- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: Inherited IRA: Caution: TurboTax is using basis for a non-inherited IRA held by same person.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Inherited IRA: Caution: TurboTax is using basis for a non-inherited IRA held by same person.

An individual has a Traditional IRA with a basis and no remaining balance and an active Inherited IRA with no basis and a balance. After all the 1099-R forms are input and Turbo Tax is restarted, Turbo Tax insists on using the basis from the Traditional IRA against the activity on the Inherited IRA. This is resulting in an under-reporting of taxable income. If you redo the 1099-R form processing for the Inherited IRA, Turbo Tax corrects itself. Yet, when you save the return and restart Turbo Tax, you are back to the original error.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Inherited IRA: Caution: TurboTax is using basis for a non-inherited IRA held by same person.

This problem has been previously reported and there is no good workaround. Hopefully there will be a timely fix in a future update, but it's impossible to predict when that will happen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Inherited IRA: Caution: TurboTax is using basis for a non-inherited IRA held by same person.

The developers have not yet conceded that it is a problem. They keep wanting more "token" files when it is trivial to reproduce.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Inherited IRA: Caution: TurboTax is using basis for a non-inherited IRA held by same person.

Agree, it does seem easy to replicate. Also, serious issue if you don't double check Turbo Tax's work.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Inherited IRA: Caution: TurboTax is using basis for a non-inherited IRA held by same person.

I've been scratching my head on this one for a few weeks. I worked around this problem for my situation by setting the cost basis to $0 on the IRA Information Worksheet, since I'm currently only taking withdrawals from my inherited IRA, which has no cost basis. The cost basis of my other traditional IRAs won't be needed for many years, until I start taking RMDs from these accounts.

Oddly, I didn't have this problem with TurboTax from 2012 through 2019, even though it was keeping track of the cost basis of my other IRAs, but this did not affect the inherited IRA calculations. Apparently this bug was introduced in the 2020 version.

Hopefully by the time I need to take RMDs from my other IRAs, TurboTax will separately handle any inherited IRA cost basis as well as traditional IRA cost basis, as specified by the IRS. From what I've read, inherited IRA cost basis must be maintained separately unless the IRA is inherited from a spouse.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Inherited IRA: Caution: TurboTax is using basis for a non-inherited IRA held by same person.

Exactly what I did as a work around to this "bug" e.g. " setting the cost basis to $0 on the IRA Information Worksheet."

Also this is my experience:

"Oddly, I didn't have this problem with TurboTax from 2012 through 2019, even though it was keeping track of the cost basis of my other IRAs, but this did not affect the inherited IRA calculations. Apparently this bug was introduced in the 2020 version."

Hoping they fix this bug it can be very misleading as it causes taxable income from inherited IRA to be really under reported.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Inherited IRA: Caution: TurboTax is using basis for a non-inherited IRA held by same person.

I'm seeing the same "bad math" WRT to IRAs and information from 1099-R (Inherited IRA with RMD) + non-deductible Traditional IRA contributions. I thought I was losing my mind until I round this thread. TT indicated I was due a refund until I verified the numbers it has for the taxable and non-taxable parts of the 1099-R Inherited IRA with RMD and saw that 2020 TT is for some reason saying parts of that RMD are not taxable when every box on the 1099-R says taxable!

Digging further, I believe they are confusing when you have both an inherited IRA/1099-R with RMD AND you have made non-deductible contributions to a regular IRA with being tracked by TT. It's somehow really messing up the "taxable part of the RMD" which should be 100% taxable. It is also messing with the basis of the traditional IRAs and asking me (for the first time) the "value of all your traditional IRAs" on 12/31/2020. It's never, ever asked that before. Now when you enter those YE 2020 values, it really seems to get confused.

TT support needs to fix this promptly b/c non of us will be able to file.

I'm reviewing the posts above for more clues. THANKS so much for posting your same dilemma! Stay safe, stay alive! Peace.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Inherited IRA: Caution: TurboTax is using basis for a non-inherited IRA held by same person.

