- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

@SamS1 wrote:

I would not recommend break them out. Enter your 1099R as you received. If you are over 70 1/2, you will see the RMD screens after the 1099R entry screens, Enter "None of this withdrawal was RMD". On the next screen you will be asked what you did with the money. You can indicate on the following screens that you rolled over the $19,000. There is no RMD requirement for 2020. That should take care of the roll back into the Traditional.

I am a little surprised you did not get a separate 1099R for the roll from the traditional IRA to the Roth IRA. It sounds like this was a separate transaction and a separate 1099R should have been gnerated.

@SamS1 - Banks issue one 1099-R for the years total distributions, not two. They never issue two 1099-R's for 2 or more distributions from the same IRA - they are always totaled on a single 1099-R.

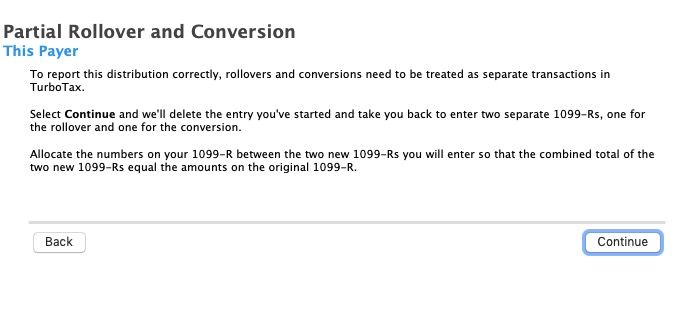

Yes that is the correct way to do it in TurboTax, because multiple destinations are not supported in TurboTax

In fact if you attempt to enter it in a single 1099-R TurboTax will tell you to split it.

Also see "Situations not supported by TurboTax"