- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: When will update for CARES act 1099-R distributions be ready? It continues to say "You'll nee...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will update for CARES act 1099-R distributions be ready? It continues to say "You'll need to visit the Form 1099-R Retirement topic"

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will update for CARES act 1099-R distributions be ready? It continues to say "You'll need to visit the Form 1099-R Retirement topic"

Please see IRS forms availability table for TurboTax individual (personal) tax products for when Form 8915-F will be available.

Once the section is available follow these steps to report any further tax to be paid or any repayment:

- Login to your TurboTax Account

- Click on the Search box on the top and type “1099-R”

- Click on “Jump to 1099-R”

- If you do not have any 2021 1099-R answer "No" to "Did you get a 1099-R in 2021?" (If you have any other 1099-R then enter all 1099-R and after entering your last 1099-R click "Continue" on the “Review your 1099-R info” screen)

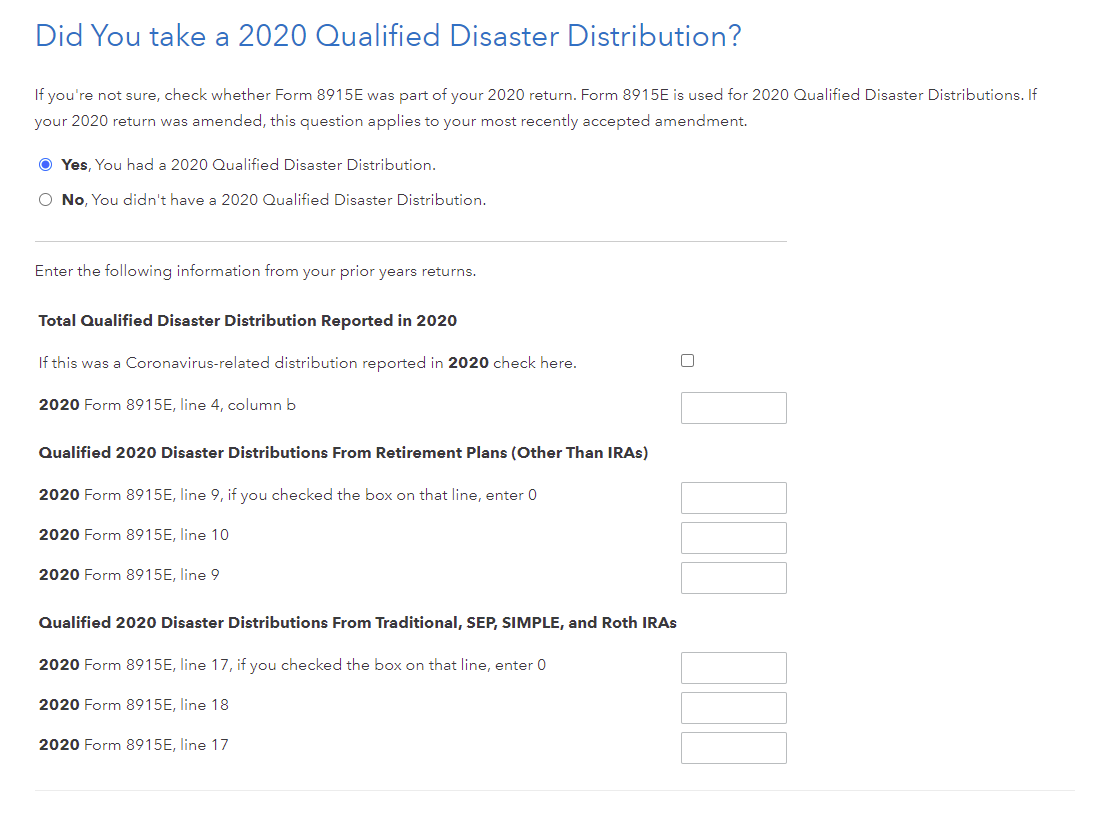

- Answer "Yes" to the "Have you ever taken a disaster distribution before 2021?" screen

Please be aware, you’ll have three years to pay back the funds you withdrew, without the amount impacting that year’s cap on contributions. If you pay back the amount within that time, you’ll be able to claim a refund on those taxes paid when you file an amended tax return.

