- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: IRA Distribution and Covid

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA Distribution and Covid

I had an RMD requirement of about $32K in 2020 and took the distribution in January of 2020. About $13K in taxes were withheld and a net of about $19K was deposited into a brokerage account. Later, the rules changed so that no RMD was required for 2020. Eventually, I found out that since no RMD was required, I could treat the distribution as a rollover to a Roth IRA. I had already paid the taxes, so I directed the financial institution to move the net $19K into my Roth account. However, I recently downloaded the 2020 tax data from the financial institution and they showed a distribution of approximately $51K in 2020. I think this is because when I told them to move the money into the Roth they moved the $19K temporarily back into the regular IRA and then moved it to the Roth. On the 1040, there is line for IRA distributions and another for the taxable amount of the distribution. I can't figure out a way to make the gross distribution number be $51K and the taxable amount number be $32K. Either they are both $51K or both $32K. There is a place to put an explanation of the numbers if I use the $32K numbers for both lines but I would rather it showed the gross on one line and the net on the other. How do I fix this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA Distribution and Covid

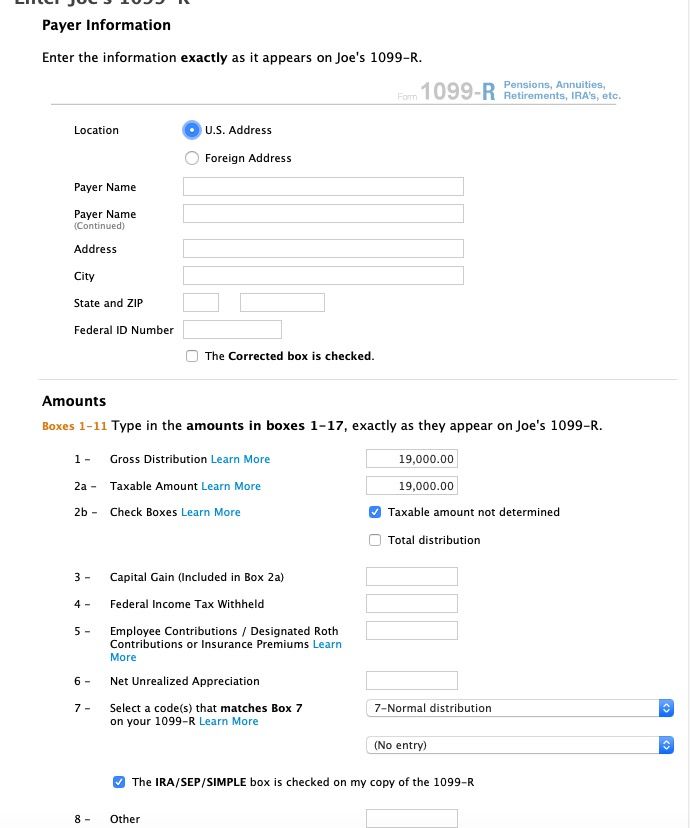

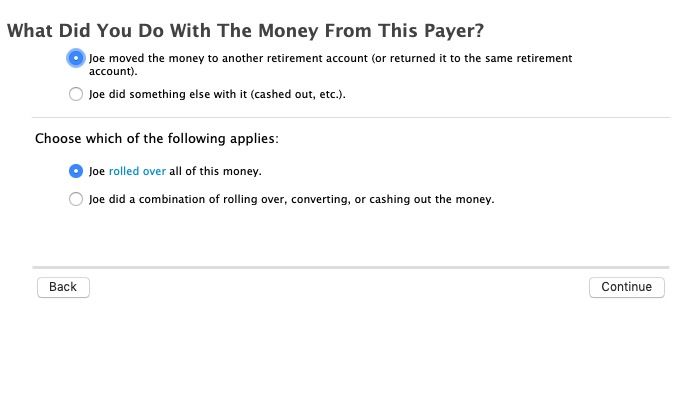

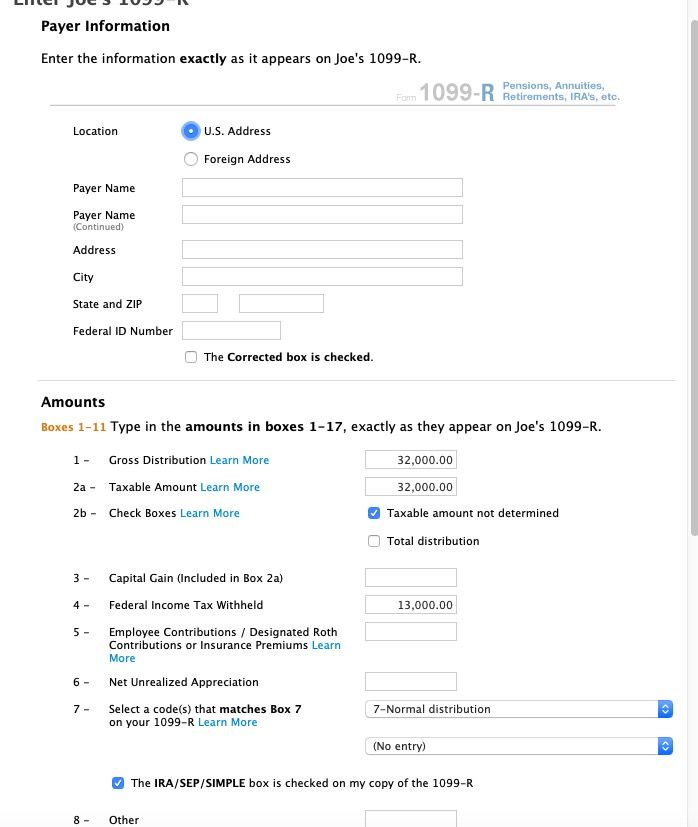

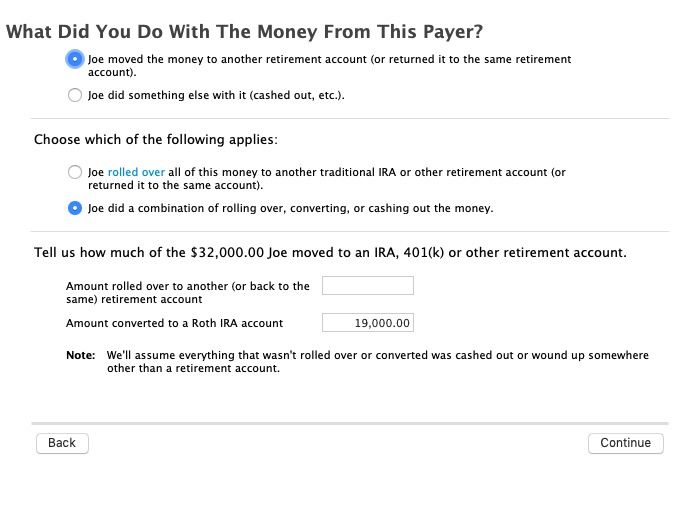

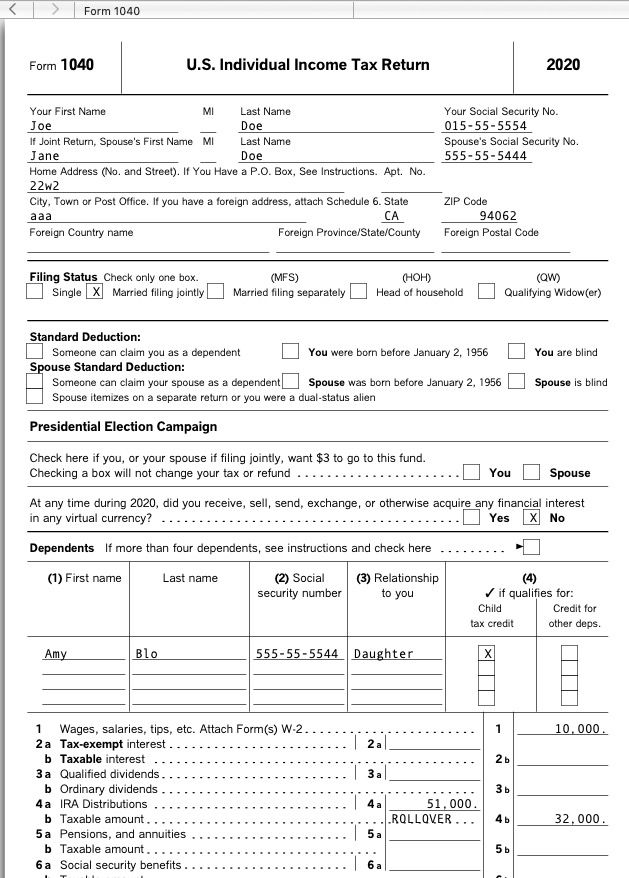

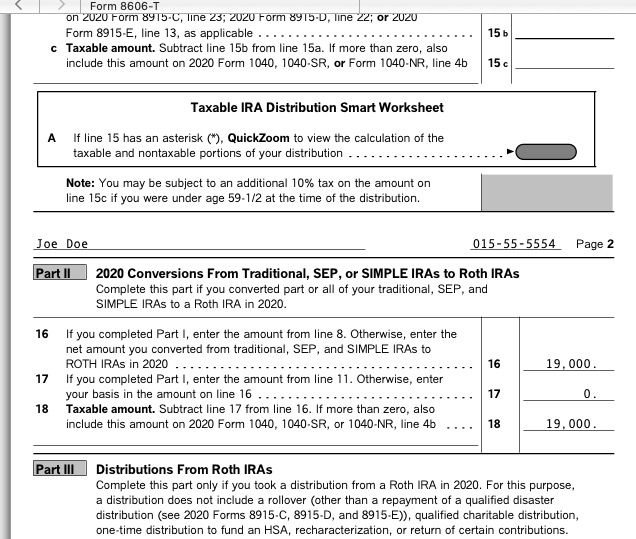

OK - here is how it looks using your numbers on the desktop version and the 8606 form to report the Roth conversion has the $19 on line 16 & 18. With the total and taxable amounts on the 1040 line 4

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA Distribution and Covid

Do yiu have the 2020 1099-R yet? What amount is in box 1 and 2a?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA Distribution and Covid

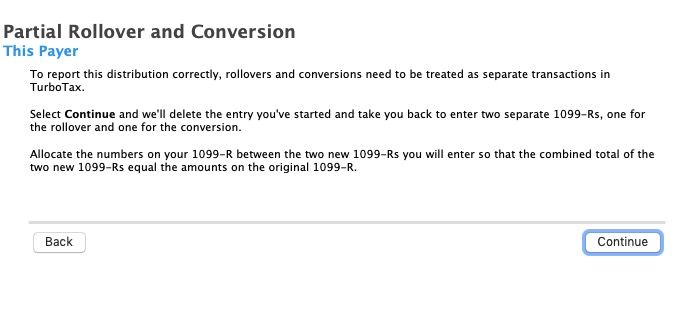

If the 1099-R shows the total of both transactions then TurboTax cannot handle two different destinations on a single 1099-R. You will need to split the 1099-R into two.

Allocate the amounts so that one is just the amount rolled back to the IRA and the second the amount converted to a Roth so that the totals add up to the original 1099-R.

Check the 1040 line 4a and 4b for the amount of the total on 4a and the Roth conversion amount on 4b with the word ROLLOVER next to it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA Distribution and Covid

Using the rounded numbers I used in the post, the 1099-R shows $51K in both box1 and 2a. I also have a 5498 form showing a rollover contribution of $19K.

Are you saying I should break the 1099-R in two, one showing $32K in box1 and 2a and the withheld taxes on that form and another 1099-R showing $19K in box1 and $0 in box 2a and no taxes withheld?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA Distribution and Covid

I would not recommend break them out. Enter your 1099R as you received. If you are over 70 1/2, you will see the RMD screens after the 1099R entry screens, Enter "None of this withdrawal was RMD". On the next screen you will be asked what you did with the money. You can indicate on the following screens that you rolled over the $19,000. There is no RMD requirement for 2020. That should take care of the roll back into the Traditional.

