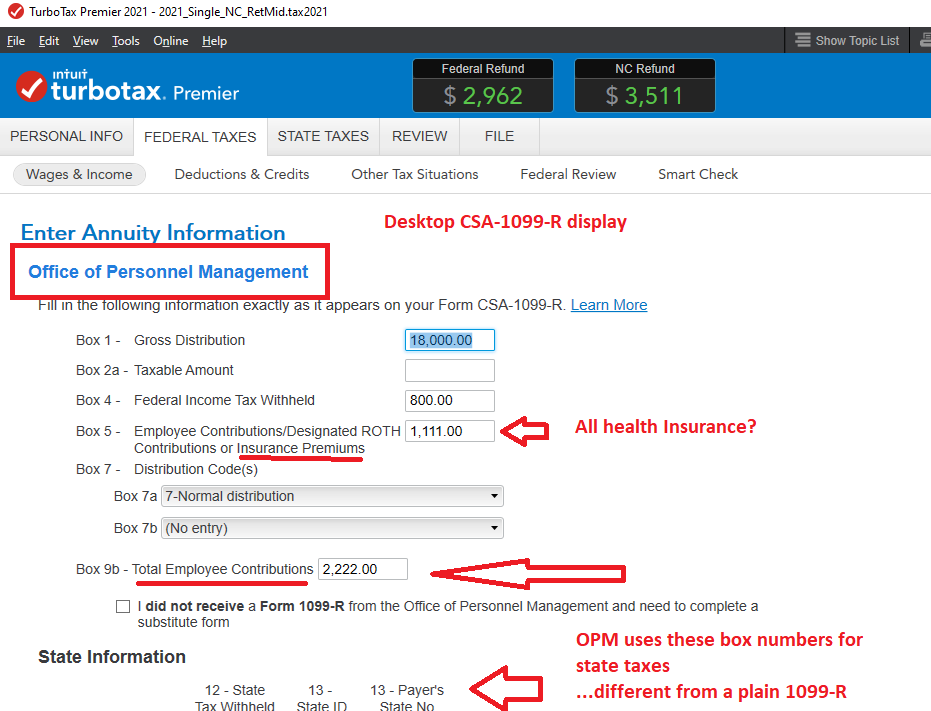

Make sure you are using the correct form-type when you enter that CSA- or CSF-1099-R.

Insurance premiums are in box 5 of the CSA-1099-R form....BUT....TTX will move that to another area on the background "worksheet" taht TTX uses. Ther is also a followup question after the main CSA-1099-R form that asks about the box 5 value that you need to answer:

_________________________________________

Main "Online" CSA-1099-R entry page:

_________________________________________________

____________________________________________________

Main "Desktop" CSA-1099-R entry page:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do the boxes on my 1099 -R form not match the turbotax form?

2021 paper copy from ND teacher fund for retirement is differant

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do the boxes on my 1099 -R form not match the turbotax form?

The 1099-R from an ND teacher's retirement (TFFR) would likely be just a plain 1099-R form. It would never be a CSA- or CSF-1099-R.

Boxes on that 1099-R "should" match the same boxes on the Software's standard 1099-R form....but if they don't, please describe to us which exact boxes don't match,,,and the labels on your TFFR 1099-R for those boxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do the boxes on my 1099 -R form not match the turbotax form?

The boxes on your ND Teacher Fund 1099R should match the TurboTax boxes. Here is a link for comparison to your paper copy.

- Next "Update" the "IRA, 401K, Pension Plan..." topic in the "Wage & Income" tab.

- "Delete" the 1099R that is reading improperly.

- "Yes" to confirm the deletion.

- "Add a 1099R"

- "I'll type it in myself"

- "Continue"

- Select the "1099R, withdrawal of money from 401K retirement..." option

- "Continue"

- The boxes should now match

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do the boxes on my 1099 -R form not match the turbotax form?

I have a similar issue: I received "Form 1099-R" Although I am Federal Govt, I am not civil service and the 1099 received does not have any other designation other than "Form 1099-R". The box numbers do not match those on turbotax. Example, my form has "State Tax Withheld" as box 12 (different than turbotax). AND my box 15 called "Health Benefits" does not even show up on the turbotax fields. Where do I enter the amount from my box 15? Thanks for any guidance you may have.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do the boxes on my 1099 -R form not match the turbotax form?

You can enter the health care premiums under

"Deductions & Credits"

"Medical"

Looks like FERS is reported on a 1099-R which uses a similar layout as a CSA 1099-R so please use that section in TurboTax to enter it.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do the boxes on my 1099 -R form not match the turbotax form?

Definitely....that looks like a CSA-1099-R if the state withholding is in box 12.

Look on the form again....the vertical squint-print on the Left side of your 1099-R form. They may be showing that it is a CSA-1099-R in that squint-print......even if they are foolishly misleading people by putting just "1099-R" in the upper rt corner.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do the boxes on my 1099 -R form not match the turbotax form?

Thank you SteamTrain and KrisD15 for your helpful replies. The form is indeed has the boxes set up that match with the CSA-1099-R and I am able to select CSA-1099-R, for a match. However, neither the squint print, margin print, instructions on the obverse side or any other typing identify it as CSA-1099-R. It consistently says "Form 1099-R" only. Both of your directions to treat if it were a CSA-1099-R did the trick!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do the boxes on my 1099 -R form not match the turbotax form?

KrisD15: Perfect -- thanks for your guidance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do the boxes on my 1099 -R form not match the turbotax form?

I do not have a box 9a on my 1099-r form. I don't have a clue about the percentage they ask about.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do the boxes on my 1099 -R form not match the turbotax form?

IRS Form 1099-R Instructions states:

Box 9a. Your Percentage of Total Distribution

If this is a total distribution and it is made to more than one person, enter the percentage received by the person whose name appears on Form 1099-R. You need not complete this box for any IRA distributions or for a direct rollover.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do the boxes on my 1099 -R form not match the turbotax form?

Turbo Tax REVIEW says theState/Payers state no. on my 1099-R is missing. That is CORRECT there is nothing on the 3 different forms I received from the tax payers I have accounts with. I have called the state of Iowa and they have not given a "number", I have used Turbo tax for 5 years. I looked and this form in previous years and it was not required!!! I have spent almost 5 hours trying to obtain this number. IS it absolutely required THIS year or can I ignore this number and move on?

Richard C.

[phone number removed]

[email address removed]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do the boxes on my 1099 -R form not match the turbotax form?

A couple things to try:

1) IF no IA state taxes were withheld, box 14 should be entirely empty...do not put a zero in box 14. A payer's state number is not needed in box 15 when no taxes were withheld for the state.

IF that doesn't work

2) make boxes 14, 15, and 16 all empty....no "IA" in the first part of box 15.

One of those should do it.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Sarmis

New Member

dinesh_grad

New Member

RyanK

Level 2

ajm2281

Level 1

rawalls18

New Member