- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: What is the proper way to adjust the cost basis for the SLV / GLD ETFs that are structured as...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is the proper way to adjust the cost basis for the SLV / GLD ETFs that are structured as trusts, and have monthly expenses that show up on your 1099-B?

The Acquired Date must be retrieved from your records, and there is already a publicly available calculator to determine your cost basis for these trust expenses. My question is how do you enter this information properly into TT?

The "Cost or other basis" line item for the transaction is blank in TT and there is also a checkbox for "The cost basis is incorrect or missing on my 1099-B"

1 - Do you fill out the calculated Cost Basis (which is missing on the 1099-B) and check the box for cost basis is incorrect or missing?

2 - Do you leave the Cost Basis line empty (as it is on the 1099-B), check the box for cost basis is incorrect or missing, and then go to the next section and adjust the actual cost basis when asked by TT?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is the proper way to adjust the cost basis for the SLV / GLD ETFs that are structured as trusts, and have monthly expenses that show up on your 1099-B?

To correct the cost basis on stocks from a 1099-B

- Start at Investment income

- Select Stocks, Mutual Funds ....

- Choose the Broker or Institution

- Select the individual stock

- The data you entered will be there

- Toward the bottom of the screen select [I'll enter additional info on my own]

- In the entry for Box 2 enter Corrected Cost Basis

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is the proper way to adjust the cost basis for the SLV / GLD ETFs that are structured as trusts, and have monthly expenses that show up on your 1099-B?

Hi John,

Your answer doesn't answer my specific question. I'm asking specifically how to input the adjusted basis into the TT module after you've imported the 1099-B and clicked on the specific SLV trade for which the cost basis must be adusted.

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is the proper way to adjust the cost basis for the SLV / GLD ETFs that are structured as trusts, and have monthly expenses that show up on your 1099-B?

Yes, and my description is correct.

- Select the individual transaction

- Toward the bottom of the screen select [I'll enter additional info on my own]

- In the entry for Box 2 enter Corrected Cost Basis

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is the proper way to adjust the cost basis for the SLV / GLD ETFs that are structured as trusts, and have monthly expenses that show up on your 1099-B?

Hey John -

Thank you for your post, you def know more than I do for this. Respect!

I have followed the directions you list here and I see each monthly proceed for the sale of GLD shares to pay expenses.

I am getting hung up on the costs basis. I have followed all five steps for all the five purchases I made in 2019 of the GLD trust: https://www.spdrgoldshares.com/media/GLD/file/SPDR-Gold-Trust-Tax-Information-2019.pdf

I have so much data, new cost basis for each lot for 21/31/2019, total gains / loss for each lot, cost of gold sold, etc

I also have the Cost Basis Factor on the broker 1099-B, cost basis for each lot, etc

It's a lot of data points and it seems like I have everything it's just not clicking for me.

Any insight on how to calculate the data for "Box 1e - Cost or other basis" would be greatly appreciated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is the proper way to adjust the cost basis for the SLV / GLD ETFs that are structured as trusts, and have monthly expenses that show up on your 1099-B?

I wasted 3 hours on the phone with TD Ameritrade and Turbotax CPAs. There isn't a single person who knows how to resolve this, nor wants to spend the time to figure it out. I'm very disappointed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is the proper way to adjust the cost basis for the SLV / GLD ETFs that are structured as trusts, and have monthly expenses that show up on your 1099-B?

if you hold these ETFs in a non-tax-deferred account, you get twelve transactions to report on your tax return for each such ETF.

For the most part, it is just a pain.

see www.costbasis.com for a calculator

NOTE: As an active investor, be aware that your category Box A sales without adjustments do not require Form 8949, so there is no reason to import or key in those transactions.

Instead use the "enter a summary" option to put your numbers on Schedule D Line 1a.

If these show up as category A, then you can avoid the hassle.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is the proper way to adjust the cost basis for the SLV / GLD ETFs that are structured as trusts, and have monthly expenses that show up on your 1099-B?

