- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: 1099-B stock has the Box 1b as "Various (or more than one date)" But I try to review all my t...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B stock has the Box 1b as "Various (or more than one date)" But I try to review all my taxes and it gives me a "Check This Entry" for it that will only allow a date?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B stock has the Box 1b as "Various (or more than one date)" But I try to review all my taxes and it gives me a "Check This Entry" for it that will only allow a date?

Wednesday, February 17, 2021

4:14 PM

There is a procedure for entering Various into you investment transactions.

- Open (continue) your return if it isn't already open.

- Income & Expenses

- Scroll to Stocks, Mutual Funds, Bonds, Other

- Answer Yes to Did you sell stocks, mutual funds, bonds, or other investments in 2020?

- If you see Here's the info we have for these investment sales, select Add More Sales.

- Answer Yes to Did you get a 1099-B or brokerage statement for these sales?

- At Let's get your tax info, choose how you want to enter your 1099-B (type it in yourself)

- Select the pencil to work on the transaction

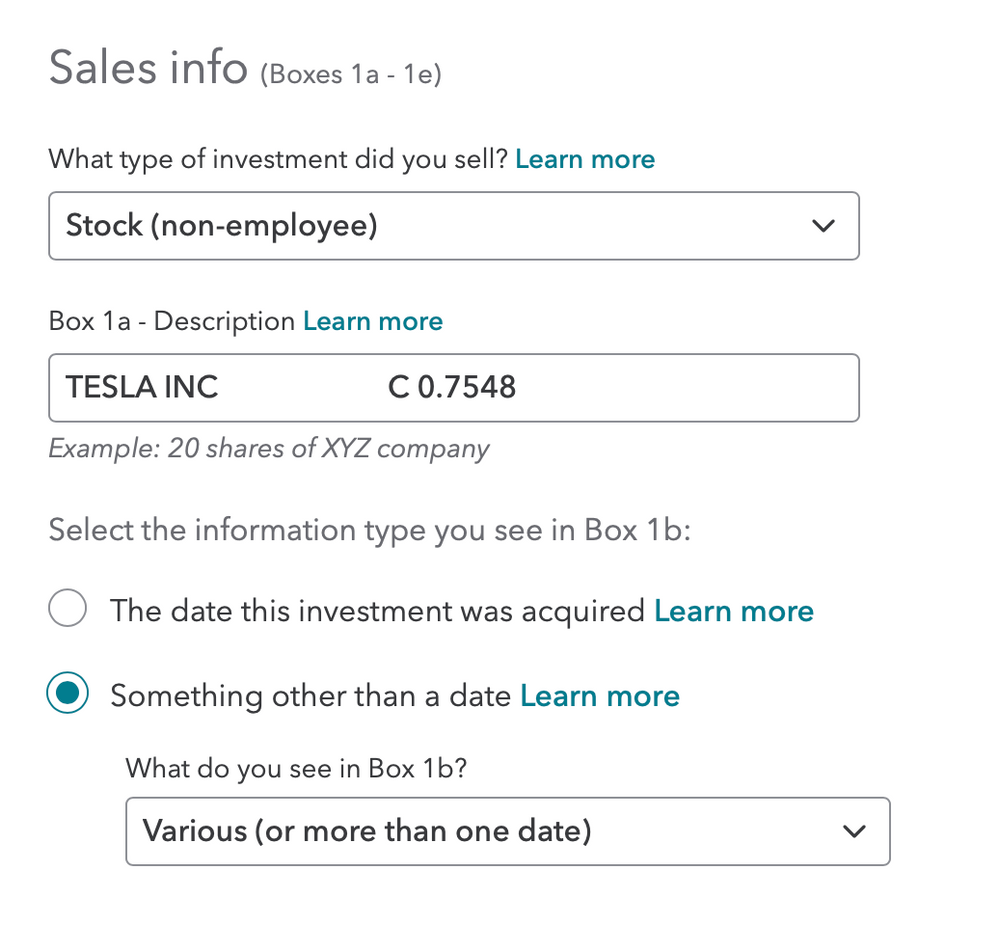

- In the date area there are two bullets.

- On one Date, and

- Something other than a Date

- Select Something other than a Date

- There is a drop down menu for Various.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B stock has the Box 1b as "Various (or more than one date)" But I try to review all my taxes and it gives me a "Check This Entry" for it that will only allow a date?

