- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: Form 8915-E

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-E

@DoninGA I did delete 1099-R and inputted again, but Hawaii has same error message for Exclusion. I am able to file Federal not state.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-E

Hi,

I am using Turbotax online. This question is as of 5 March 2021.

I have a CARES Act distribution from my workplace Roth 401K. After I enter my 1099-R, I am not getting any covid/cares act related questions and the software is charging me the 10% penalty.

TT takes me to an exception screen "Do any of these situations apply" - but there is no COVID/Cares act option there.

please help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-E

@sanket2016 wrote:

Hi,

I am using Turbotax online. This question is as of 5 March 2021.

I have a CARES Act distribution from my workplace Roth 401K. After I enter my 1099-R, I am not getting any covid/cares act related questions and the software is charging me the 10% penalty.

TT takes me to an exception screen "Do any of these situations apply" - but there is no COVID/Cares act option there.

please help!

What is the code in box 7? Did you mistakenly check the IRA box? Is there a taxable amount entered in box 2a?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-E

The code in box 7 is 1B. It's a early withdrawal from Roth 401k. I need to pay tax on the Roth earnings.

I did NOT check the IRA box - I've triple-checked my 1099-R entries several times.

Yes, there is a taxable amount in box 2a.

My 401k plan administrator issued me a "Qualified CARES act withdrawal certificate" because I meet the eligibility criteria.

Issue: Right now, TT is charging me the 10% penalty and not giving me any option to spread tax over 3 years. (There is no mention of a Cares Act withdrawal in all of the 1099-R steps, or even after wrapping up Federal income.)

This issue is occurring in Federal taxes. I've gone through all the steps and finished my Federal taxes; I haven't started my state taxes yet.

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-E

@dmertz You have this issue of a Roth 401(k) distribution with a code of 1B covered perfectly. Could you assist?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-E

Currently the online version will not present the COVID related questions for a 1099-R with a box 7 code that contains a "B".

User @dmertz posted the following workaround for the Online version 1099-R code B bug.

In online TurboTax a workaround is needed to get around the flaw in TurboTax that prevents it from asking if the distribution is COVID-19 -related when there is a code B in box 7. Enter the Form 1099-R as is but omit the code B, enter only code 1, 2 or 7 (If box 7 has only code B, temporarily enter code 7 instead). Complete the follow-up questions, then, when you reach the Review Your 1099-R Info page, edit this 1099-R and add the code-B selection. The COVID-19-related information will remain even though you won't have access to those questions with the code B present.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-E

@Jedi4380 I did edit 1099-R but it still gives me

Retirement Exclusion message for Hawaii. Glad it worked for you. I’m also using premier for mac.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-E

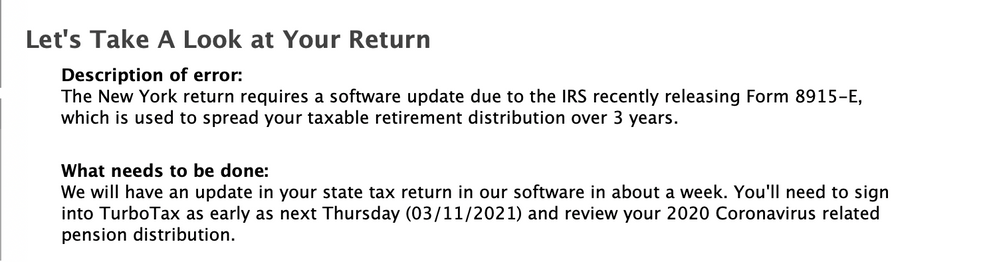

@huamapu False alarm. NY rejected my return saying they weren't ready to process Form 8915-E. The federal was accepted though. TurboTax has a message (screenshot below) that hopefully by 3/11 I can re-file.

FYI to other New Yorkers.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-E

@Jedi4380 Thank you for the information. Hopefully HI will be the same date. 🤔

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-E

After 4 prior dates mentioned by TurboTax, I can’t say I’m holding my breath here for 03/11 ..! @Jedi4380

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-E

Thank you @macuser_22 .

The workaround for code 1B in my 1099-R worked for CARES act distribution.

I am now waiting for the New York state tax software to be updated for COVID distribution.

Thanks for your help!

Update 3/9: I switched to TaxAct and finished filing my taxes. Pretty much every other tax software out there has Form 8915-E updated for Federal and State. After 12 years of using TurboTax, happy to switch. Bugs and other issues in TurboTax are just not worth my time anymore.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-E

Does anyone know when TT is going to fix the Retirement Distribution Exclusion? State of Hawaii taxes is going to be due in about a month. This is the only thing that I'm waiting for. I hope someone from TT can give an answer.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-E

Please see the information in the link below for an update.

Form 8915-E state returns update

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-E

@JotikaT2 Too late 😂. Likely my last year using TT because of this

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-E

All, state filing now works with form 8915-E online and desktop.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

javigilante8243

Level 2

rrectanus

New Member

apcoulte

Level 2

ccsnreg

New Member

gmmayes94

Returning Member