Thanks for trying to help. Unfortunately, I'm not a professional. Costbasis.com has over 100 links on its landing page. There's no information about where to calculate cost basis for precious metal ETFs. Additionally, the TurboxTax UI is poor in this area. It's not clear what option you pick. Schedule D Line 1a? What does that mean?!

Hey Turbotax, how about a KB Article with some screenshots? #NotRenewingNextYear

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is the proper way to adjust the cost basis for the SLV / GLD ETFs that are structured as trusts, and have monthly expenses that show up on your 1099-B?

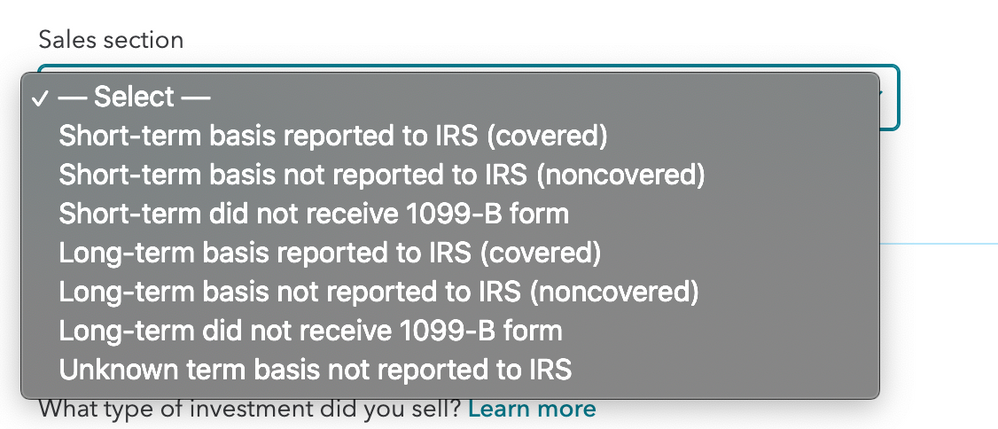

Does UNDETERMINED = Unknown?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is the proper way to adjust the cost basis for the SLV / GLD ETFs that are structured as trusts, and have monthly expenses that show up on your 1099-B?

Were you able to resolve this issue? I would greatly appreciate more info on how to resolve this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is the proper way to adjust the cost basis for the SLV / GLD ETFs that are structured as trusts, and have monthly expenses that show up on your 1099-B?

You can try going to https://www.costbasistools.com/silver/SLV.php for SLV or https://www.costbasistools.com/gold/GLD.php for GLD to determine the cost basis and capital gain/loss for each of the monthly sales transactions, then just edit the information in Turbotax as needed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is the proper way to adjust the cost basis for the SLV / GLD ETFs that are structured as trusts, and have monthly expenses that show up on your 1099-B?

If the amounts are small enough just leave the basis zero

and chalk it up to the cost of TurboTax and/or holding that security.

How much GLD or SLV are you holding ?

There are other better investments.

A piece of paper is not going to help you in a world collapse.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is the proper way to adjust the cost basis for the SLV / GLD ETFs that are structured as trusts, and have monthly expenses that show up on your 1099-B?

I came across this thread while doing research. I have to do this type of thing on my return so I'm in the same boat as you.

The solution appears to be quite simple (famous last words) since you've done your calculations already, you just need to create your own 8949 (or 8949 schedule) for the GLD and SLV shares.