Example from the IRS:

"If, for example, you receive a coronavirus-related distribution in 2020, you choose to include the distribution amount in income over a 3-year period (2020, 2021, and 2022), and you choose to repay the full amount to an eligible retirement plan in 2022, you may file amended federal income tax returns for 2020 and 2021 to claim a refund of the tax attributable to the amount of the distribution that you included in income for those years, and you will not be required to include any amount in income in 2022."

Please see IRS Coronavirus-related relief for retirement plans and IRAs for more details.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will update for CARES act 1099-R distributions be ready? It continues to say "You'll need to visit the Form 1099-R Retirement topic"

Please see IRS forms availability table for TurboTax individual (personal) tax products for when Form 8915-F will be available.

Once the section is available follow these steps to report any further tax to be paid or any repayment:

- Login to your TurboTax Account

- Click on the Search box on the top and type “1099-R”

- Click on “Jump to 1099-R”

- If you do not have any 2021 1099-R answer "No" to "Did you get a 1099-R in 2021?" (If you have any other 1099-R then enter all 1099-R and after entering your last 1099-R click "Continue" on the “Review your 1099-R info” screen)

- Answer "Yes" to the "Have you ever taken a disaster distribution before 2021?" screen

Please be aware, you’ll have three years to pay back the funds you withdrew, without the amount impacting that year’s cap on contributions. If you pay back the amount within that time, you’ll be able to claim a refund on those taxes paid when you file an amended tax return.

Example from the IRS:

"If, for example, you receive a coronavirus-related distribution in 2020, you choose to include the distribution amount in income over a 3-year period (2020, 2021, and 2022), and you choose to repay the full amount to an eligible retirement plan in 2022, you may file amended federal income tax returns for 2020 and 2021 to claim a refund of the tax attributable to the amount of the distribution that you included in income for those years, and you will not be required to include any amount in income in 2022."

Please see IRS Coronavirus-related relief for retirement plans and IRAs for more details.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will update for CARES act 1099-R distributions be ready? It continues to say "You'll need to visit the Form 1099-R Retirement topic"

This is still an issue on 3/25. The link provided above says the form is available, yet the online filing software still says to revisit the topic. Going back to revisit information I've already provided doesn't change the response from the system. It's still broken. Giving up and filing by paper. This is ridiculous.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will update for CARES act 1099-R distributions be ready? It continues to say "You'll need to visit the Form 1099-R Retirement topic"

It is not broken. Follow the instructions on the screen to visit the 1099-R section. You will get to the screen to finish up your tax return.

@cindyhuckabee

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will update for CARES act 1099-R distributions be ready? It continues to say "You'll need to visit the Form 1099-R Retirement topic"

It still tells me to revisit that page as well. I entered the information it requested and it still does it. So I entered the 1099-R again but I don’t think I should. Idk what to do.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will update for CARES act 1099-R distributions be ready? It continues to say "You'll need to visit the Form 1099-R Retirement topic"

It is ready now. Log out of the return and clear cache and cookies. Maybe even try a new browser.

- Login to TurboTax

- Click on the Search box on the top and type “1099-R”

- Click on “Jump to 1099-R”

- If you do not have any 2021 1099-R answer "No" to "Did you get a 1099-R in 2021?"

- Answer "Yes" to the "Have you ever taken a disaster distribution before 2021?" screen.

You will be guided through the screens.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will update for CARES act 1099-R distributions be ready? It continues to say "You'll need to visit the Form 1099-R Retirement topic"

I get the same error seen above. When I get to section 6 of 9, I fill out the details you posted. As I go through the next sections (7 through 9) it takes me through some final checks before moving to deductions and credits. Before it let's me move on, this warning pops up. It is not properly reporting the 8915-F form information I entered. I am showing I had distribution this year, but it looks as if Turbo Tax expects a 1099-R for 2021, which we will not have. We should simply be using the 8915-F to report taxable income in 2021 from the 2020 distribution.

