- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: Form 8606 with Roth Rechar to TIRA and backdoor Roth

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8606 with Roth Rechar to TIRA and backdoor Roth

In 2018 I contributed $5500 to a Roth. In Jan 2019 I contributed $1200 to my Roth. Early 2019 while doing my 2018 taxes TurboTax told me that my MAGI was too high to contribute to Roth. I re-characterized the $5500 (total rechar = $5,694.16 per 2019 1099-R box 7=R) to a newly created TIRA. And converted the entire TIRA to the Roth (Total converted $5,749.03 per 2019 1099-R box 7=2). The TurboTax generated Form 8606 for 2018 had $5500 on lines 1, 3, and 14.

In March 2020 while doing my 2019 taxes, TurboTax told me that my MAGI was again too high to contribute to the Roth. I re-characterized the $1200 (total rechar = $1,135.44 per letter from Fidelity) to my TIRA. I also contributed another $4800 (done in March 2020 for 2019) non-deductible straight to the TIRA. And then converted the entire TIRA (~$5935) to the Roth.

The 2019 TurboTax generated form 8606 has the following:

Line 1: 6000

Line 2: 5500

Line 3: 11500

Line 4: 4800

Line 5: 6700

Line 6 – 12 are blank

Line 13: 5749

Line 14: 5751

Lines 15a,b,c: 0

Line 16: 5749

Line 17: 5749

Line 18: 0

I was thinking that I would need to owe taxes on the gains $5749-$5500= $249. However, the 2019 TurboTax generated form 8606 line 18 says there is $0 taxable amount. Is that correct? Also, why would lines 6-12 be blank? When I fill out form 8606 with what I think should be in lines 6-12 I get the following:

Line 6: 1200

Line 7: 0

Line 8: 5749

Line 9: 6949

Line 10: .964

Line 11: 5543

Line 12: 0

Line 13: 5543

Line 14: 5957

Line 15a,b,c: 0

Line 16: 5749

Line 17: 5543

Line 18: 206

This shows some tax owed on line 18, but still seems off. Can anyone let me know what I am doing wrong or why TurboTax says no tax is owed?

Thank you.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8606 with Roth Rechar to TIRA and backdoor Roth

At this point you may wish to contact a specialist that can work through that section of the return with you. The specialists can look at your return on their screen to find out exactly what is causing this issue and suggest how you can take corrective action if needed.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8606 with Roth Rechar to TIRA and backdoor Roth

First, lines 6-12 are blank because there is probably an * next to line 15 that says the lines 6-12 calculations are done on the "Taxable IRA Distribution Worksheet) and not on the 8606 form.

Even though line 6 is not there, it appears that you failed to enter the 2019 total December 31 value of all Traditional IRA accounts that you have so the entire non-deductible basis was applied rather then pro-rating it between the conversion and remaining IRA value. Entering the year end value should fix it.

Enter a 1099-R here:

Federal Taxes,

Wages & Income

(I'll choose what I work on - if that screen comes up)

Retirement Plans & Social Security,

IRA, 401(k), Pension Plan Withdrawals (1099-R).

OR Use the "Tools" menu (if online version left side) and then "Search Topics" for "1099-R" which will take you to the same place.

Be sure to choose which spouse the 1099-R is for if this is a joint tax return.

Be sure to pick the correct 1099-R type: Standard 1099-R, CSA-1099-R, CSF-1099-R, RRB-1099-R.

[NOTE: When you get to the "Your 1099-R Entries" screen where you can add another 1099-R, use "continue" to keep going as there are additional interview questions after that screen in most cases. You can always return as shown above.]

You will be asked of you had and tracked non-deductible contributions - say yes. The enter the amount from the last filed 8606 form line 14 if it did not transfer. Then enter the total value of any Traditional, SEP and SIMPLE IRA accounts that existed on December 31, 2019.

That will produce a new 8606 form with the taxable amount calculated on lines 6-15 and the remaining carry-forward basis on line 14.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8606 with Roth Rechar to TIRA and backdoor Roth

I just noticed the * next to lines 13, 15c, and 18 and now see that TurboTax filled out the Taxable IRA Distribution Worksheet. So I guess that explains why there is nothing on 6-12 on the 8606. Line 4 of the worksheet has the $1200 that I contributed to the Roth in 2019 and recharacterized to the TIRA this year. And line 9 & 11 nontaxable portion is 5759. This gets transferred to for 8606 line 13 & 17.