Oh, I forgot to add, the Inherited IRA is NOT from a spouse and that's where I think things are also getting confused. It popped up a very strange question near the end after exiting the 1099-R about my basis... and I think this is related to all the wrong calculations. Yes, the IRA "Worksheet" seems like there's a lot of wrong math there.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Inherited IRA: Caution: TurboTax is using basis for a non-inherited IRA held by same person.

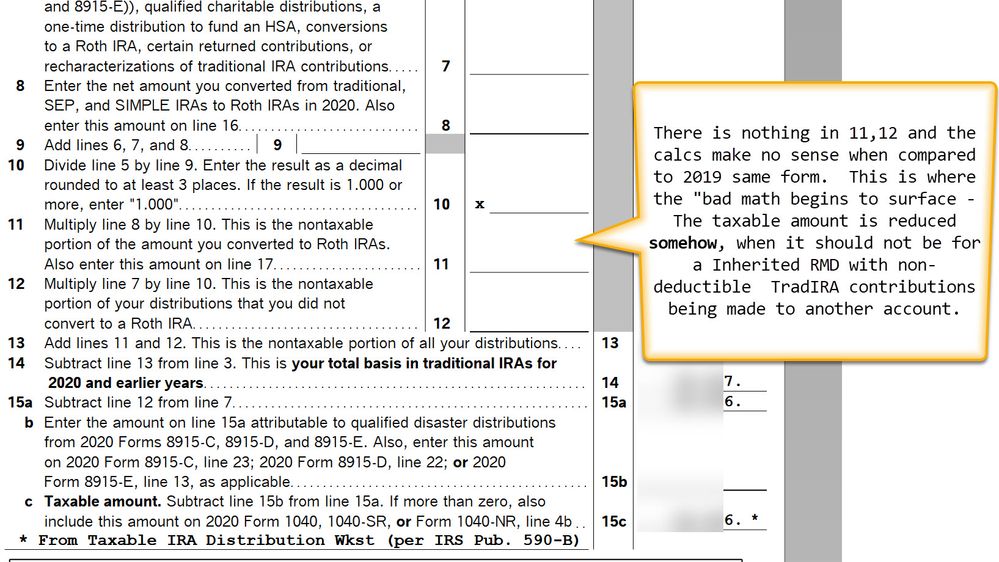

Here's where it looks like the wrong math starts going way off... The inputs up top look suspect too.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Inherited IRA: Caution: TurboTax is using basis for a non-inherited IRA held by same person.

I agree with the analysis of @gattaca that this problem is related to the inherited IRA being inherited from someone other than a spouse, and the presence of the new question about the year-end value of the traditional IRAs, which were not seen in previous years and are not relevant to calculating the taxable amount of the inherited IRA.

It seems that there is enough detailed information in this thread for TurboTax to identify and resolve the problem (info from @dwb54A , @gattaca and myself). So how do we get the TurboTax developers to actually acknowledge and fix the problem?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Inherited IRA: Caution: TurboTax is using basis for a non-inherited IRA held by same person.

Call customer support.

There is no single published number because it changes contently depending on the nature of the call and agent availability. Following the link below will either give a current number for you to call or take your number for a callback.

(Note that phone support is for paying customers only. There is no phone support for Free Customers.)

Here is a TurboTax FAQ for contacting customer support.

https://ttlc.intuit.com/questions/1899263-what-is-the-turbotax-phone-number

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Inherited IRA: Caution: TurboTax is using basis for a non-inherited IRA held by same person.

I called TurboTax Support this afternoon at [phone number removed]. The first level support person forwarded me to a second level support person who opened a ticket for this issue, which links to this thread. Near the end of our call I received an email confirming the case number [social security number removed]. Unfortunately, nine minutes later I received another email saying the case is closed, without further explanation. I don't have another hour or more today to follow up on this. Perhaps some others who have posted to this thread can also call support.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Inherited IRA: Caution: TurboTax is using basis for a non-inherited IRA held by same person.