After I enter the information from the 2020 8915-E form and return to the main income section screen, it still reports $0 for 2021. This is on Turbo Tax Deluxe for Mac.

What is even more annoying is Turbo Tax does not automatically import this from the 2020 tax file, if I have to do to this all manually I might as well skip Turbo Tax in 2023...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will update for CARES act 1099-R distributions be ready? It continues to say "You'll need to visit the Form 1099-R Retirement topic"

I'm having this same problem.

Then when I continue and it checks the Federal return is telling me to enter FEMA Disaster Number??? Anybody know what to do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will update for CARES act 1099-R distributions be ready? It continues to say "You'll need to visit the Form 1099-R Retirement topic"

I ended up calling. The lady I spoke with said to put Covid Relief and leave the FEMA # empty. It worked for me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will update for CARES act 1099-R distributions be ready? It continues to say "You'll need to visit the Form 1099-R Retirement topic"

I called and they walked me through it. Everything worked and I was able to submit my taxes while I was on the phone with them to make sure I didn’t have anymore issues.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will update for CARES act 1099-R distributions be ready? It continues to say "You'll need to visit the Form 1099-R Retirement topic"

For those people it worked for, how did you get past that step? At what point did it actually re-calculate your taxes owed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will update for CARES act 1099-R distributions be ready? It continues to say "You'll need to visit the Form 1099-R Retirement topic"

Anyone? After that error, I can go all the way through submission without any change. It is not counting that towards my taxable income. This is very frustrating.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will update for CARES act 1099-R distributions be ready? It continues to say "You'll need to visit the Form 1099-R Retirement topic"

@budchevy358 wrote:

Anyone? After that error, I can go all the way through submission without any change. It is not counting that towards my taxable income. This is very frustrating.

