- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: How do I indicate in Turbotax that I have a federal pensions, which is not subject to taxes i...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I indicate in Turbotax that I have a federal pensions, which is not subject to taxes in Hawaii, my state of residence?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I indicate in Turbotax that I have a federal pensions, which is not subject to taxes in Hawaii, my state of residence?

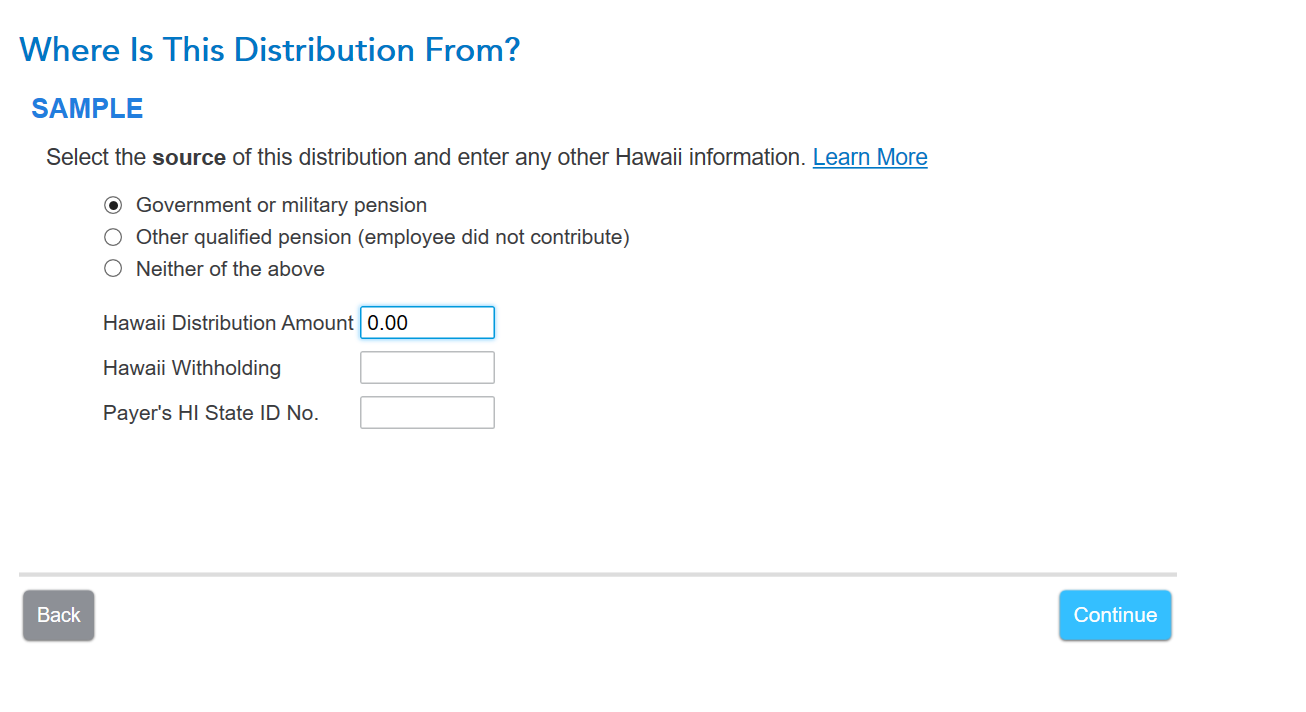

You have to indicate it is a government pension on the screen below (screenshot attached). To get to this screen, go back to your 1099-R input. After you input the amounts from your 1099-R, click Continue and you will reach the below follow-up screen. Since it is not taxable in Hawaii, enter 0.00 for the Hawaii distribution amount.

If you need assistance getting back to your 1099-R, click here.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I indicate in Turbotax that I have a federal pensions, which is not subject to taxes in Hawaii, my state of residence?

Edited...Prior comment here may no longer be valid, at least for desktop software.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I indicate in Turbotax that I have a federal pensions, which is not subject to taxes in Hawaii, my state of residence?

