- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

I came across this thread while doing research. I have to do this type of thing on my return so I'm in the same boat as you.

The solution appears to be quite simple (famous last words) since you've done your calculations already, you just need to create your own 8949 (or 8949 schedule) for the GLD and SLV shares.

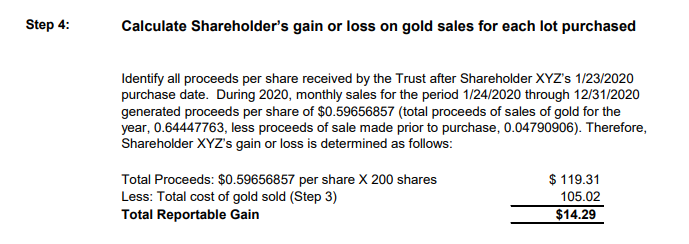

You report your pro-rata proceeds as determined following Step 4 on GLD's Trust Tax Information PDF on your form 8949 as a sale in terms of ounces or fractions thereof and report that capital gain or loss for 2020 while using code C:

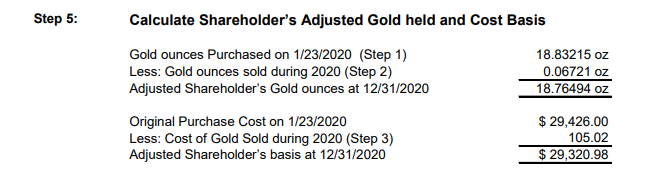

You carry the cost of gold sold ($105.02 in the example above) into your own spreadsheet tracking the purchases of your GLD or SLV shares and subtract that ($105.02) from the cost basis making that your new adjusted cost basis as seen in Step 5 of the PDF below:

Whenever you sell the GLD or SLV share, you use the adjusted basis as your cost basis in column (e) of 8949 (or your 8949 schedule). In other words you'll be subtracting the cost of gold sold from Step 4 from the 8949 worksheet your broker may or may not be giving you. You also use code C.

So to summarize:

1. Report pro-rata proceeds when they occur as a sale of silver/gold on your 8949 (or 8949 schedule) using code C.

2. Track the cost of metal sold from step 1 and adjust the cost basis of your GLD or SLV shares accordingly.

3. When you sell the adjusted GLD or SLV shares, report that adjusted cost basis on your 8949 (or 8949 schedule) using code C.

Hopefully that helps you with doing this on your own (if anyone spots a mistake please let me know). It's a lot of administrative hassle for not a lot of net tax change (unless the price of silver of gold either spikes or flash crashes on one of step 1's dates). If you want more personal attention from me on this matter, I am qualified to prepare tax returns but I will not have enough time to help you before the May deadline. If you're extending your filing deadline or want assistance for next year's return and want to communicate with me further, send me a private message here.

Necessary documents for GLD and SLV are here:

https://www.spdrgoldshares.com/media/GLD/file/SPDR-Gold-Trust-Tax-Information-2020.pdf

SLV has an available Workbook at: https://www.ishares.com/us/library/tax

Thanks.