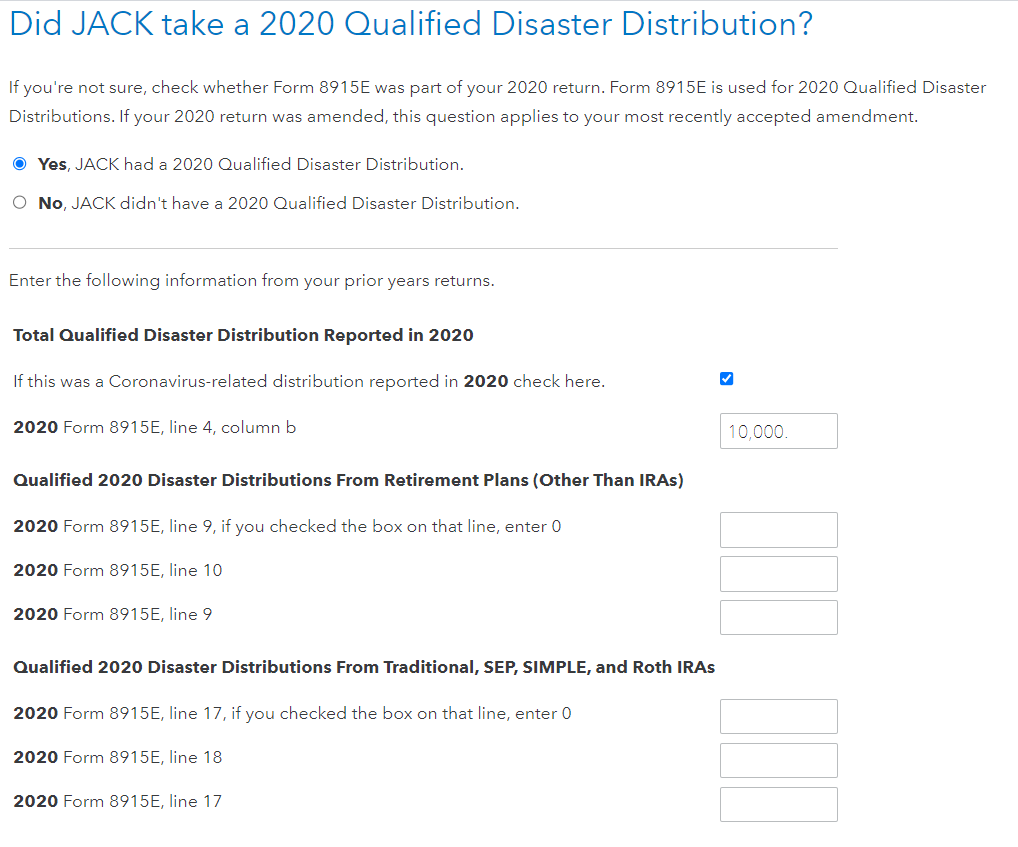

Follow this procedure and make sure that you enter the amount of the 2nd year of the distribution in both boxes -

You must go to the Retirement Income section of the program for a Form 1099-R to be able to enter your 2nd year of the 2020 distribution -

Click on Federal

Click on Wages & Income

Scroll down to Retirement Plans and Social Security

On IRA, 401(k), Pension Plan Withdrawals (1099-R), click on the Start or Revisit button

On the screen Did you get a 1099-R in 2021? Click on NO, if you did not receive a 2021 Form 1099-R

If you had a Covid-19 related distribution in 2020 and selected to spread the distribution over 3 years -

Answer Yes when asked Have you ever taken a disaster distribution before 2021?

Answer Yes when asked if you took a Qualified 2020 Disaster Distribution

Check the box that this was a Coronavirus-related distribution reported in 2020

In the box 2020 Form 8915-E, line 4, column b - Leave blank or enter a 0

This is not required on a Form 8915-F for a Coronavirus-related distribution

If the 2020 distribution was from an account that was Not an IRA

Enter 1/3 of the amount from the 2020 distribution in both boxes for Line 9

2020 Form 8915E, line 9, if you checked the box on that line, enter 0

2020 Form 8915E Line 9

If the 2020 distribution was from an IRA account

Enter 1/3 of the amount from the 2020 distribution in both boxes for Line 17

2020 Form 8915E, line 17, if you checked the box on that line, enter 0

2020 Form 8915E Line 17

Do not enter anything in the other boxes, leave them blank (empty)

The 1/3 of the amount from the 2020 distribution will be entered on the 2021 Form 1040 Line 4b if from an IRA or on Line 5b if from a retirement plan other than an IRA

After completing the Wages & Income section you will land on a screen Did you take a disaster distribution at any time between 2018 and 2020?

Answer NO since you have already completed the entering the 1/3 of the 2020 distribution.

You can view your Form 1040 at any time using the online editions. Click on Tax Tools on the left side of the online program screen. Click on Tools. Click on View Tax Summary. Click on Preview my 1040 on the left side of the screen.

Using the desktop editions click on Forms. Open the Form 1040

NOTE - During Federal Review you may get a notice to check an entry. Clicking Check Entries takes you to the Check This Entry screen showing a box for entering a FEMA Disaster name. Put your cursor in the box (click in the box) and then click on the spacebar. Click on Continue On the following screen Run Smart Check Again click on Done.

The Form 8915-F you completed already has the box for the Coronavirus checked on Item D of the form.

As stated on the Form 8915-F -

If your disaster is the coronavirus, check this box ▶ Don’t list the coronavirus in item C.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will update for CARES act 1099-R distributions be ready? It continues to say "You'll need to visit the Form 1099-R Retirement topic"

Thanks for the reply. I ended up having to start the return all over. When I realized I selected myself instead of y wife having the distribution, I had to start all over again.

There is a bug or something in there and it is not recalculating. What a pain!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Smurfect

New Member

tbduvall

Level 4

currib

New Member

trust812

Level 4

banditsfrog75

New Member