- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: Basis after Backdoor Roth conversions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Basis after Backdoor Roth conversions

last year (and several years prior to that) i both contributed the max to a TIRA and then backdoor Roth'ed it - all during Jan 1 - April 15 for the previous tax year. On my 8606 from last year it shows basis of 5500. my overarching goal is to not have ANY nondeductible monies in my accounts, so that its pure roth/after tax dollars only. but my 8606 basis is 5500 on line 14. Does this mean my strategy is off if I have a basis every year?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Basis after Backdoor Roth conversions

As long as any Traditional IRA, SEP IRA or SIMPLE IRA account exists anywhere, there will always be some basis. Only if all such accounts are closed will the basis all be applied.

You can NEVER withdraw ONLY the nondeductible part - it must be prorated over the entire value of ALL Traditional IRA accounts which include SEP and SIMPLE IRA's. (For tax purposes you only have ONE Traditional IRA which can be split between as many different accounts as you want, but for tax purposes they are all added together).

For example using rough figures: if you had $60K of nondeductible contributions in an IRA with a total value of $600K (10:1 ratio), then when you take a $60K distribution from any IRA account $6,000 would be nontaxable and $54,000 would be taxable (same 10:1 ratio) , with the remaining $54K of basis staying in the IRA for future distributions. As long as there is any money in the IRA, there will be some basis.

TurboTax will ask for your non-deductible "basis" and then the *Total Value* of *all* Traditional IRA, SEP and SIMPLE accounts as of Dec 31, of the tax year. That is so the prorating of the basis can be properly proportioned between the current years distribution and the remaining IRA value. That is done on the 8606 form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Basis after Backdoor Roth conversions

If I contribute $5500 to a nondeductible ira account that has zero dollars in it in April 2019 for tax year 2018, then quickly convert the entire balance to a Roth a few days later, rendering the nondeductible ira account balance zero again...and I have no other nondeductible money in any ira account, is that 5500 my “basis” when I file despite fact I zeroed out the non deductible amount right away?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Basis after Backdoor Roth conversions

You are asking about the past - what you did last year in 2019?

If that is the ONLY Traditional IRA account then yes.

Be sure that you filed a 2018 8606 form reporting it as a 2018 nondeductible contribution to be able to do that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Basis after Backdoor Roth conversions