Being a glutton for punishment, I spent another hour to get to another second level support rep. First she wanted me to explain the whole problem again from scratch, as she didn't seem to have access to the notes from the first support rep, which took at least 20 minutes to create, nor did she seem to have access to this forum like the first support rep did. Eventually, she told me that the case being closed only means that the first support rep was done with her part of the case, and that the case has been forwarded to someone else for action. Whether this is really true or not, I guess time will tell. Unfortunately, there is apparently no way to get back in touch with the first support rep for any follow up questions.

In any event, they shouldn't be sending out an email saying the case is closed with no explanation about what this really means.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Inherited IRA: Caution: TurboTax is using basis for a non-inherited IRA held by same person.

Thank You for opening an official case! I agree 100% - customer support cases should not be "closed" until the problem is resolved with comments for the reporter by the person closing the case. This is very misleading and dubious of any modern enterprise customer support and service request system closing customer facing cases unless customer support is using one ticket system and development is using another. :( That does not play well for customers and should be avoided b/c now the customer support teams have zero visibility into any repair action on the customer's problems and there's no way a customer will be able to see that 2nd ticket. That sure sounds like what was explained on your call. :( It means "Our staff is not working on your issue...for whatever reason is stated in the ticket and when there's nothing...anyone in customer service knows that's the quickest way to anger valuable, paying customers!"

Sorry to digress. I thought I'd explain what MIGHT be happening but we (customers) really do not know.

Now back to this issue. After diving further, it is clear to me the 2020 IRA worksheet is treating an "Inherited IRA RMD from a non-spouse" which has mandatory RMD incorrectly. The rules changed on this a year or so ago which complicates matters too. Some things are grandfathered in. Couple this with when the recipient also has earned income and is also making non-deductible contributions to a "Traditional IRA" and we have a math mess.

My gut says something on our IRA worksheets is very confused. That new 2020 question about the "Total 12/31/20 value of all your "Traditional IRAs" is another clue that this issue is linked into the rules about converting "Traditional IRAs" to Roth IRAs too. The math (as I already posted) does not add up. The result as of today's "fixed TT updates" is the IRA worksheet lowers the "taxable" amount of the "Inherited IRA" RMDs. These are marked as clearly taxable per the 1099-R forms. There's a huge disconnect here. Failure to notice this is going to result in some really bad math and large underpayments of taxes due for anyone not checking TT math.

To temporarily work-around, I needed to "override" values in the IRA worksheet per below. These are probably going to flag any return and may also prevent returns from being electronically filed until this error is fixed by TT. All the internal checkpoints must add up. These flagged forms are usually marked with a red "!" if you start overriding the wrong fields and those are errors.

Anyone who's in this situation needs to verify all the math to avoid underpayment. Of course your situation may be different - YMMV. None of this posting should be considered tax advice. We are only trying to help TT support ID and fix this issue for everyone. TT support, this, plus the other posts should be the roadmap for where to look:

- Part I Line 3 "Basis Carryover as of 12/31/2020" for anyone with an "Inherited RMD"

- TT is messing up that carryover value for the "Traditional IRA basis" which is carried forward every year + the current year's contributions.

- Verify that each 1099-R has the correct check boxes for the inherited state on each form for each person

- Override Part IV, Line 18 with 0 as other posters have noted.

After the above items are fixed, TT makes my "Inherited RMD" fully taxable. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Inherited IRA: Caution: TurboTax is using basis for a non-inherited IRA held by same person.

My workaround is to put 0 in Part III, Line 12 of the IRA Info Worksheet (basis for 2019 and earlier years). This makes the traditional IRA cost basis $0 and results in the entire inherited IRA withdrawal being taxable, as it should be (at least for my situation). Since the IRA Info Worksheet is not filed with the IRS, and doing this removes the unnecessary Form 8606-T (for this situation), I don't think this workaround will adversely affect the ability to file, and it does result in the correct tax amount being calculated.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

wilsonjls

Returning Member

hemphess

New Member

sailorsj

New Member

rudygac

Level 2

dea44

Level 2