- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: If I receive a additional amount of State EIC for 2020 is it taxable in 2022? The standard de...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I receive a additional amount of State EIC for 2020 is it taxable in 2022? The standard deduction was used in all tax years so wouldn't the tax benefit rule apply?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I receive a additional amount of State EIC for 2020 is it taxable in 2022? The standard deduction was used in all tax years so wouldn't the tax benefit rule apply?

Can you clarify which state return are you filing? and what do you mean by additional amount of state EIC?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I receive a additional amount of State EIC for 2020 is it taxable in 2022? The standard deduction was used in all tax years so wouldn't the tax benefit rule apply?

Thank you for asking MayaD. The Iowa state return was amended in 2022 for 2020 taxes to claim only additional Earned Income Credit, no refund of withholding. The additional funds were received in 2022. The standard deduction was taken in both 2020 and 2021 on federal and state taxes as itemized deductions were much less than the standard deduction. For that reason, I am under the impression that the tax benefit rule applies but TT is including it as 2022 income. Does the 2 year gap make a difference?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I receive a additional amount of State EIC for 2020 is it taxable in 2022? The standard deduction was used in all tax years so wouldn't the tax benefit rule apply?

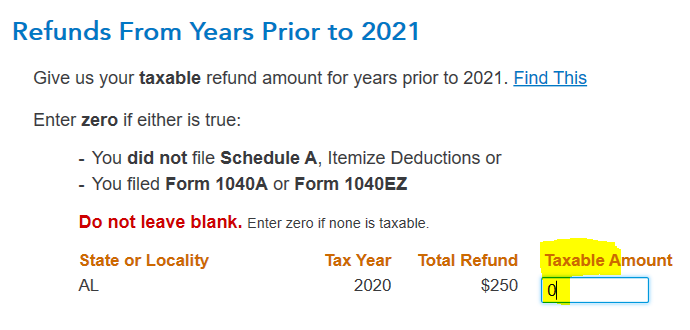

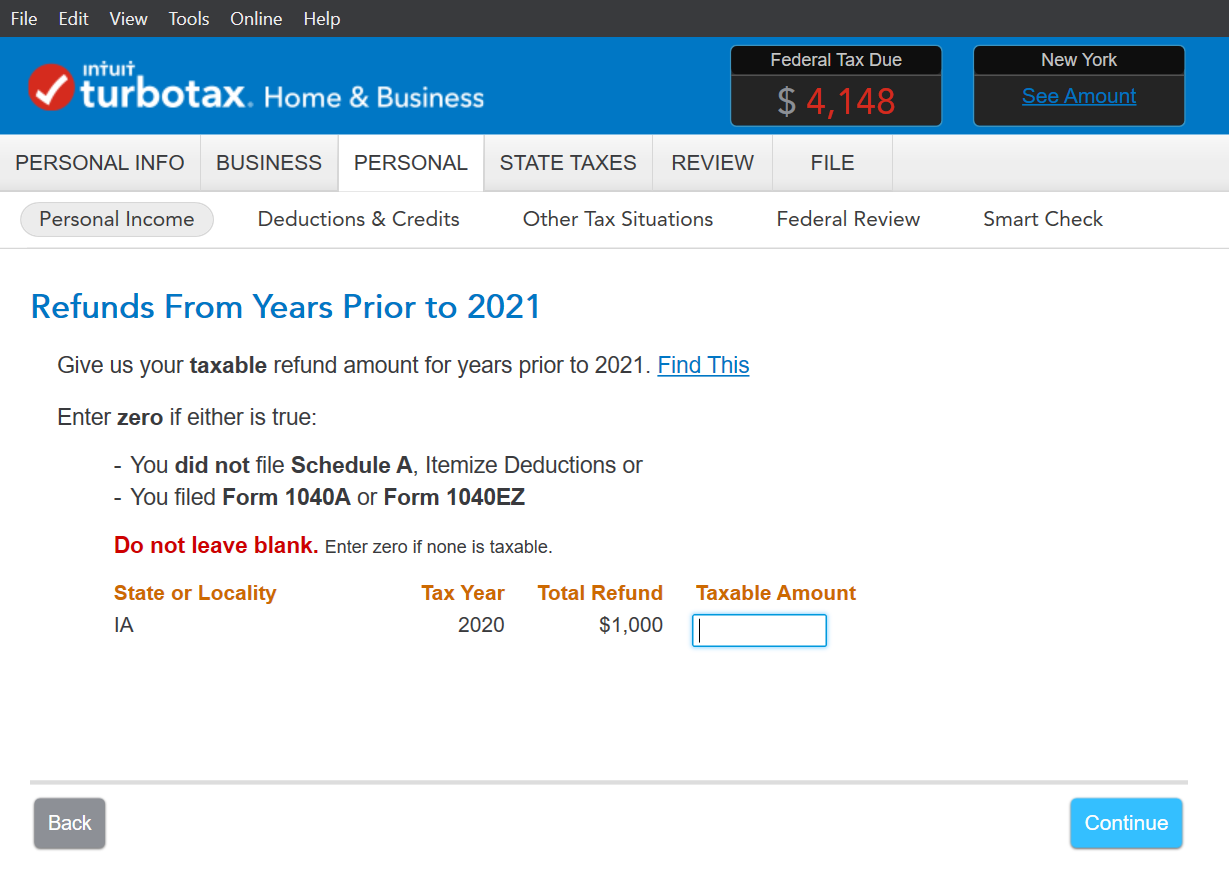

No, the gap is not the issue. The 1099-G is showing taxable when it should not be. The IRS states:

Don't report any of the refund as income if you didn’t itemize your deductions on your federal tax return for the tax year that generated the refund.