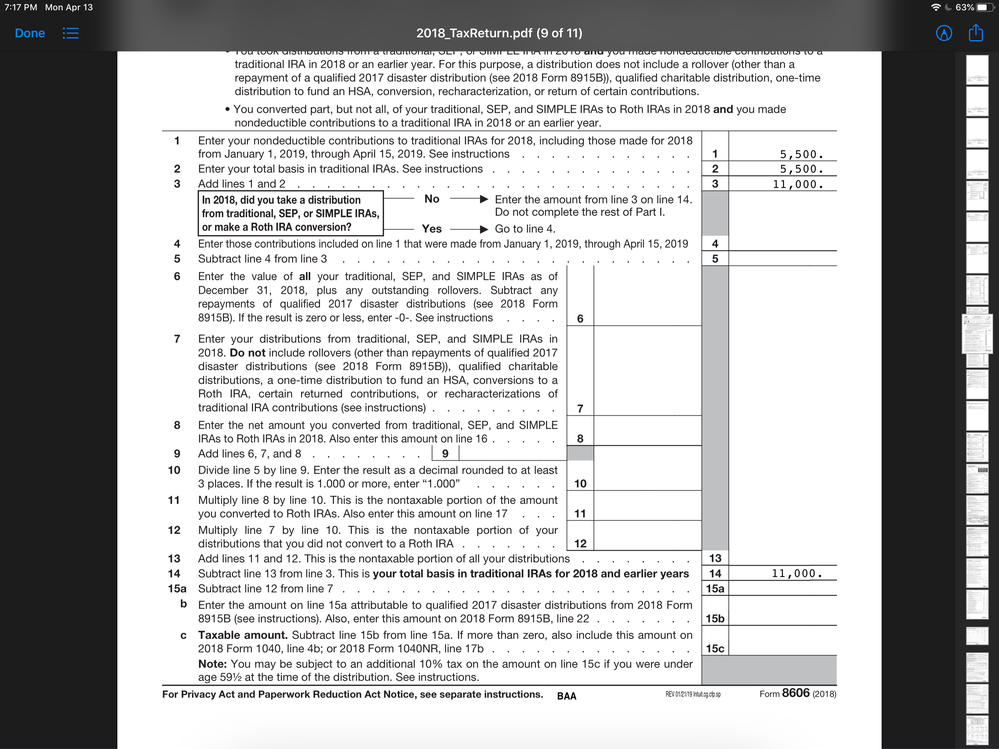

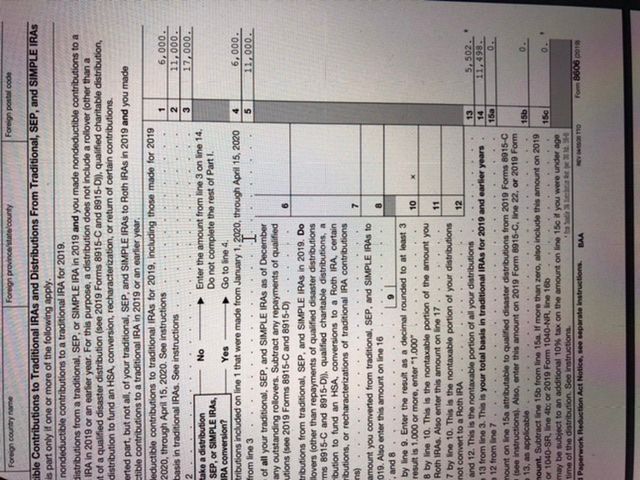

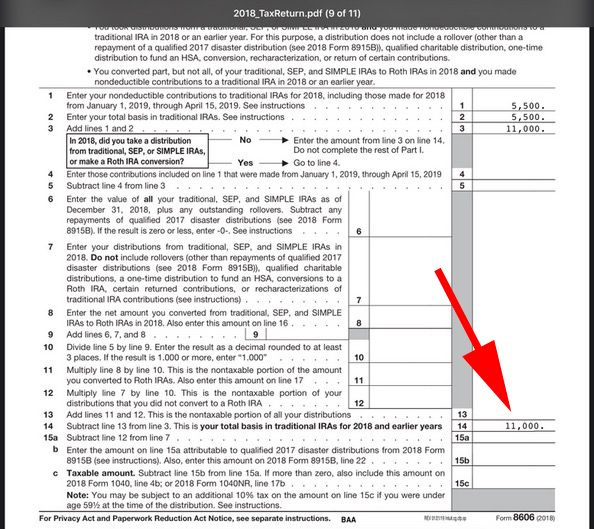

you’ve been very helpful, thank you so much. This is my 2018 8606. In 2019, I am contributing 6000, again doing so in January - April (July) 2020 time period. The second screen shot is my DRAFT 2020 8606, does that look right to you? Promise I’ll leave you alone after this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Basis after Backdoor Roth conversions

2018 looks correct assuming that you had a 2018 $5,500 contribution and also a $5,500 contribution from a prior year that carried to line 2.

2019 is not complete but does not see correct since line 13 says $5,502 is not taxable for the 2019 distribution and line 15c says the taxable amount is zero but line 14 says that there is still $11,498 of basis in the IRA.

1) Line 4 indicates that you made a 2019 contribution in 2020 so that is exclude from any 2019 distribution that occurred before that contribution was made. That means that the 2019 year end value could not have been zero.

Some of the calculations are missing because lines 6-12 are done on the "Taxable IRA Distribution Worksheet" and not on the 8606.

