- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: Is the birth of a child exception for early withdrawal of IRA/401k plan still in effect and if so how would that work withdrawing in 2022 being unemployed? Waiver of 10%?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the birth of a child exception for early withdrawal of IRA/401k plan still in effect and if so how would that work withdrawing in 2022 being unemployed? Waiver of 10%?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the birth of a child exception for early withdrawal of IRA/401k plan still in effect and if so how would that work withdrawing in 2022 being unemployed? Waiver of 10%?

[Edited to add: this answer is out of date because a new exception was indeed passed recently, see the other answer below.]

There is no childbirth exception to early withdrawal of funds from an IRA. The only penalty exception that applies to unemployed persons is an exception for paying health care premiums but only after your health care premiums have exceeded 7.5% of your gross income. If you did qualify for the exception to withdrawing funds to pay health insurance premiums while unemployed, this only applies to the IRA and not the 401(k). You could roll over the 401(k) into an IRA and then withdraw the money from the IRA, but if you withdrew it directly from the 401(k) the penalty exception would not apply because the rules for penalty exceptions for 401(k)s are different and the rules for IRAs.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the birth of a child exception for early withdrawal of IRA/401k plan still in effect and if so how would that work withdrawing in 2022 being unemployed? Waiver of 10%?

Thanks. I will most likely take your advice on rolling over the 401k to an IRA. However, according to the 5329 form's instructions it says its a new exception that used with code 12 "other" and that you just have to send a statement with baby's name, age, and TIN number. But I believe this exception was with that CARES act that was good till the end of December 2021. So that's my other question. Will the CARES act be extended(which there is talk that it will be) or does this have nothing really to do with the CARES act and I can just use this form to denote the withdrawal that I plan to make this year? This below link is to the instructions on 5329 form.

https://www.irs.gov/pub/irs-pdf/i5329.pdf

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the birth of a child exception for early withdrawal of IRA/401k plan still in effect and if so how would that work withdrawing in 2022 being unemployed? Waiver of 10%?

OK, I learned something new today. The important point was the inclusion of the instructions that referenced IRS notice 2020-68. See section D and the questions that follow especially question D-4.

https://www.irs.gov/pub/irs-drop/n-20-68.pdf

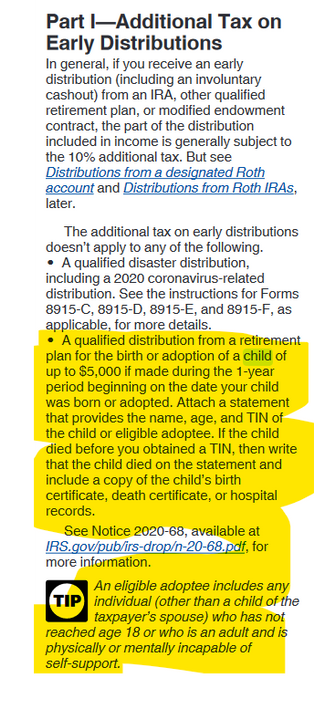

There is a new exception to the 10% penalty on early withdrawal for the birth or adoption of a child. This was created in the SECURE act, not the CARES act, and is permanent. The distribution must be taken within one year of the birth or the adoption of the child. What is important for purposes of your question is that a 401(k) is still not eligible for this exception. Other retirement plans are eligible and an IRA is eligible but not a 401(k), I couldn’t tell you why the law was written that way.

The total amount eligible for the penalty exception is $5000, although you will still pay regular income tax on the distribution. Because the 401(k) is not eligible, if you want to use the 401(k) money, you would first need to do a rollover to an IRA.

However, also note that in most cases you can’t withdraw from a 401(k) if you are still employed at the company that sponsors the plan. A 401(k) plan may allow hardship withdrawal‘s, but that is up to the individual company, and the rules to qualify for a hardship withdrawal may vary. If you are no longer employed with the plan sponsor, then it will be no problem to do a roll over to an IRA and then withdraw the money. If you are still employed, you will have to talk with their benefits office about whether or not you can do a rollover treated as a hardship withdrawal.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the birth of a child exception for early withdrawal of IRA/401k plan still in effect and if so how would that work withdrawing in 2022 being unemployed? Waiver of 10%?

Excellent. This is great to know. I have some other questions. You mentioned that I would still need to pay the income tax on it. Is that if I don't rollover to an IRA or that's even after rolling it over? And the federal income tax that I would pay is 10%? So this would be to waive the early withdrawal penalty fee which is an additional 10% otherwise it would be 20% total between the income tax fee and the early withdrawal penalty fee?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the birth of a child exception for early withdrawal of IRA/401k plan still in effect and if so how would that work withdrawing in 2022 being unemployed? Waiver of 10%?

@chrisdg30 wrote:

Excellent. This is great to know. I have some other questions. You mentioned that I would still need to pay the income tax on it. Is that if I don't rollover to an IRA or that's even after rolling it over? And the federal income tax that I would pay is 10%? So this would be to waive the early withdrawal penalty fee which is an additional 10% otherwise it would be 20% total between the income tax fee and the early withdrawal penalty fee?

You always owe regular income tax when you withdraw money from a pre-tax account, because you did not pay tax on the contributions. The withdrawal is added to your other income to determine your total tax, it might be 10%, 12%, 22%, or higher, depending on your total income. The special exemption only excuses you from the 10% additional penalty on withdrawals before age 59-1/2.

If you do a rollover from the 401(k) to an IRA, that is a non-taxable event. When you withdraw money from the IRA, that will be taxable income.