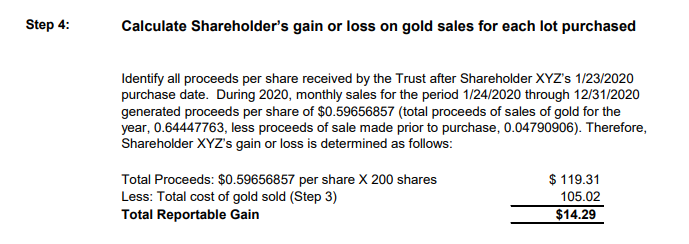

You report your pro-rata proceeds as determined following Step 4 on GLD's Trust Tax Information PDF on your form 8949 as a sale in terms of ounces or fractions thereof and report that capital gain or loss for 2020 while using code C:

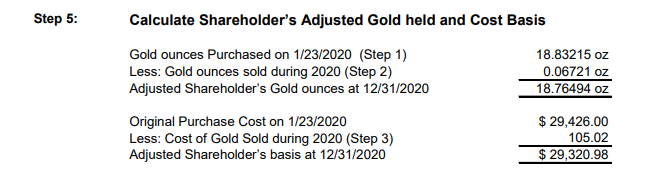

You carry the cost of gold sold ($105.02 in the example above) into your own spreadsheet tracking the purchases of your GLD or SLV shares and subtract that ($105.02) from the cost basis making that your new adjusted cost basis as seen in Step 5 of the PDF below:

Whenever you sell the GLD or SLV share, you use the adjusted basis as your cost basis in column (e) of 8949 (or your 8949 schedule). In other words you'll be subtracting the cost of gold sold from Step 4 from the 8949 worksheet your broker may or may not be giving you. You also use code C.

So to summarize:

1. Report pro-rata proceeds when they occur as a sale of silver/gold on your 8949 (or 8949 schedule) using code C.

2. Track the cost of metal sold from step 1 and adjust the cost basis of your GLD or SLV shares accordingly.

3. When you sell the adjusted GLD or SLV shares, report that adjusted cost basis on your 8949 (or 8949 schedule) using code C.

Hopefully that helps you with doing this on your own (if anyone spots a mistake please let me know). It's a lot of administrative hassle for not a lot of net tax change (unless the price of silver of gold either spikes or flash crashes on one of step 1's dates). If you want more personal attention from me on this matter, I am qualified to prepare tax returns but I will not have enough time to help you before the May deadline. If you're extending your filing deadline or want assistance for next year's return and want to communicate with me further, send me a private message here.

Necessary documents for GLD and SLV are here:

https://www.spdrgoldshares.com/media/GLD/file/SPDR-Gold-Trust-Tax-Information-2020.pdf

SLV has an available Workbook at: https://www.ishares.com/us/library/tax

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is the proper way to adjust the cost basis for the SLV / GLD ETFs that are structured as trusts, and have monthly expenses that show up on your 1099-B?

This is my first time buying GLD, (it's painful & stupid, will never buy this ETF again !!!)

If the ETF management can't calculate this for investors, why should you be an investor of stupid management.???

I have a quick questions:

In step 5, there are adjusted gold ounces & adjusted cost basis.

1. what is the function of adjusted gold ounces?

2. in TurboTax, there is no question how much gold ounces in ETF?,

3. also rather confused wrt substraction of original cost? isn't that increases the gain, and therefore increases the tax?

4. what is the effect of adjusted gold ounces wrt my gain?

5. if adjusted cost basis can only be deducted on schedule A, it means ordinary people can't make deduction if they choose "standard deduction".?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is the proper way to adjust the cost basis for the SLV / GLD ETFs that are structured as trusts, and have monthly expenses that show up on your 1099-B?

Calculating Fee Gains/Losses and Cost Basis of GLD Shares:

[Update: See all my posts below as well as this one. There are calculators at costbasistools dot com that you can use (I trust it, but cannot vouch for it 100% without being able to see all data entered etc.), but you have to know how to report the information. And you have to enter each lot separately. The following can be used where there is no calculator at the moment for GBTC for example.]

It took me a long time to work through the details of this, so I'm sharing this out of sheer sympathy! I would assume the same sort of process is required for SLV, but I did not check it directly.