Does not add up!!! Did you enter the 2019 year end value that should be on the "Taxable IRA Distribution Worksheet" line 4?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Basis after Backdoor Roth conversions

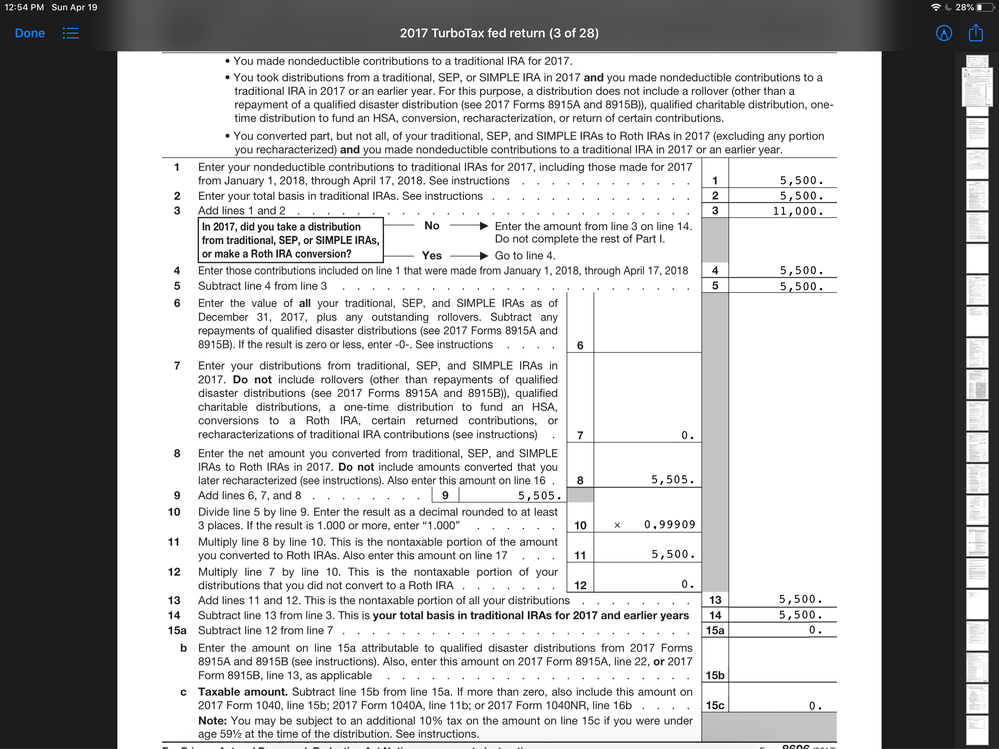

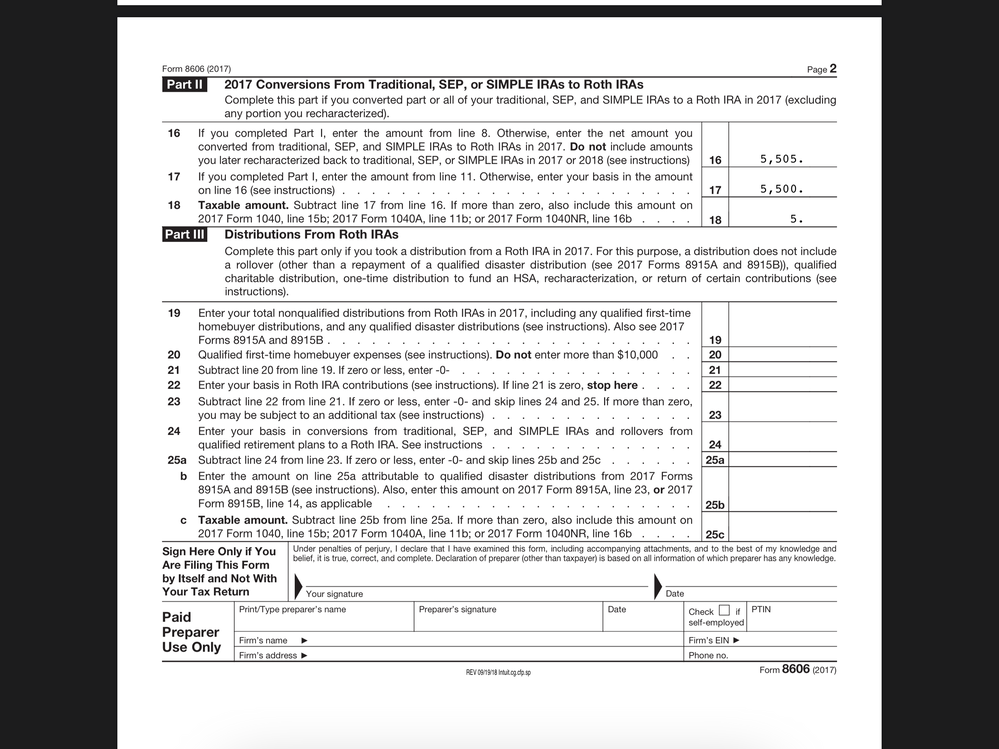

Thank you so much. So, this is my 2017 return.

2017 tax filing:

- Contributed $5,500 for tax year 2017 in a non deductible IRA in Jan-Apr 2018. Non-deductible account balance prior to contribution was $0 and in 3 days after $5500 contribution, I converted entire account balance to my Roth, thus making no deductible account balance $0 again. So, on December 31, 2017 the balance of my one and only non deductible IRA account was $0, then had $5500 in it for 3 days or so in early 2018 then was $0 again and was thus $0 on December 31, 2018, as well. 2017 8606 below to show this work

2018 tax filing:

- Contributed $5,500 for tax year 2018 in a non deductible IRA in Jan-Apr 2019. Non-deductible account balance prior to contribution was $0 and in 3 days after $5500 contribution, I converted entire account balance to my Roth, thus making no deductible account balance $0 again. So, on December 31, 2018 the balance of my one and only non deductible IRA account was $0, then had $5500 in it for 3 days or so in early 2019 then was $0 again and was thus $0 on December 31, 2019, as well. I see I may have screwed up this filing as on my 8606, as you pointed out, I failed to say the 2018 contribution I made was between Jan - April 2019. Do you think that’s where this all went awry?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Basis after Backdoor Roth conversions

Now I am almost positive, I screwed up in 2018 filing so amending it in 2019 filing to ensure my basis is never more than 5500 in any given year. Basis should have been 5500 in 2018, not 11K

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Basis after Backdoor Roth conversions

