- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: Why am I being taxed a 10% penalty for pulling retirement early if it should be excused due t...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I being taxed a 10% penalty for pulling retirement early if it should be excused due to covid 19 qualifications?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I being taxed a 10% penalty for pulling retirement early if it should be excused due to covid 19 qualifications?

A COVID-19 related distribution is reported on a new 8915-E form that is not yet available and there is no estimated release date since the form is still in the draft state at the IRS. There is no telling how long it will take the IRS to make the electronic form available.

The draft paper form 8915-E is here:

https://www.irs.gov/pub/irs-dft/f8915e--dft.pdf

https://www.irs.gov/pub/irs-dft/i8915e--dft.pdf

Also to see if you qualify for a COVID-19 related distribution see:

https://www.irs.gov/newsroom/coronavirus-related-relief-for-retirement-plans-and-iras-questions-and-...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I being taxed a 10% penalty for pulling retirement early if it should be excused due to covid 19 qualifications?

Thank you for response. Does that mean if I file now or before that form is available, that I will be automatically taxed the 10%?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I being taxed a 10% penalty for pulling retirement early if it should be excused due to covid 19 qualifications?

@Leann-tafolla wrote:

Thank you for response. Does that mean if I file now or before that form is available, that I will be automatically taxed the 10%?

If you file before the form is available the you will be knowingly filing a false and incomplete tax return - wait for the form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I being taxed a 10% penalty for pulling retirement early if it should be excused due to covid 19 qualifications?

Hello, I see there was an update on the IRS site today. It mentions a pdf form that is to be sent with my online form. Do you have an new information in regards to this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I being taxed a 10% penalty for pulling retirement early if it should be excused due to covid 19 qualifications?

The issue has been submitted and is currently under investigation. Please click on the following link and sign up for an email notification when it's fixed.

Thank You for your patience

If you are under age 59 1/2, the distribution from the retirement plans and IRAs is considered as an early withdrawal. Generally, you will pay both regular tax plus an additional 10% penalty of your entire distribution unless you met certain criteria. Due to the CARES Act, if your retirement distribution is related the Covid-19, you will not be liable for this additional penalty. You will still pay the normal taxes like your wages and income. For more information from the IRS, click here: Covid Relief. If your distribution is not related to the Covid, you will need to pay the penalty.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I being taxed a 10% penalty for pulling retirement early if it should be excused due to covid 19 qualifications?

That remains to be seen since the form itself is still in the draft state at the IRS.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I being taxed a 10% penalty for pulling retirement early if it should be excused due to covid 19 qualifications?

Is the online form available on turbo tax yet? I checked today as directed and I can’t find it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I being taxed a 10% penalty for pulling retirement early if it should be excused due to covid 19 qualifications?

The TurboTax 8915-E should be available on Feb. 25 (pending IRS approval by then). Updates are usually at night so check on the 26th.

See the forms availability list:

https://ttlc.intuit.com/community/forms/help/irs-forms-availability-table-for-turbotax-individual-pe...

The IRS just finalized the form on Feb 11. TurboTax must now submit their 8915-E software to the IRS for testing to be sure that both TurboTax and the IRS e-file computer are compatible. That process usually takes the IRS 2-3 weeks for approval to release the new form to the public.

See below for a link to sign up for an email when the form is ready.

This form is necessary to report COVID related distributions from IRA's and other retirement plans to report the distribution, pay it back over 3 years or spread the tax over 3 years.

A COVID-19 related distribution is reported on a new 8915-E form.

See this TurboTax FAQ to sign up for an e-mail when the form is ready.

https://ttlc.intuit.com/community/tax-topics/help/why-am-i-getting-getting-a-10-penalty-on-my-1099-r...

The TurboTax 8915-E should be available on Feb. 25 (pending IRS approval by then). Updates are usually at night so check on the 26th.

See the forms availability list:

https://ttlc.intuit.com/community/forms/help/irs-forms-availability-table-for-turbotax-individual-pe...

The IRS just finalized the form on Feb 11. TurboTax must now submit their 8915-E software to the IRS for testing to be sure that both TurboTax and the IRS e-file computer are compatible. That process usually takes the IRS 2-3 weeks for approval to release the new form to the public.

See below for a link to sign up for an email when the form is ready.

This form is necessary to report COVID related distributions from IRA's and other retirement plans to report the distribution, pay it back over 3 years or spread the tax over 3 years.

A COVID-19 related distribution is reported on a new 8915-E form.