I am a little surprised you did not get a separate 1099R for the roll from the traditional IRA to the Roth IRA. It sounds like this was a separate transaction and a separate 1099R should have been gnerated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA Distribution and Covid

@jesschoen wrote:

Using the rounded numbers I used in the post, the 1099-R shows $51K in both box1 and 2a. I also have a 5498 form showing a rollover contribution of $19K.

Are you saying I should break the 1099-R in two, one showing $32K in box1 and 2a and the withheld taxes on that form and another 1099-R showing $19K in box1 and $0 in box 2a and no taxes withheld?

The one for the rollover should have $19K in box 1 and 2a $0 in box 4 and indicate the entire amount was rolled back. That will not be taxable.

The other should have $32K in box 1 and 2a, $13K in box 4 and indicate that $19k was converted to a Roth.

That will make the $19K rollover not taxable, the $19K Roth conversion and $13K tax withheld taxable and will all total the original $51K distribution with $13K tax withholding.

Your 1040 line 4a should have the $51K amount and 4b the ($19K + $13K) = $32K taxable amount. (Which is what you intended to do in the first place before the bank did it differently).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA Distribution and Covid

@SamS1 wrote:

I would not recommend break them out. Enter your 1099R as you received. If you are over 70 1/2, you will see the RMD screens after the 1099R entry screens, Enter "None of this withdrawal was RMD". On the next screen you will be asked what you did with the money. You can indicate on the following screens that you rolled over the $19,000. There is no RMD requirement for 2020. That should take care of the roll back into the Traditional.

I am a little surprised you did not get a separate 1099R for the roll from the traditional IRA to the Roth IRA. It sounds like this was a separate transaction and a separate 1099R should have been gnerated.

@SamS1 - Banks issue one 1099-R for the years total distributions, not two. They never issue two 1099-R's for 2 or more distributions from the same IRA - they are always totaled on a single 1099-R.

Yes that is the correct way to do it in TurboTax, because multiple destinations are not supported in TurboTax

In fact if you attempt to enter it in a single 1099-R TurboTax will tell you to split it.

Also see "Situations not supported by TurboTax"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA Distribution and Covid

Sounds good. Thanks for the clarification. I was thinking there would a different box 7 coding generating a new 1099R but the roll to the Roth would be taxable and the same coding as the original 1099R so splitting it in TurboTax would be the way to handle it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA Distribution and Covid

I broke the numbers into two 1099-Rs per your suggestion but the amount shown in box 4a of the 1040 is only $32K instead of $51K. The taxable amount in box 4b is $32K which is correct. It would seem like the 4a box should be adding up all the relevant 1099-Rs but it isn't. When I click on box 4a with the $32K, it takes me to a worksheet with $32K in the 4a box. When I click on that, it wants me to choose one of the 1099-Rs rather than computing a sum of the relevant 1099-Rs.

Also, for the 1099-R for the $19K what is the code that goes in Box 7? It was 7 on the original 1099-R sent by the financial institution (Fidelity).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA Distribution and Covid

The box 7 code depends on the type of account that the distribution came from and your age (under or over 59 1/2), not what you did with the money - you tell the IRS that by how it is reported on the 1040 form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA Distribution and Covid

OK - here is how it looks using your numbers on the desktop version and the 8606 form to report the Roth conversion has the $19 on line 16 & 18. With the total and taxable amounts on the 1040 line 4

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA Distribution and Covid

macuser-22

Thanks, your graphics of the instructions did the trick. I don't normally use the interview method and instead just go to the forms but that didn't work in this case. Thanks for your help.

James

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA Distribution and Covid

@jesschoen wrote:

macuser-22

Thanks, your graphics of the instructions did the trick. I don't normally use the interview method and instead just go to the forms but that didn't work in this case. Thanks for your help.

Only an expert should use the forms mode for data entry. Using the forms mode will void the TurboTax accuracy guarantee because the users knowledge about interlinked tax returns is necessary to make the proper entries on related forms and do their own error checking that the interview mode does for you. It is not always obvious which forms and/of worksheets need entries to arrive at a correct result (some form entries are derived form worksheets and not direct form entry).

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Max171

Returning Member

persimman

Level 2

74borabora

New Member

jccheng9

New Member

smsprauer

Level 2