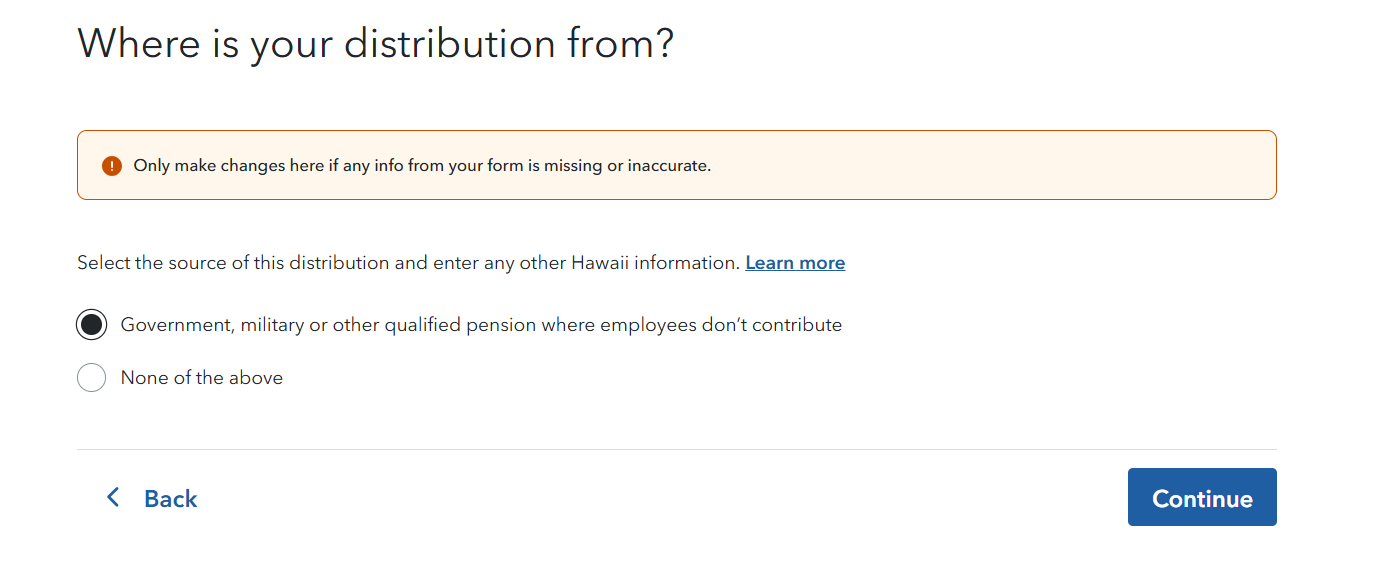

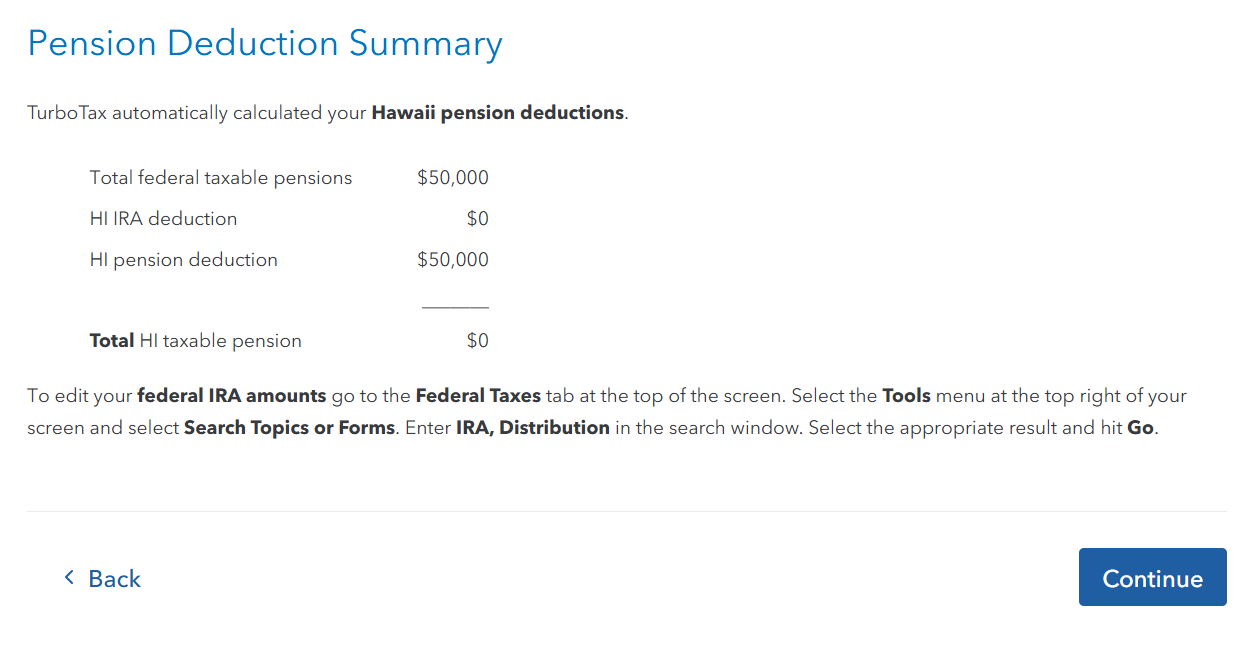

I am having technical issues downloading the state program to test this in TurboTax Desktop. However, when I tested this in TurboTax Online, the distribution screen I posted earlier does not include the same Hawaii distribution amount box. However, when going through the state program, it automatically deducted the pension distribution. Because of the differences in screens, I cannot determine whether this would happen in TurboTax Desktop. I will continue to attempt TurboTax Desktop and edit my answer accordingly.

If you are using TurboTax Online, please ensure you marked the correct type of distribution after your 1099-R entry.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I indicate in Turbotax that I have a federal pensions, which is not subject to taxes in Hawaii, my state of residence?

Somewhat...My mistake.

What I indicated above, used-to-be how the $$ were to be entered (having used the software for over 20 years)....BUT Apparently TTX desktop has made some changes in the past few years.

...I went back to my NC test files and checked the NC distribution amount for a CSA-1099-R from OPM, where checked as Bailey Settlement (What NC uses for US Govt pensions established before a certain date.)

At least back to 2021, it made no difference whether I entered 0.00 or the value from box 2a, the software always used the box 2a value as the NC income deduction amount. Almost seems as if the software developers realized folks were mis-entering it , and recoded it to always use the right number. (not sure what they do if box 2a is empty/undetermined.)

(I'll delete my comment above)

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

JWAmpsOnly

Level 2

AKL1

Level 2

bluemoon

Level 3

drj838

Level 1

_John__

Level 2