- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: Should the amount enter in TurboTax for SSA income include the amount withheld for Medicare or is it just the net amount I received?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should the amount enter in TurboTax for SSA income include the amount withheld for Medicare or is it just the net amount I received?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should the amount enter in TurboTax for SSA income include the amount withheld for Medicare or is it just the net amount I received?

The total Social Security benefits you receive before any deduction for Medicare premiums paid.

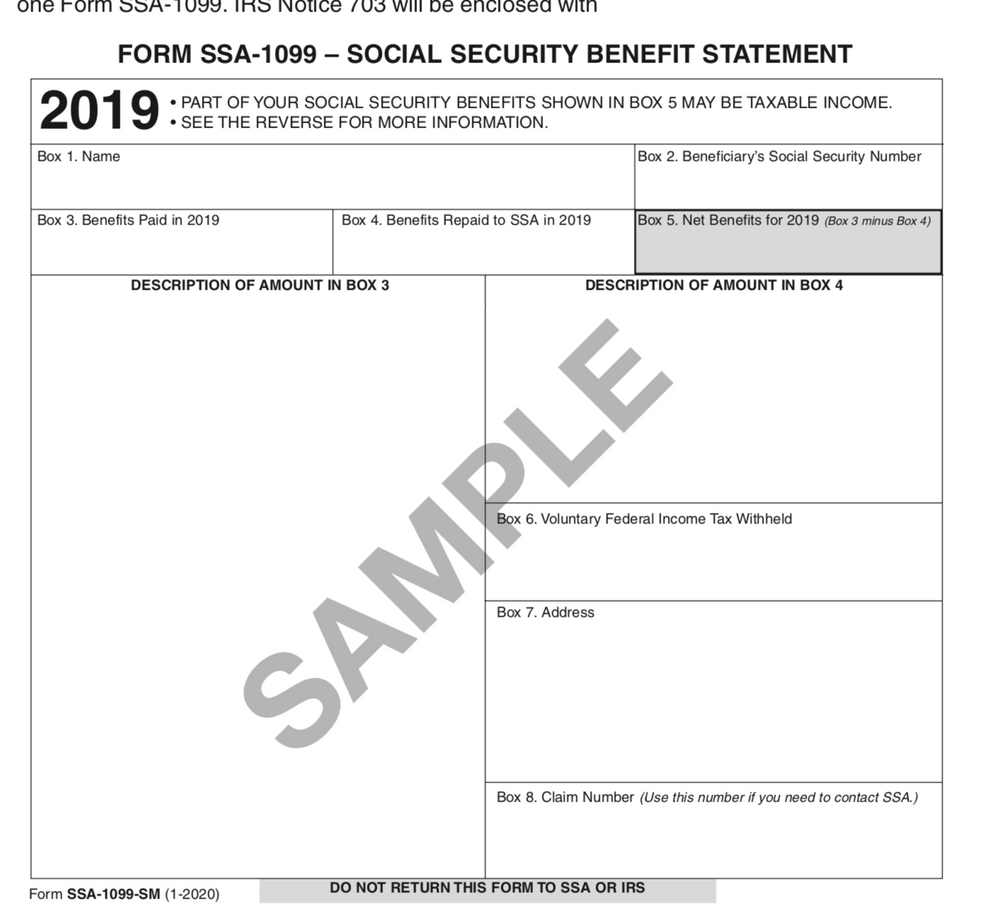

The amount to enter is from box 5 of the SSA-1099 which you will receive in January 2021 for the 2020 benefits paid.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should the amount enter in TurboTax for SSA income include the amount withheld for Medicare or is it just the net amount I received?

Is this your first year? Do you have a copy of last year's? Here a blank one to see. You enter the amount in box 5 which is before deductions. Medicare deductions will be listed in the big box on the left side.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should the amount enter in TurboTax for SSA income include the amount withheld for Medicare or is it just the net amount I received?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should the amount enter in TurboTax for SSA income include the amount withheld for Medicare or is it just the net amount I received?

Thanks

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ydarb213

New Member

jstan78

New Member

mulleryi

Level 2

mulleryi

Level 2

rodiy2k21

Returning Member