- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: Pensions annuities worksheet

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pensions annuities worksheet

Part II, line 2c

trying to enter an amount which is lower than line 2b because only part of pension can be excluded from state taxable income

it WILL NOT LET ME DO IT

it wants an amount equal to line 2b and I cannot even override it because if I do, it will not let me file electronically

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pensions annuities worksheet

Please clarify and expand upon your question. First, what version of TurboTax are you using? You refer to line 2b, but that is the checkbox line for if the taxable amount is not determined or a total distribution. Also, the followup questions regarding the type of pension may shed light on the reason you are having difficulty with. Was it from a Governmental entity? Please review and clarify further. Thank you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pensions annuities worksheet

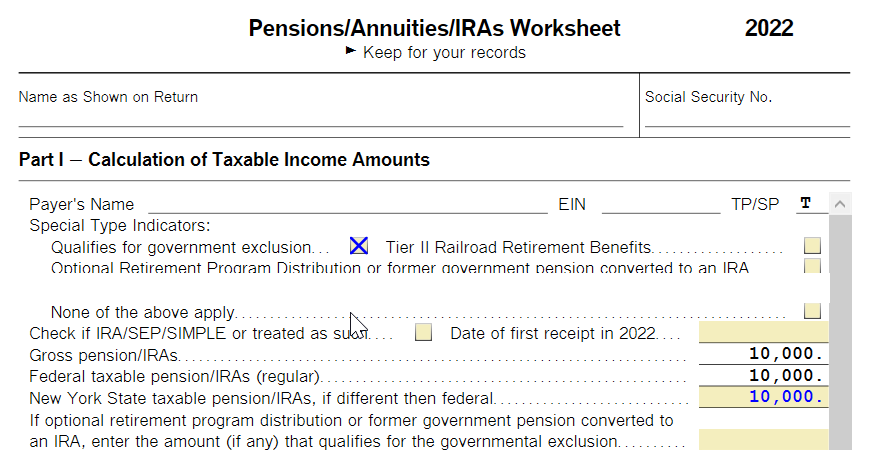

it is the form called "pen Ann IRA WKS" for state of NY

Part II

lines 2b and 2c

they are forcibly linked in amount, but for employees of CUNY, only a portion may be deductible in NY state

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pensions annuities worksheet

Your CUNY pension qualifies for the $20,000 exclusion. New York says:

Q: If a taxpayer worked in the private sector, do the retirement payments received from TIAA/CREF (Teachers Insurance & Annuity Association & College Retirement Equities Fund) or ING Financial Advisors qualify for full exclusion as a NYS pension?

A: No. Since private-sector colleges are not funded by NYS, the pension payments do not qualify as NYS pension income. The pension would, however, qualify for the $20,000 pension and annuity income exclusion under Tax Law section 612(c)(3-a)

See Common questions and answers about pension subtraction adjustments.

If you believe it is not eligible for the government exclusion or other exclusion, go to the top of the Pennsion/Annuities/IRAs Worksheet and check the exclusion box.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pensions annuities worksheet

CUNY is the city university of NY

contributions to TIAA are excludable for NY in part

contributions to RA CAN BE EXCLUDED for NY

contributions to SRA and GSRA cannot

hence the need to show excluded amount smaller than total if employee contributed to both

please do not mislead other users

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pensions annuities worksheet

expert Ernie SO

this is not helpful

Turbotax picked up my wife's pension and entered it in Part I for some reason

does NOT allow me to enter the CUNY pension, part of which is non-taxable in NY in part into PART I as you suggest.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pensions annuities worksheet

I would try deleting the Forms 1099-R and reentering them. Make sure they are properly entered as yours and your spouses.

You may even want to try deleting your State return and reenter it and see if doing this corrects the problem.

Here's how to clear (delete) a state return in the TurboTax for Windows CD/Download software:

- With your return open in TurboTax, switch to Forms Mode by selecting the Forms icon at the top-right corner of the screen.

- From the File menu, choose Remove State Return.

- Select the return you want to delete and select Remove.

Here's how to delete a state return in TurboTax Online:

Note: If you've already paid your TurboTax state fees or registered your free version with your state return attached, you can't delete your state return.

- Sign in and open a section of your return

- From the menu, select State and then select Continue on the Let's get your state taxes done right screen

- On the Status of your state returns screen, select Delete next to your state, then answer Yes

Also, keep in mind:

To enter your tax-exempt State employee pension, you will first have to enter the necessary information in your Federal Income tax return, which will then flow to your NY state return. You have to indicate when you initially enter your Form 1099-R,what type of pension income this is for state purposes. For example if it was a Governmental Plan fully excluded from NYS Income you would select that.

Find your Form 1099-R by typing 1099-R in the search box, and follow the steps below:

- Click on Jump to 1099-R

- Scroll down to Retirement Plans and Social Security

- At IRA,401(k), Pension Plan Withdrawals (1099-R), click Update

- Click on Edit then Continue

- Answer the next questions until you get to the Where Is This Distribution From? screen

- Select the correct source and enter the information requested: This will carryforward the information needed to your state tax return to make your pension tax exempt.

- Click on Continue

- Click on From a Qualified Plan

- Continue answering the questions

Now on your state return:

- At the Changes to Federal Income page, scroll down to Received retirement income, click Start/Update

- At the Retirement Distributions Summary page, click on Edit State

- If no additional information is required, click on Continue

- Click Done

To view your State Return in TurboTax:

- Select Tax Tools in the left menu (if you don't see this, select the menu icon in the upper-left corner).

- With the Tax Tools menu open, you can then:

- Select Print Center and then Print, Save, or Preview This Year's Return to preview your entire return, including all forms and worksheets (you may be asked to register or pay first).

- View only your 1040 form by selecting Tools. Next, select View Tax Summary in the pop-up, then Preview my 1040 in the left menu.

Please click here for a TurboTax Help link to watch a video to help walk you through the steps.

Click here to contact Turbo Tax for assistance .

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pensions annuities worksheet

NOT HELPFUL

Please read the Q carefully

assume that 1099-R shows 1,000

this full amount is taxable for IRS, but only 600 of it is state taxable

if I state that source is CUNY, then it reduces state income by full 1,000

If I state that it is not, then it does subtract the 600

Turbotax either subtracts the full 1,000, or nothing on its own, without allowing me to subtract only a portion of the amount.

It does NOT ALLOW subtracting only a portion of the amount on the worksheet

and yes I tried erasing ans re-entering data, same thing. Turbotax assumes and locks me into either all or nothing

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pensions annuities worksheet

apparently, IRS asks funds to send only one 1099-R if possible.

now, if the tax free amount is different from the total, the worksheet does NOT allow a different entry. The WS wants to treat either the whole or nothing as a deductible, which is INCONSISTENT with reality

I hear no answer and no help from TURBOTAX.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pensions annuities worksheet

TURBOTAX has insurmountable error

It assumes that all 1099-R entries are of the same character

they may NOT BE

some are taxable for the states, some are not

and yet, the worksheet assumes that they are all either one or the other.

it does NOT ALOW me to show some as taxable and some as not, because the identification happens when the WS is opened. The form then assumes that the identification as taxable is for the full amount.

IT is NOT a binary issue.

Is anyone at TURBOTAX listening? Issuer of 1099-r MUST SHOW all entries as one sum as per IRS, on one 1099-R. But tax treatment may vary for different parts of the sum, which the WS does not PROVIDE for.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

lnashett

New Member

my wife hs been using her ssn al

New Member

whitedw151

New Member

rogue1954

Level 1

ewong1-wong-gmai

New Member