The 1099-G can be entered a couple of places in the program. Please make sure that you are entering it as a state and local refund. Because it is a 2 year gap, the program will ask for your information from that year. Enter zero as the taxable amount.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I receive a additional amount of State EIC for 2020 is it taxable in 2022? The standard deduction was used in all tax years so wouldn't the tax benefit rule apply?

I should mention I am on TT Home & Biz desktop. I'm sure it was entered in the correct place as it appears with the transfer amount for my 2021 Iowa refund. In my case, the screen did not appear as shown in your example and I was not given the option for taxable. Any other workaround ideas?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I receive a additional amount of State EIC for 2020 is it taxable in 2022? The standard deduction was used in all tax years so wouldn't the tax benefit rule apply?

The screen "Refunds From Years Prior to 2021" appears in Home & Business after you tap DONE on "State and Local Tax Refund Summary,"

- Tap the Personal tab, then Personal Income

- Select I'll choose what I work on

- On "Your 2022 Income Summary" find State and Local Tax Refunds on Form 1099-G and UPDATE

- On "State and Local Refund Summary" tap DONE

You will see "Refunds From Years Prior to 2021."

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I receive a additional amount of State EIC for 2020 is it taxable in 2022? The standard deduction was used in all tax years so wouldn't the tax benefit rule apply?

ErnieSO:

Thank you for your response. The screenshot you are showing in your comments looks nothing like mine. I do not have the option to enter zero on taxable. I am using desktop Home & Biz and have done all updates. I'm at a loss with this. Either overstate my income as TT support suggested so as not to ignore or leave it blank. I am confident that it is not taxable as the Standard Deduction was taken. I did not have much to benefit from itemizing. TT did not generate a Schedule A for 2020. Any ideas?

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I receive a additional amount of State EIC for 2020 is it taxable in 2022? The standard deduction was used in all tax years so wouldn't the tax benefit rule apply?

