- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: I am trying to report income from a 1099-R form. The Tax ID # is asked for from the Northern Trust Company. Turbo Tax is saying this is a required field to fill in. I called Northern Trust Company...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am trying to report income from a 1099-R form. The Tax ID # is asked for from the Northern Trust Company. Turbo Tax is saying this is a required field to fill in. I called Northern Trust Company Pen

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am trying to report income from a 1099-R form. The Tax ID # is asked for from the Northern Trust Company. Turbo Tax is saying this is a required field to fill in. I called Northern Trust Company Pen

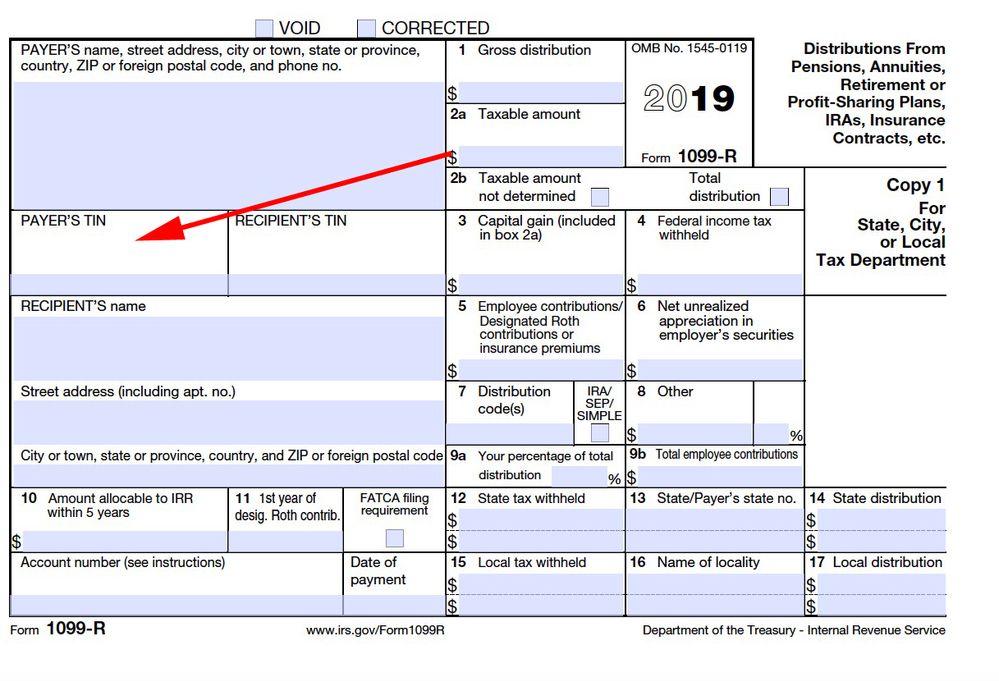

The Payer's TIN (Taxpayer Identification Number) is a required field to be entered. Enter the 9 digit TIN as shown on the Form 1099-R.

To enter, edit or delete a form 1099-R -

- Click on Federal Taxes (Personal using Home and Business)

- Click on Wages and Income (Personal Income using Home and Business)

- Click on I'll choose what I work on (if shown)

- Scroll down to Retirement Plans and Social Security

- On IRA, 401(k), Pension Plan Withdrawals (1099-R), click the start or update button

Or enter 1099-r in the Search box located in the upper right of the program screen. Click on Jump to 1099-R

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am trying to report income from a 1099-R form. The Tax ID # is asked for from the Northern Trust Company. Turbo Tax is saying this is a required field to fill in. I called Northern Trust Company Pen

Your question was cut off because you entered it int the title and not the details box under the title.

Yes, the payers TIN is required and must be on the 1099-R form the they sent you.

This is the official IRS 1099-R form:

https://www.irs.gov/pub/irs-pdf/f1099r_19.pdf

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

lbanuelo

New Member

RamGoTax

New Member

mormor

Returning Member

leslietordoya620

New Member

RyanK

Level 2