- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

Your question was cut off because you entered it int the title and not the details box under the title.

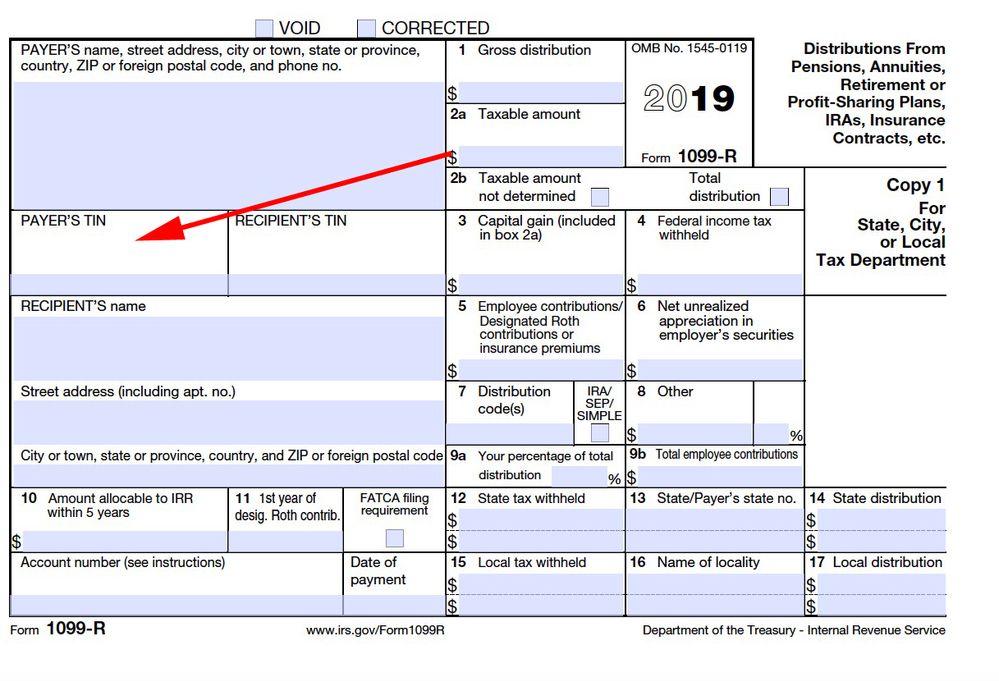

Yes, the payers TIN is required and must be on the 1099-R form the they sent you.

This is the official IRS 1099-R form:

https://www.irs.gov/pub/irs-pdf/f1099r_19.pdf

**Disclaimer: This post is for discussion purposes only and is NOT tax advice. The author takes no responsibility for the accuracy of any information in this post.**

June 17, 2020

10:58 AM