Just looking at 2017, the 8606 does not reflect with what you said you did.

You said " 2017 tax filing:

- Contributed $5,500 for tax year 2017 in a non deductible IRA in Jan-Apr 2018. Non-deductible account balance prior to contribution was $0 and in 3 days after $5500 contribution, I converted entire account balance to my Roth, thus making no deductible account balance $0 again.

Line 4 on the 20-17 8606 shows the $5,500 contribution made for 2018 in 2018 which is correct. Line 8 on the 2017 8606 indicated that you reported a $5,500 conversion *in* 2017. That would leave $5,500 of non-deductible basis to carry to 2018 on line 14. Since the 2017 year end value was zero, line 13 shows that $5,500 of the $5,005 conversion was not taxable leaving $5 of taxable interest.

Your 2018 8606 correctly shows that the carry-forward 2017 8606 line 14 $5,500 carried to line 2 and a $5,500 2018 contribution on line 1. It does not show any 2018 conversions at all in 2018 leaving the $11,000 on line 14 to carry to 2019 - which would leave a IRA 2018 year end value of at least $11,000.

For 2017 did you convert $5,500 in 2017 or 2018?

Did you confuse the April 15 due date to make IRA *contributions* for the previous year with conversions that must be done before December 31, to be for that tax year. You cannot convert in 2018 and report it in 2017.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Basis after Backdoor Roth conversions

every year that I file (for the last 5 years), I do two things:

- I contribute the max $5,500 for that tax year I'm filing, but always do so in the following year's Jan-April period and report that contribution in my April 15 tax filing

- I ALSO convert that entire amount to a Roth right after I do the contribution (within a week), leaving the traditional IRA account balance $0

I am very much aware that my 8606 reporting is supposed to be providing information on my current tax year's (*for tax year*) contribution AND the previous tax year's (*within tax year*) conversion event.

