- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

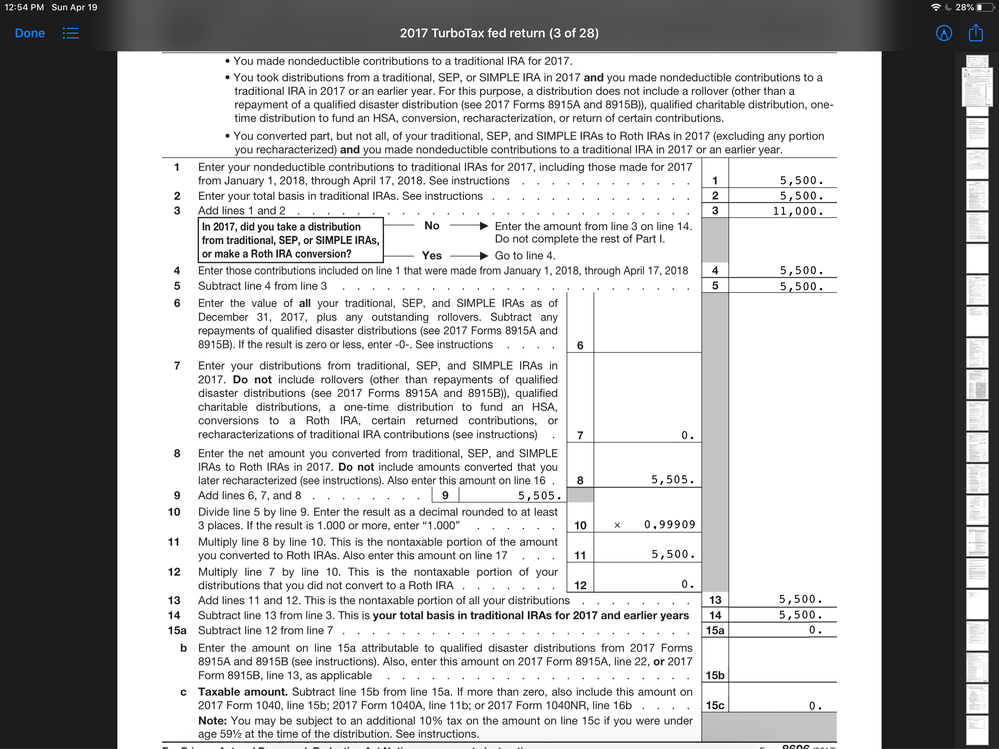

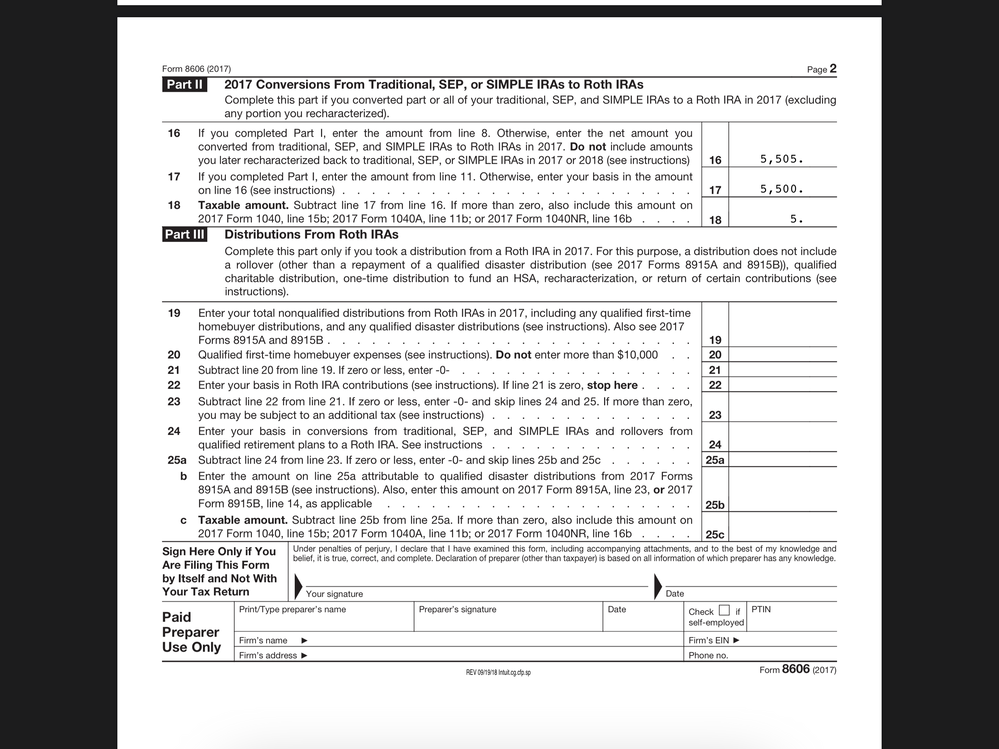

Thank you so much. So, this is my 2017 return.

2017 tax filing:

- Contributed $5,500 for tax year 2017 in a non deductible IRA in Jan-Apr 2018. Non-deductible account balance prior to contribution was $0 and in 3 days after $5500 contribution, I converted entire account balance to my Roth, thus making no deductible account balance $0 again. So, on December 31, 2017 the balance of my one and only non deductible IRA account was $0, then had $5500 in it for 3 days or so in early 2018 then was $0 again and was thus $0 on December 31, 2018, as well. 2017 8606 below to show this work

2018 tax filing:

- Contributed $5,500 for tax year 2018 in a non deductible IRA in Jan-Apr 2019. Non-deductible account balance prior to contribution was $0 and in 3 days after $5500 contribution, I converted entire account balance to my Roth, thus making no deductible account balance $0 again. So, on December 31, 2018 the balance of my one and only non deductible IRA account was $0, then had $5500 in it for 3 days or so in early 2019 then was $0 again and was thus $0 on December 31, 2019, as well. I see I may have screwed up this filing as on my 8606, as you pointed out, I failed to say the 2018 contribution I made was between Jan - April 2019. Do you think that’s where this all went awry?