- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: Where do I enter tax penalty exemption for early retirement withdrawal based on age 55 rule f...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter tax penalty exemption for early retirement withdrawal based on age 55 rule for terminated employment ?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter tax penalty exemption for early retirement withdrawal based on age 55 rule for terminated employment ?

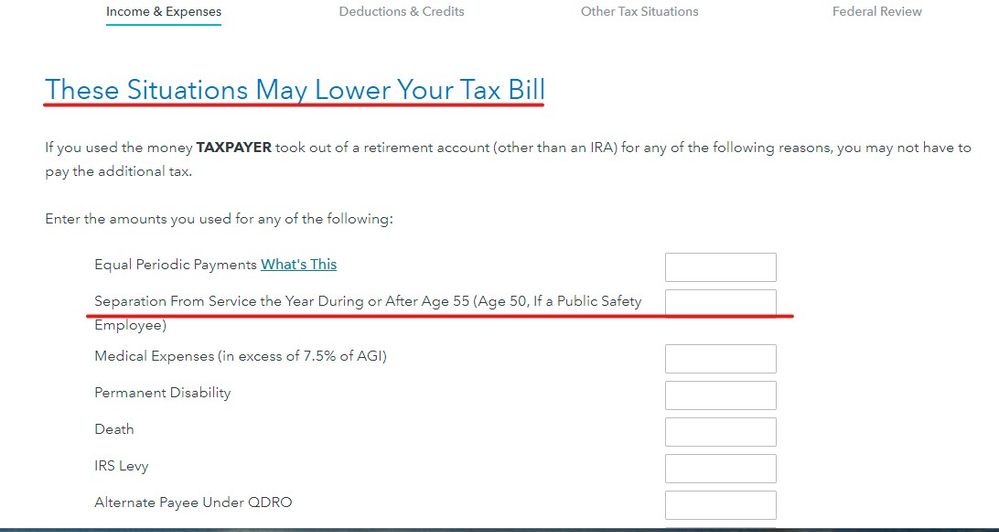

The screen to claim an exception to the 10% based on your age of 55 or older is found a few screens after the 1099-R input screen.

Please follow the directions below to find the correct screen.

- Log in and click take me to my return (unless already in).

- Click the federal tab on the left.

- Click the Wages & Income tab at the top of the page.

- Click the edit tab beside IRA, 401(k), Pension Plan Withdrawals (1099-R) or scroll down to enter your 1099-R.

- Click continue once you have edited or input your Form 1099-R. You should be led to a screen titled Let's see if we can reduce your early withdrawal penalty. Click continue and answer the question on the next screen.

- On the next screen, you will see a list of exceptions. Type in the full amount of your withdrawal next to the option that says Separation From Service the Year During or After Age 55 (Age 50, If a Public Safety Employee)

(See my screenshots below for reference)

Note: The age 55 exception is only available for distributions from company plans, such as 401(k)s and 403(b)s. It DOES NOT apply to distributions from IRAs or IRA based plans, like SEP and SIMPLE IRAs.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter tax penalty exemption for early retirement withdrawal based on age 55 rule for terminated employment ?

The screen to claim an exception to the 10% based on your age of 55 or older is found a few screens after the 1099-R input screen.

Please follow the directions below to find the correct screen.

- Log in and click take me to my return (unless already in).

- Click the federal tab on the left.

- Click the Wages & Income tab at the top of the page.

- Click the edit tab beside IRA, 401(k), Pension Plan Withdrawals (1099-R) or scroll down to enter your 1099-R.

- Click continue once you have edited or input your Form 1099-R. You should be led to a screen titled Let's see if we can reduce your early withdrawal penalty. Click continue and answer the question on the next screen.

- On the next screen, you will see a list of exceptions. Type in the full amount of your withdrawal next to the option that says Separation From Service the Year During or After Age 55 (Age 50, If a Public Safety Employee)

(See my screenshots below for reference)

Note: The age 55 exception is only available for distributions from company plans, such as 401(k)s and 403(b)s. It DOES NOT apply to distributions from IRAs or IRA based plans, like SEP and SIMPLE IRAs.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter tax penalty exemption for early retirement withdrawal based on age 55 rule for terminated employment ?

Is this information still valid for tax year 2021? I don't see the screen after entering my 1099R.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter tax penalty exemption for early retirement withdrawal based on age 55 rule for terminated employment ?

Yes, it still exists. Make sure the IRA box is not checked if you have a pension. Also, answer yes, that you got periodic payments.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter tax penalty exemption for early retirement withdrawal based on age 55 rule for terminated employment ?

I assume you mean periodic payments based on life expectancy. I cannot find documentation in IRS code that requires periodic payments for qualified rule of 55 withdrawers. If turbotax has programmed it this way I need to know why.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter tax penalty exemption for early retirement withdrawal based on age 55 rule for terminated employment ?

If you have a code 1 in box 7 of the form 1099-R then follow the interview screens in that section ... if you are subject to a penalty then the options to waive the penalty will be shown ...

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Jeffsjams

Returning Member

gwalls2002

New Member

InTheRuff

Returning Member

kwhite7777

New Member

manwithnoplan

Level 2