Given this constantly staggered way of doing this, I thought my 2017 8606 was actually correct since it is 1) showing my tax year 2017 $5,500 contribution that was made in Jan-April 2018 AND 2) is showing the $5,500 basis that represents the Roth conversion of 2016's $5,500 contribution that I performed in Jan-April 2017. The $5 of taxable amount on line 18 is simply the minimal earning that transpired within the 3 or so days the 2016 contribution sat in the non-traditional account before I converted it all to Roth.

So, my thinking was that 2017 filing is correctly done based on how I do my contributions and conversions and that it was my 2018 filing that screwed up my modus operandi. Somehow in 2018 filing, the $5,500 I contributed in Jan-April 2019 for tax year 2018 did NOT get recorded as being done in Jan-April 2019, thus effectively screwing up the software's understanding of my basis (which I think should always be around $5,500 if I am always doing my contributions the following year before tax deadline while also reporting the previous year's conversion event.

Am I making sense or am I losing it??

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Basis after Backdoor Roth conversions

Last thing...

Given my modus operandi the last 5 years, my basis should always be around $5500 while my balance on all nontraditional IRAs on December 31st of any year should be zero.

Maybe this logic is incorrect and contributing to my confusion

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Basis after Backdoor Roth conversions

If that is what you did in 2017 also, then 2017 is correct. You did not indicate that you made a 2017 conversion of the 2016 contribution.

However, your 2018 8606 does not appear to show *any* 2018 conversion at all since the entire 2017 carry-forward basis and the 2018 contribution ($11,000) appear on line 14.

That indicates that if you did have and entered a 2018 1099-R for a 2018 conversion, you failed to complete the 1099-R after the 1099-R summary screen where the questions are asked to enter the basis.

If you failed to check the IRA/SEP/SIMPLE box on the TurboTax 1099-R screen the same thing would happen - that question about basis would never be asked - it is only asked if that box is checked.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Basis after Backdoor Roth conversions

I think I rectified things by using easy guide in TT software and telling IRS that I mistakenly filed last year with incorrect basis / didn’t correctly add in my 1099_r. Here’s now my 2019 draft after doing so

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Basis after Backdoor Roth conversions

It is your 2018 8606 that you posted before, that shows $11,000 on line 14 that carries to the 2019 8606 line 2. That seems to be the problem. Your 2019 8606 shows $5,500 on line 2. What happened to the other $5,500?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Basis after Backdoor Roth conversions

I followed this guidance from TurboTax boards and used EasyGuidein my 2019 filing process to tell IRS that my basis should have only been 5500 in previous year filing:

You have two choices: Either correct the amount in 2018 TurboTax and provide explanation that your 2013 Form 8606 incorrectly had $18,019 on line 2 instead of the $34,950 from line 14 of your 2012 Form 1099-R, that no distributions or conversions occurred in 2013 through 2017 and that you are correcting that by adding an adjustment of $16,931 on line 2 of your 2018 Form 8606, or file amended 2013 through 2017 Forms 8606.

Amending each of the incorrect Forms 8606 is probably more proper since it will make it explicit that none of your basis was applied to any distribution or Roth conversion. The IRS might charge a $50 fee for each of the amended forms (this probably covers the cost of verifying that these have no effect on your tax liability for 2013 through 2017); they'll bill if they do. However, just making the change on your 2018 tax return with explanation will probably raise less attention and might not get reviewed at all.

In the case where you just modify the value in 2018 TurboTax, if you use the EasyGuide button just mark the first two boxes on the Any of These Apply? page. TurboTax will prompt for explanation whether or not you use the EasyGuide button.

In the case where you amend the 2013 through 2017 Forms 8606, to avoid including any explanation with your 2018 tax return you'll need to prepare your amended the 2017 Form 8606 with 2017 TurboTax, then you'll need to clear your 2018 tax return and start over to transfer in from the amended 2017 tax file. If you just modify the value in 2018 TurboTax without transferring in the correct amount from the amended 2017 tax file, TurboTax will still prompt you for explanation.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17717116761

New Member

Michael16

Level 4

LarryinDC

New Member

deborahrosee55

New Member

love-the-irs

Level 2