- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: RRB-1099-R

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

RRB-1099-R

I'm doing my taxes and either there is an issue with the TurboTax software / form or the form I received from the Railroad Retirement Board. The software asks for Box 5 Total Net Benefits but there is nothing in box 5 on the form I received -- there is an amount in Box 4 though. The software asks for Box 10 Federal Tax Withheld, but the form I received has that amount in Box 9. I think the TurboTax software is wrong.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

RRB-1099-R

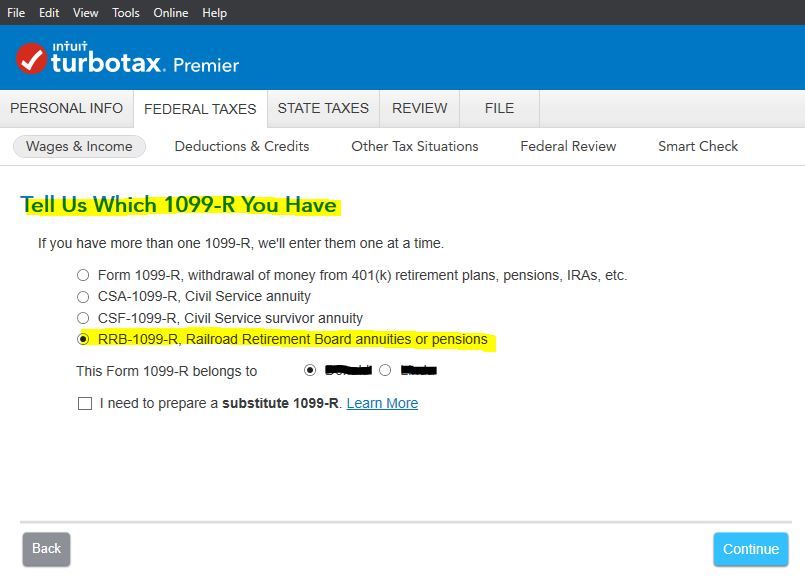

You selected the wrong form in the program. You selected a Form 1099-R and not the Form RRB-1099-R.

Delete the form you entered.

Enter 1099-r in the Search box located in the upper right of the program screen. Click on Jump to 1099-R

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

RRB-1099-R

I'm having problems with my RRB-1099-R. It is wanting my Plan Cost at annuity starting date, and the starting date. Not sure what to enter. My late husband was the RR employee and I didn't start drawing RRR until I hit 60. I've always used a cpa before and he's never asked this question.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

RRB-1099-R

I don't think you are in the right screens. Delete what you have entered and start over. After you have logged in and are in your return in TurboTax Online:

- Go to Search at the top of the screen.

- Enter RRB-1099 in the search box.

- You will see a Jump To function that will take you to the RRB-1099 input screens.

- There you will see a question if this is for Medicare or Railroad Benefits

- Then enter your information off the RRB-1099

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

RRB-1099-R

Thanks SamS1,

I'm not having trouble with the RRB-1099 part, that went very smoothly. I'm having trouble with the RRB-1099-R part. That's the one that deals with the amount rail road employees pay above the SS amount. It's treated like a pension rather than SS income.

Still trying to figure this out.

Thanks for any and all advice,

Highwoods2020

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

RRB-1099-R

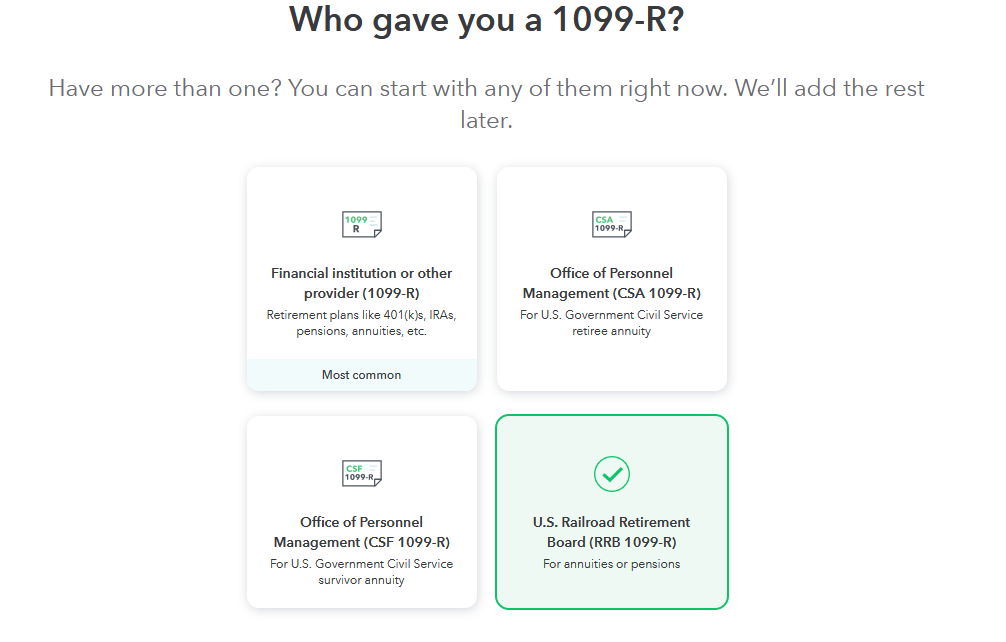

You need to enter that through the 1099R entry screens. After you have logged in and are in your return in TurboTax Online:

- Go to Search at the top of the screen.

- Enter RRB-1099-R in the search box.

- You will see a Jump To function that will take you to the 1099-R input screens.

- Then add a new 1099R and manually enter your RRB-1099-R.

At the financial services screens, click "Change how I enter my form" then "Type it myself" Continue through to this screen and indicate US Railroad Retirement. That should be the screens you need. Indicate at the bottom you are the spousal beneficiary. It is asking for the plan cost to determine if any portion of the annuity is non-taxable. This would be after-tax contributions made by your husband. If you were not asked this by your other tax preparer, I am guessing he entered 0.00. This would make the entire annuity taxable.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mdonant1103

New Member

purplecejay1

New Member

annsilver55

New Member

anvilman56

Level 1

williebl8r

New Member