- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

No, the gap is not the issue. The 1099-G is showing taxable when it should not be. The IRS states:

Don't report any of the refund as income if you didn’t itemize your deductions on your federal tax return for the tax year that generated the refund.

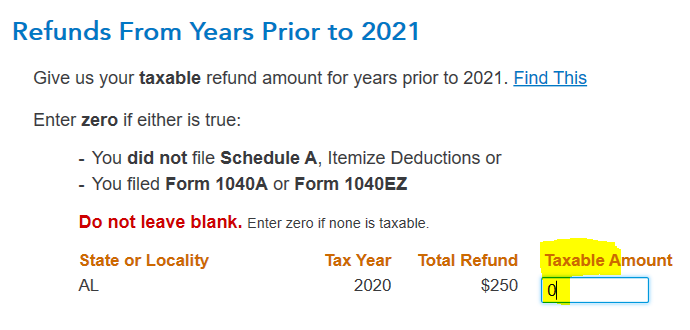

The 1099-G can be entered a couple of places in the program. Please make sure that you are entering it as a state and local refund. Because it is a 2 year gap, the program will ask for your information from that year. Enter zero as the taxable amount.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 30, 2023

3:29 PM