- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: I only have form ssa-1099-social security benefit statement.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I only have form ssa-1099-social security benefit statement.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I only have form ssa-1099-social security benefit statement.

If you only get SS or SSDI or ssi it is not taxable and you do not have to file a return. And there is no benefit in claiming dependents or deductions. And you can't efile a return with no taxable income. If you want to file you will have to print and mail it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I only have form ssa-1099-social security benefit statement.

Yeah I have form SSA-1099 -Social security benefit statement…

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I only have form ssa-1099-social security benefit statement.

You likely do not have to file a return when all you have is social security. If you did not receive the third economic impact payment, you may need to file a return to receive it. It would have been $1,400 received early in the year.

You may want to file if you have not yet received the third stimulus payment of $1,400.00. More information can be found in the link below.

Filing requirements for a single taxpayer, over 65 is $14,250.00.

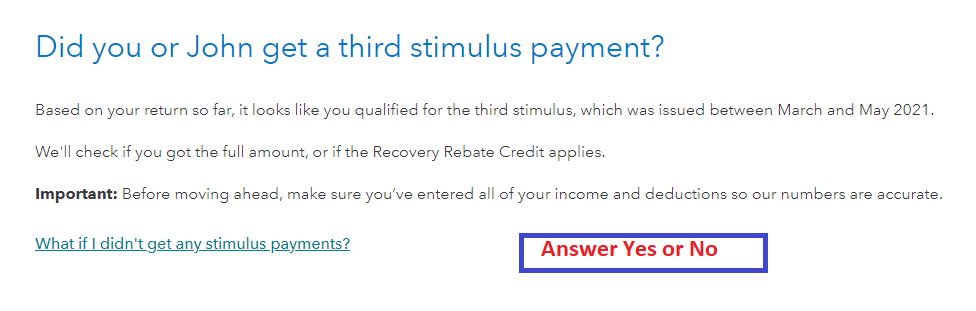

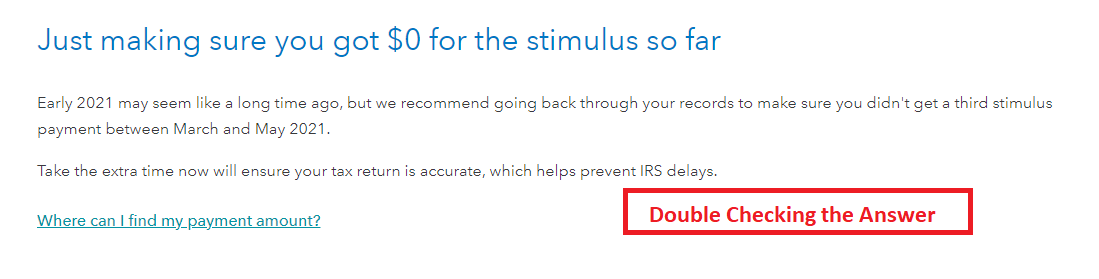

When you are logged into your TurboTax account use the following steps to enter your third stimulus payment or enter zero if you didn't receive it yet.

- Select 'Federal Review' at the top right

- Answer the questions to be sure you have all you are entitled to

- Continue to complete your tax return

- See the images below

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jfoster219

New Member

user17717734672

New Member

mviruet60

New Member

sarahduffy28

New Member

user17717170333

New Member