- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

Your CUNY pension qualifies for the $20,000 exclusion. New York says:

Q: If a taxpayer worked in the private sector, do the retirement payments received from TIAA/CREF (Teachers Insurance & Annuity Association & College Retirement Equities Fund) or ING Financial Advisors qualify for full exclusion as a NYS pension?

A: No. Since private-sector colleges are not funded by NYS, the pension payments do not qualify as NYS pension income. The pension would, however, qualify for the $20,000 pension and annuity income exclusion under Tax Law section 612(c)(3-a)

See Common questions and answers about pension subtraction adjustments.

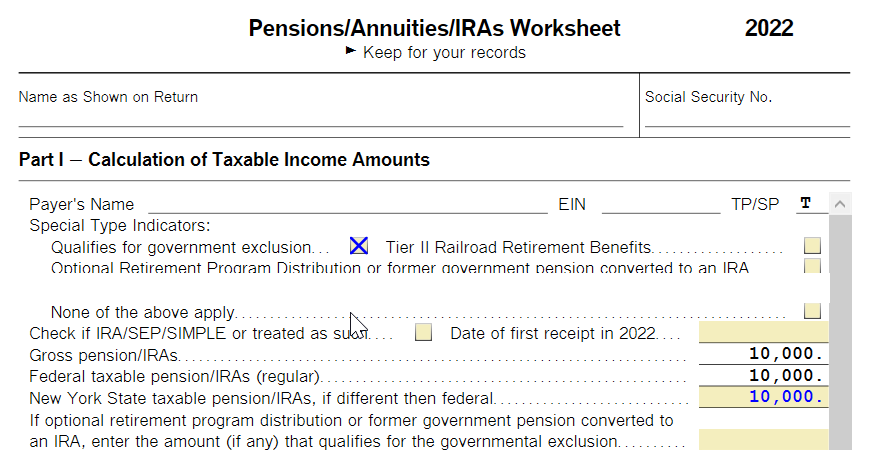

If you believe it is not eligible for the government exclusion or other exclusion, go to the top of the Pennsion/Annuities/IRAs Worksheet and check the exclusion box.

**Mark the post that answers your question by clicking on "Mark as Best Answer"