So I guess the gains (5749-5500=249) from the 2019 TIRA conversion do not get taxed. Still don't understand why, but seems like I've entered the numbers correctly and TurboTax is calculating correctly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8606 with Roth Rechar to TIRA and backdoor Roth

If the IRA had $11,500 in non-deductible contribution in it and you only converted $5,749 then there should still be at least $5,751 in it. That amount (or more) should be on the Taxable IRA Distribution Worksheet line 4.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8606 with Roth Rechar to TIRA and backdoor Roth

At the end of 2019 my TIRA had $0 in it. I converted 100% of my TIRA in March 2019 ($5749). In March of 2020 I recharacterized $1200 ($1135 after losses) from Roth to TIRA (was originally contributed Jan 2019) so would that be the value of the TIRA at the end of 2019? Or should I also add the $4800 (non-deductible) that I contributed to the TIRA in March 2020 (2019 contribution)? So would line 4 of the Taxable IRA Distribution Worksheet be 0, 1135, 1200 or 6000?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8606 with Roth Rechar to TIRA and backdoor Roth

If the 2019 year end IRA value was zero then line 4 should be zero.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8606 with Roth Rechar to TIRA and backdoor Roth

So why would line 4 of the worksheet be 0 and not 1200 or 6000?

The 1200 was a 2019 roth contribution that was recharacterized to TIRA in 2020, so isn't that considered to have been a 2019 TIRA contribution?

Also, why doesn't the 2019 TIRA contribution (made in 2020) of 4800 not get added on to the line 4?

Thanks again for taking the time to reply.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8606 with Roth Rechar to TIRA and backdoor Roth

A contribution *for* 2019 made in 2020 should be on line 4.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8606 with Roth Rechar to TIRA and backdoor Roth

Your original post said that the $1,200 Roth contribution was made in 2019, not 2020 so after recharacterizing it is still a 2019 contribution. As you posted the 2019 $4,800 contribution make in 2020 is on line 4 as it should be. When I said line 4 should be zero, that was in regard to the $1,200 contribution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8606 with Roth Rechar to TIRA and backdoor Roth

Line 4 of the Taxable IRA Distribution Worksheet says:

"Enter the value of all your traditional IRAs as of 12/ 31/2019 (including any outstanding rollovers from traditional IRAs to other traditional IRAs).

Line 4 of the form 8606 says:

"Enter those contributions included on line 1 that were made from January 1, 2020, through April 15, 2020"

I agree that Line 4 on form 8606 should be 4800.

My past few questions have been for the IRA Distribution Worksheet.

Would line 4 of the Taxable IRA Distribution Worksheet be 1200 or 6000?

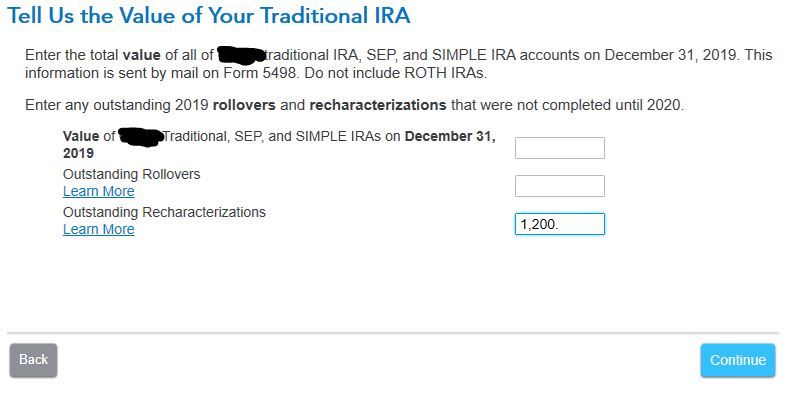

In the step-by-step section that you pointed out in your first reply it asks to

"Enter the total value of all of TIRA, SEP, and Simple IRA on December 31, 2019

Enter any outstanding 2019 rollovers and recharacterizations that were not completed until 2020.

Value of Traditional, SEP and SIMPLE IRAs on December 31, 2019 _________________

Outstanding Rollovers ______________

Outstanding Recharacterizations _____________

Currently I only have 1200 on the recharacterization line. If I put 6000 on the Value line it adds 1200 to 6000. 7200 doesn't seem right.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8606 with Roth Rechar to TIRA and backdoor Roth

If the total value of the all Traditional IRA accounts at the end of 2019 was zero, then line 4 on the worksheet should be 0 if there was no money in the IRA..

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8606 with Roth Rechar to TIRA and backdoor Roth

Line 4 of the worksheet comes from those three lines in the step-by-step. The 1200 was for 2019 contribution (rechar in 2020) why wouldn't that be on that third line in the step-by-step?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8606 with Roth Rechar to TIRA and backdoor Roth

delete

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8606 with Roth Rechar to TIRA and backdoor Roth

The 3rd line I am referring to is from the step-by-step section that you pointed out in your very first reply (see picture)

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ChickenBurger

New Member

LMTaxBreaker

Level 2

Carter337

Level 1

LMTaxBreaker

Level 2

Kerala

Level 1