Reference: https://www.spdrgoldshares.com/media/GLD/file/SPDR-Gold-Trust-Tax-Information-2020.pdf

If you read the document for GLD 2020 Tax year, you cannot deduct the expenses from your taxes; you have to adjust your cost basis by the cost basis of the gold sold by the fund for your given number of shares. "Although Trust expenses are not deductible for U.S. federal income tax purposes in 2020 Trust expenses are factors used to calculate each shareholders tax basis." The value of the fund goes down due to the fees, so you have to lower your cost basis as well.

1. When you go from month to month (and I'll give you an example to make this clear), you adjust the cost basis EACH MONTH by the COST BASIS (NOT the value) of the underlying gold sold to cover the fund's expenses. Your share number stays the same (we are assuming no dividend reinvestment). What changes is the cost basis of the shares you hold adjusted ONLY for the cost basis of the gold sold to generate fees.

2. Set up an Excel Spreadsheet. From left to right enter ("/" means a separate column):

Date / Proceeds (1d on 1099-B) / Cost Basis Factor (from 1099-B; righthand column called "Additional Information") /

Calculated Cost Basis of gold sold for fees = [Total Cost Basis of All Shares at end of Prior Period X Cost Basis Factor] / Loss or Gain on Shares = [Proceeds (1d) - Cost Basis of gold sold for fees] / New Adjusted Basis = [Prior Total Share Cost Basis - Cost Basis of Gold Sold for fees]. Follow these formulas exactly or you'll get lost. 😉

NOTE: GOLD is sold by the fund and they are telling you how much. They do not take SHARES from you. The value of the shares goes down as they take the fees off each month. They sell gold to get their fees in currency.

To repeat in a different way. Start with your last Total share cost basis prior to new fees. Calculate the cost basis of shares sold (see formula above). Subtract that from the Proceeds to see if there is a gain or loss and add up all the monthly gains and losses to determine what gain or loss you need to report. You can report them on the same line if they are all long term or all short term. For each month, subtract the cost basis of gold sold for fees from the prior cost basis to use for the next month's calculation. Each month's starting cost basis is LOWERED by the cost basis of the gold sold for fees, not by the "Proceeds" number.

Say you bought GLD on Nov.30th, so you only have to account for two months of fees. The math would look like this: (the cost basis numbers were removed by this website and they were

| 0.[removed] |

and

| 0.[removed] |

| Total Adjusted Cost Basis | |||||||

| PROCEEDS 1099-B | Cost basis factor | COST Basis | LOSS (-)or GAIN (+) | 15000.00 | STARTING Cost Basis of all shares | ||

| Fee Month 1 | 5.00 | 0.[removed] | 4.91 | 0.09 | 14995.09 | New Cost Basis | |

| Fee Month 2 | 6.00 | 0.[removed] | 6.80 | -0.80 | 14988.29 | New Cost Basis | |

| -0.71 | |||||||

| Total Loss |

3. What you have is a continual tally from Day 1 of your GLD buy of your shrinking cost basis. If the gold price never changed, you'd lose the fees until you owned no gold in the end. Nice business! Note that the cost basis of all the shares held is adjusted (2nd column from right) by the amount of the cost basis of the given month's fee cost basis in the 4th column from the left. The gain or loss is separately tallied in the 5th column from the left.

4. See Step 4 on page 12 of the PDF. It says that if the proceeds exceed the cost basis, you have a "reportable gain." It would be a short (365 days or less - count starts with next day after purchase as day 1) or long term gain (366 days or more) depending on when the shares were purchased. Short term gains are taxed at regular income tax rates. If long term, it has to be reported as a collectible sale (there is a box to check in the tax software) as gold gains are taxed at the higher collectable rate of 28%. This seems strange that we're expected to pay taxes on a gain when the money is going to fees, but as one of the other posters here said, the federal government doesn't care what you do with a capital gain. They still tax it. The law is obviously written badly, probably purposefully so, as most other ETFs account for their costs by adjusting the ETF price, which lowers your gain.

I hope that helps!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Elianabc

Level 1

melissaforpeace315

Level 4

KarenL

Employee Tax Expert

crash345u

Level 5

Eroc1234

Level 1