- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

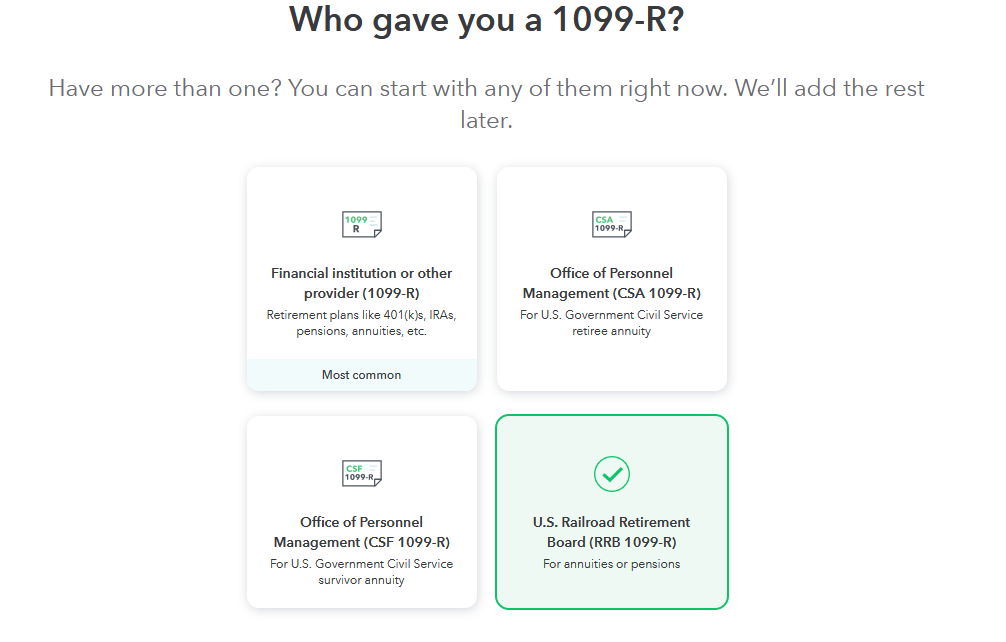

You need to enter that through the 1099R entry screens. After you have logged in and are in your return in TurboTax Online:

- Go to Search at the top of the screen.

- Enter RRB-1099-R in the search box.

- You will see a Jump To function that will take you to the 1099-R input screens.

- Then add a new 1099R and manually enter your RRB-1099-R.

At the financial services screens, click "Change how I enter my form" then "Type it myself" Continue through to this screen and indicate US Railroad Retirement. That should be the screens you need. Indicate at the bottom you are the spousal beneficiary. It is asking for the plan cost to determine if any portion of the annuity is non-taxable. This would be after-tax contributions made by your husband. If you were not asked this by your other tax preparer, I am guessing he entered 0.00. This would make the entire annuity taxable.

February 28, 2021

3:43 PM