- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: 1099-R turbo tax shows taxes due for withdrawal from nonqualified annunity less than purchase...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R turbo tax shows taxes due for withdrawal from nonqualified annunity less than purchase price

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R turbo tax shows taxes due for withdrawal from nonqualified annunity less than purchase price

Please clarify and expand on your question. What boxes on the 1099-R have data in them? That may be the determining factor along with the type of distribution code shows in Box 7.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R turbo tax shows taxes due for withdrawal from nonqualified annunity less than purchase price

1099-R

Box 1. 87,828

Box 5. 94,561

Box 7. 7D

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R turbo tax shows taxes due for withdrawal from nonqualified annunity less than purchase price

TurboTax may also be accounting for box 2a amounts so please clarify that as well.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R turbo tax shows taxes due for withdrawal from nonqualified annunity less than purchase price

1099-R

Box 1 87,828

Box 2b Total Distribution

Box 5 94561

Box 7 7D

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R turbo tax shows taxes due for withdrawal from nonqualified annunity less than purchase price

Box 2a blank

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R turbo tax shows taxes due for withdrawal from nonqualified annunity less than purchase price

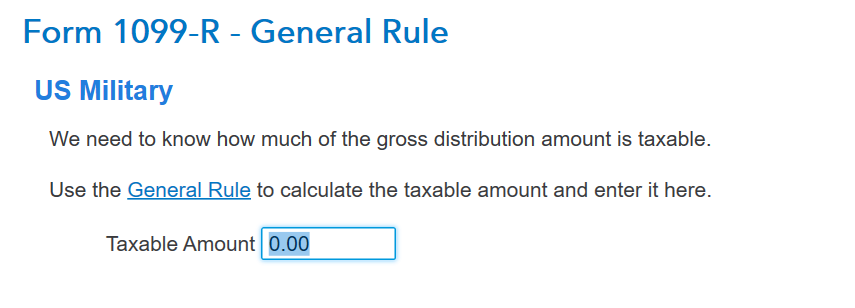

If you choose the General Rule to calculate the taxable portion of your pension distribution and enter $0 for the taxable amount, it would not show as taxable on your tax return. You will see those options after you enter your form 1099-R in TurboTax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R turbo tax shows taxes due for withdrawal from nonqualified annunity less than purchase price

Using the General Rule in TurboTax simply puts in box 2a whatever amount you enter for the taxable amount under the General Rule. In this case, with box 2b Taxable amount not determined being unmarked, the payer mistakenly left box 2a blank when they meant to indicate that $0 was taxable. (Unfortunately there are payers that think that a blank box 2a means $0 when, in fact, box 2a should always have a numeric value when box 2b Taxable amount not determined is unmarked.)

Being nontaxable income, the amount from box 1 will be included on Form 1040 line 5a but will be excluded from line 5b.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

pizbamc1

Returning Member

Gd2

Level 2

JoeBi

Level 1

JoeBi

Level 1

shishirdahal

Level 3