- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: Contributing Pension Income to an IRA

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Contributing Pension Income to an IRA

I filed my taxes with turbo tax and followed the prompts that said I could take part of my pension income and contribute to an IRA. I did this but have now been told by my investment advisor that my IRA contribution will not be deductible. Is this section on turbo tax not accurate?

Thanks.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Contributing Pension Income to an IRA

@khuber wrote:

I filed my taxes with turbo tax and followed the prompts that said I could take part of my pension income and contribute to an IRA. I did this but have now been told by my investment advisor that my IRA contribution will not be deductible. Is this section on turbo tax not accurate?

Thanks.

Pension income is not eligible to fund an IRA.

The maximum IRA contributions for 2020 is $6,000, or $7,000 if you’re age 50 or older by the end of the year; or your taxable compensation for the year which ever is less.

(Taxable compensation is generally wages that you worked for - W-2 or net self-employed income minus the deductible part of the SE tax, but can include commissions, certain alimony and separate maintenance, and nontaxable combat pay ).

See IRS Pub 590A "What is compensation" for details:

https://www.irs.gov/publications/p590a#en_US_2020_publink1000230355

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Contributing Pension Income to an IRA

Thank you, I agree I filed in error for sure. TurboTax needs to fix the prompts that lead me to believe contributing to an IRA was allowed and deductible even though all my income was from a pension.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Contributing Pension Income to an IRA

@khuber wrote:

Thank you, I agree I filed in error for sure. TurboTax needs to fix the prompts that lead me to believe contributing to an IRA was allowed and deductible even though all my income was from a pension.

I do not know of anything in TurboTax that would lead you to think that. What do you mean?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Contributing Pension Income to an IRA

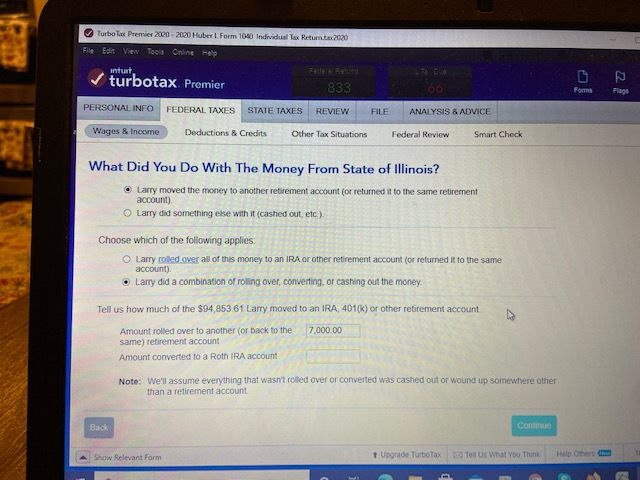

Here is a picture of the screen that directed me to believe the pension income could be rolled into an IRA. What am I missing?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Contributing Pension Income to an IRA

"Moved the money to an IRA" is a tax free rollover, not a NEW IRA contribution.

You enter the 1099-R and say that it was moved to another retirement account and rolled to an IRA.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Contributing Pension Income to an IRA

Thank you for the clarification on"moving money to an IRA", so maybe I don't need to amend my taxes if I "move" the money to an IRA instead of classifying as a contribution? Any thoughts on how I do that as opposed to a contribution?

Thank You!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Contributing Pension Income to an IRA

What code is in box 7 on your 1099-R for the 401(k)?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Contributing Pension Income to an IRA

Code 7 is in box 7.

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Contributing Pension Income to an IRA

Then if was not a direct rollover and you rolled it yourself.

Enter a 1099-R here:

Federal Taxes,

Wages & Income

I’ll choose what I work on (if that screen comes up),

Retirement Plans & Social Security,

IRA, 401(k), Pension Plan Withdrawals (1099-R).

OR Use the "Tools" menu (if online version under My Account) and then "Search Topics" for "1099-R" which will take you to the same place.

Be sure to choose which spouse the 1099-R is for if this is a joint tax return.

Be sure to pick the correct 1099-R type: Standard 1099-R, CSA-1099-R, CSF-1099-R, RRB-1099-R.

If this was a rollover, answer the question that you moved the money to another retirement account (can be the same account). The screen will open up with choices of where it was moved.

[NOTE: When you get to the "Your 1099-R Entries" screen where you can add another 1099-R, use "continue" to keep going as there are additional interview questions after that screen in most cases. You can always return as shown above.]

It will show as income on the summary screen which shows gross income, not taxable income.

The income will be reported on line 4a on the 1040 form with the word “ROLLOVER” next to it if it was a rollover.

The taxable amount will go on line 4b. In the case of a rollover, that amount will be zero.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Contributing Pension Income to an IRA

Correct, definitely not a rollover, the 1099-R I receive is just a summary of the monthly pension payments I receive throughout the year. I enter exactly as you summarized then see the screen I sent that asks if anything "moved" to an IRA. If I'm not able to "move" money to an IRA this screen should not have come up. Thank you for your responses, they have been very helpful. Am I allowed to move $ to an IRA given the type of income reported on my 1099-R?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Contributing Pension Income to an IRA

No. A monthly pension is not eligible for rollover. Only earned income W-2 or net self-employed" income can be IRA contribution.

TurboTax asks questions reguardless of the type of plan because there is nothing on a 1099-R that indicates the plan type and if it eligible for rollover or not. If you are age 70 or older it will as if it is a RMD and ALL pensions are RMD's and that will prevent the rollover questions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Contributing Pension Income to an IRA

Any idea how soon I can amend my 2020 return and send in the necessary payment? Both federal and state will need amended now.

Thanks,

Kyle

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Contributing Pension Income to an IRA

The amend function will be available after March 25.

Do not rush to amend - no hurry. You have 3 years to amend and amended returns are taking 4-6 months or longer to be processed so waiting a few weeks will make little difference and amending too soon might just compound the problem. (If you amend today you probably will not see the results until August or September).

To amend your 2020 tax return:

-- If accepted you should *wait* until your return has been processed and you receive your refund or conformation that any tax due has been paid. (If you file an amended return while you first return is being processed it can cause extended delays for both returns if two returns are in the system at the same time). In addition, if the IRS makes any change on your original return, you might end up having to amend the amendment – a sticky process that can take a year or more).

-- Then you can start the amend process.

It is suggested that it be mailed certified with return receipt (or other tracking service) to verify that the IRS receives it. That is the only proof of mailing that the IRS will accept.

-- Amended returns can be mailed or e-filed - allow 8-12 weeks - can take up to 16 weeks (4 months) for processing.

See this TurboTax FAQ for help with amending:

https://ttlc.intuit.com/questions/1894381-how-to-amend-change-or-correct-a-return-you-already-filed

You can check the status of your amended return here but allow 3 weeks after filing for it to show up:

https://www.irs.gov/filing/wheres-my-amended-return

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ilenearg

Level 2

ajs813

Returning Member

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

Lukas1994

Level 2

rodiy2k21

Returning Member

ir63

Level 2