See this TurboTax FAQ to sign up for an e-mail when the form is ready.

https://ttlc.intuit.com/community/tax-topics/help/why-am-i-getting-getting-a-10-penalty-on-my-1099-r...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I being taxed a 10% penalty for pulling retirement early if it should be excused due to covid 19 qualifications?

I filed my return before the 8915 was available and paid the 10% penalty. Can I do an amendment with the 8915 and get my 10% back? If so, can I do that online through my TurboTax account?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I being taxed a 10% penalty for pulling retirement early if it should be excused due to covid 19 qualifications?

Yes, you may amend your 2020 return to reclaim the 10% penalty amount.

- Log into Turbo Tax

- When you get to your landing page, scroll down to the bottom and select Your tax return and documents

- Select 2020 and then select change amend return

- When your amendment section happens, you may see an instant refund of your 10% penalty. If not:

- Go to federal>income and expenses>IRA, 401(k), Pension Plan Withdrawals (1099-R)>revisit

- Edit the 1099-R where you took the COVID distribution from'

- As you edit, just make sure you address all the COVID questions correctly so you can reclaim that penalty amount

- If you have issue, call tax support at 1-800-446-8848 and they can guide you through the system by looking at your screen. They can also help pinpoint any issues you may in reclaiming your 10% penalty.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I being taxed a 10% penalty for pulling retirement early if it should be excused due to covid 19 qualifications?

I tried to amend and get a message that the 1040x is not yet ready. Im not sure where to go to do the alternative...steps 5 thru 7 that you suggest. I dont see "federal" on the webite.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I being taxed a 10% penalty for pulling retirement early if it should be excused due to covid 19 qualifications?

The amend function will be available after March 25.

Do not rush to amend - no hurry. You have 3 years to amend and amended returns are taking 4-6 months or longer to be processed so waiting a few weeks will make little difference and amending too soon might just compound the problem.

To amend your 2020 tax return:

-- First, *wait* to see if your return has been accepted or rejected by the IRS or state. DO NOT do anything until you receive the accept or reject e-mail.

-- If rejected, you can correct and re-send your return.

-- If accepted you should *wait* until your return has been processed and you receive your refund or conformation that any tax due has been paid. (If you file an amended return while you first return is being processed it can cause extended delays for both returns if two returns are in the system at the same time). In addition, if the IRS makes any change on your original return, you might end up having to amend the amendment – a sticky process that can take a year or more).

-- Then you can start the amend process.

It is suggested that it be mailed certified with return receipt (or other tracking service) to verify that the IRS receives it. That is the only proof of mailing that the IRS will accept.

-- Amended returns can be mailed or e-filed - allow 8-12 weeks - can take up to 16 weeks (4 months) for processing.

See this TurboTax FAQ for help with amending:

https://ttlc.intuit.com/questions/1894381-how-to-amend-change-or-correct-a-return-you-already-filed

You can check the status of your amended return here but allow 3 weeks after filing for it to show up:

https://www.irs.gov/filing/wheres-my-amended-return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I being taxed a 10% penalty for pulling retirement early if it should be excused due to covid 19 qualifications?

I am in turbo tax to edit my 1099-R and do not see where I can perform item Go to federal>income and expenses>IRA, 401(k), Pension Plan Withdrawals (1099-R)>revisit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I being taxed a 10% penalty for pulling retirement early if it should be excused due to covid 19 qualifications?

Try this instead.

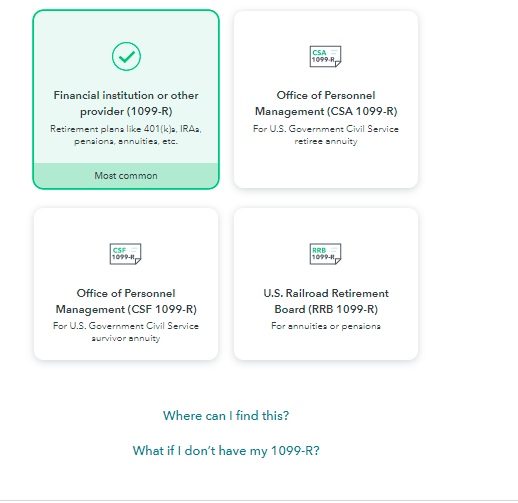

The 1099 R will be entered in the Retirement Plans and Social Security section.

• Select Federal Taxes

• Select Wages and Income

• Select Show More at Retirement Plans and Social Security

• Select IRA, 401(k), Pension Plan Withdrawals (1099-R)

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

hbearden87

New Member

ctq515

New Member

jasred

Returning Member

mrboudan

New Member

mrjoeya2013

Level 1