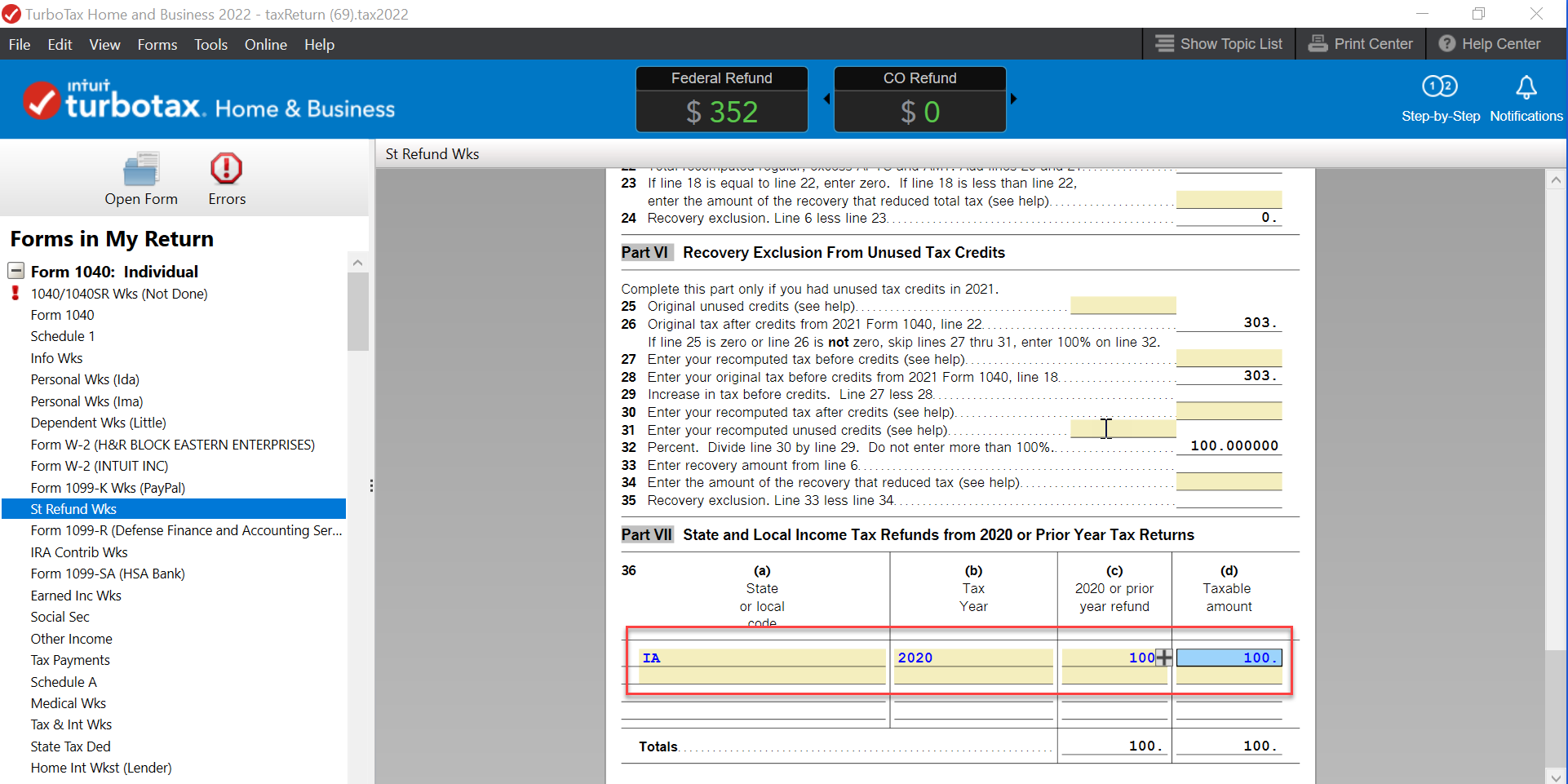

You can also use Forms mode to make the adjustment.

- Tap Forms in the top right corner.

- In the left column find and tap St Refund Wks

- Go to Part VII and change the taxable amount

- Tap Step-by-Step where Forms used to be to return to the interview mode

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

shanesnh

Level 3

bruce-carr49

New Member

rkwicks1958

New Member

CWP2023

Level 1

user17521061672

New Member