The plan custodian might be required to withhold up to 20% for taxes, but that is not the tax you actually owe. The tax you actually owe is calculated on your tax return, after considering all your income, deductions, dependents and other credits. You get credit for any withholding, just as you get credit for withholding from wages. If your total withholding is more than your total tax, that is the amount of your refund. (You will not have mandatory withholding on the rollover if you do a direct rollover--meaning you contact both plans and have the money sent electronically directly from the 401(k) to the IRA.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the birth of a child exception for early withdrawal of IRA/401k plan still in effect and if so how would that work withdrawing in 2022 being unemployed? Waiver of 10%?

Thank you for answering my questions. This is what I needed to know. Can't wait for my girl to be born!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the birth of a child exception for early withdrawal of IRA/401k plan still in effect and if so how would that work withdrawing in 2022 being unemployed? Waiver of 10%?

What happens if I took this credit with only a 401k? Did my research and didn't see this response until I had already filed claiming the QBAD.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the birth of a child exception for early withdrawal of IRA/401k plan still in effect and if so how would that work withdrawing in 2022 being unemployed? Waiver of 10%?

After the birth of a child, a parent is allowed to distribute up to $5,000 out of either an IRA or a 401(k) plan. Notice the word “after”. You are not allowed to withdraw the money prior to the child being born. New parents have up to 12 months following the date of birth to process the distribution from their retirement accounts and avoid the 10% early withdrawal penalty.

Exceptions to the 10% additional tax apply to an early distribution from a traditional or Roth IRA that is:

- Not in excess of $5,000 and the distribution is a qualified birth or adoption distribution.

Exceptions to the 10% Additional Tax

What is a qualified birth or adoption distribution See Page 13 Q D-1

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the birth of a child exception for early withdrawal of IRA/401k plan still in effect and if so how would that work withdrawing in 2022 being unemployed? Waiver of 10%?

@Angiebaby0914 wrote:

What happens if I took this credit with only a 401k? Did my research and didn't see this response until I had already filed claiming the QBAD.

It's not a credit, its an exemption from the penalty. If you withdrew money from your 401(k) after your child was born, you will receive a 1099-R from the plan sponsor. When you enter the 1099-r, Turbotax will tell you that you may owe a 10% penalty for early withdrawal, and will show you a list of boxes to check for special circumstances that qualify for an exemption to the 10% penalty. If "birth of a child" is listed, you can check that box and you will not be assessed the additional 10% penalty on the first $5000 of the withdrawal.

I remain unsure of whether the exception is available to 401k plans or only other types of plans. One page of the IRS guidance lists eligible plans and 401k plans are not listed, but another page of the guidance seems to indicate that 401k plans are eligible. Turbotax should know what kind of plan you withdrew funds from, from the codes listed on the 1099-R, so if Turbotax gave you the choice of claiming the exception for birth of a child, then I would assume the accountants at Turbotax think 401k plans are eligible.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the birth of a child exception for early withdrawal of IRA/401k plan still in effect and if so how would that work withdrawing in 2022 being unemployed? Waiver of 10%?

If both parents have separate IRA or 401k accounts can both parents withdraw the $5000 for after childbirth and be exempt from the early withdraw of 10%. I assume that money is still taxed by state and federal taxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the birth of a child exception for early withdrawal of IRA/401k plan still in effect and if so how would that work withdrawing in 2022 being unemployed? Waiver of 10%?

@horsechick48 wrote:

If both parents have separate IRA or 401k accounts can both parents withdraw the $5000 for after childbirth and be exempt from the early withdraw of 10%. I assume that money is still taxed by state and federal taxes.

Yes, each parent can separately withdraw up to $5000.

However, if a person has both an IRA and a 401k, the $5000 limit is per taxpayer, not per account.

And finally, the withdrawal only counts if it is made within 1 year starting on the date of birth or the date the adoption is finalized. Withdrawals for pre-planning expenses are not eligible for the exception. And if your child is born on (for example) July 1, 2024, you don't get to withdraw $5000 on August 1, 2024, and another $5000 on January 1, 2025. The limit is $5000 per taxpayer for qualifying birth or adoption, not $5000 per year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the birth of a child exception for early withdrawal of IRA/401k plan still in effect and if so how would that work withdrawing in 2022 being unemployed? Waiver of 10%?

@Opus 17 Is this true for married couples filing joint or can both parents only withdrawal if they are filing separately? For ex:

- baby born in Feb 2024

- dad takes out 5k from his regular 401k June 2024

- mom takes out 5k from her Roth 401k June 2024

- they file married/joint

How would the above be penalized/taxed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the birth of a child exception for early withdrawal of IRA/401k plan still in effect and if so how would that work withdrawing in 2022 being unemployed? Waiver of 10%?

@Bwill2288 wrote:

@Opus 17 Is this true for married couples filing joint or can both parents only withdrawal if they are filing separately? For ex:

- baby born in Feb 2024

- dad takes out 5k from his regular 401k June 2024

- mom takes out 5k from her Roth 401k June 2024

- they file married/joint

How would the above be penalized/taxed?

IRAs and 401(k)s are always owned by individuals, they are never joint. So whether you file separately or jointly, each spouse is allowed to withdraw up to $5000 for new child expenses from an account they individually own, as long as it is after the birth and within 1 year. The income will be added to any other income and taxed as ordinary income, but there will be no additional 10% penalty.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the birth of a child exception for early withdrawal of IRA/401k plan still in effect and if so how would that work withdrawing in 2022 being unemployed? Waiver of 10%?

I appreciate the information above. One lingering question is if the payments can be spread out over that 12 month period? For instance can you take say $4,000 immediately and then the other $1,000 several months after?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

DawnMMc

Level 1

bupp

New Member

wuhoo

Level 1

rubies1018

New Member

DaedalusReturned

New Member