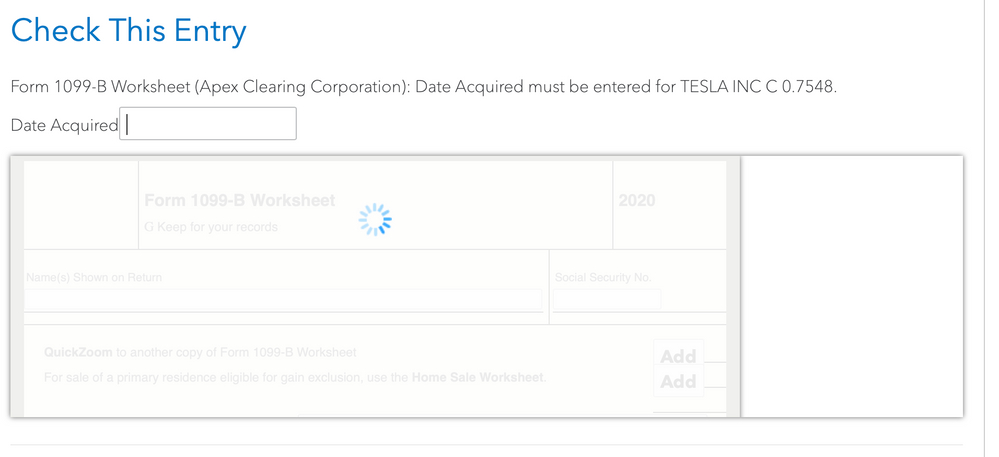

I've followed these instructions - the issue is a glitch that won't go away.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B stock has the Box 1b as "Various (or more than one date)" But I try to review all my taxes and it gives me a "Check This Entry" for it that will only allow a date?

Hello, I am just curious as I've worked for many years on various tax software programs and what we've done in past I do not see suggested to you. My apologies if it does not work, however, give it a try just to see....

Enter -11/11/1111 into that "date" field that you provided a screen shot for. Also, since I cannot see the 1099-B I am assuming you made the correct selection under "Select the information type you see in Box 1b". If the first does not work, try selecting the first and then entering -11/11/1111 and see what happens.

Since all of your information is already in the system and I do not have access to such information, this should take you only 5 minutes to test. Be sure to jump from this topic after trying the above to "Run the Alerts" to see if you get any. I do hope it works.

I am replying versus "answering your question" since clearly I haven't really answered it. Just trying to help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B stock has the Box 1b as "Various (or more than one date)" But I try to review all my taxes and it gives me a "Check This Entry" for it that will only allow a date?

I really appreciate the response - however when I type "1111" it automatically corrects to 2011.

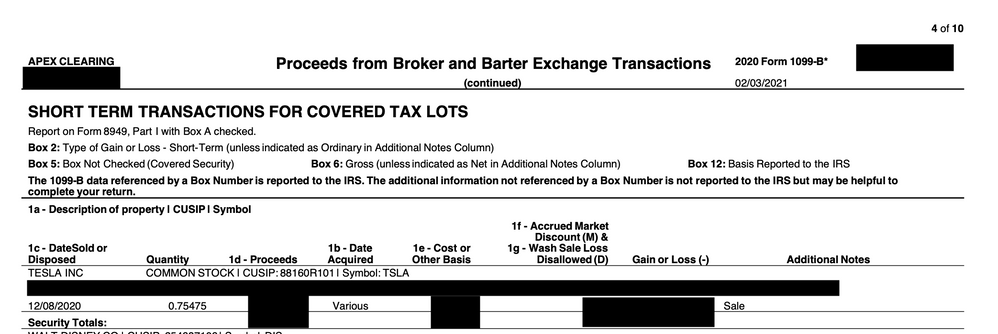

This is how it appears on my 1099-B:

Also worth noting it lets me complete the entire "Federal" income section and only appears as an error when going over the final review.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B stock has the Box 1b as "Various (or more than one date)" But I try to review all my taxes and it gives me a "Check This Entry" for it that will only allow a date?

Given that it is such a small amount as you indicated, it should not prevent you from e-filing but you do want to mail in a copy of the stock transactions pages 8949 and Schedule D to the IRS for their records. I've never seen the IRS audit anyone for not doing so, but you definitely don't want to be the first! Also, if you're up to it, try -11/11/2021 unless you already did (make sure that neg sign is there, not sure if you entered that as it does not show on what I am able to see).

Anything else I can do, just please ask!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B stock has the Box 1b as "Various (or more than one date)" But I try to review all my taxes and it gives me a "Check This Entry" for it that will only allow a date?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B stock has the Box 1b as "Various (or more than one date)" But I try to review all my taxes and it gives me a "Check This Entry" for it that will only allow a date?

It automatically removes the "-" unfortunately. Have also gone through my records and used the actual date of purchase as well, doesn't work.

I'm fairly certain this is a glitch at this point, it won't let me complete the submission in Chrome, Safari or Firefox.

This is through M1 Finance, not sure if there was an issue with the way they reported it or what.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B stock has the Box 1b as "Various (or more than one date)" But I try to review all my taxes and it gives me a "Check This Entry" for it that will only allow a date?

I will do some checking to see if M1 Finance is experiencing this as best I can for you. Please let me know if you were able to move forward. Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B stock has the Box 1b as "Various (or more than one date)" But I try to review all my taxes and it gives me a "Check This Entry" for it that will only allow a date?

There have been a number of reported issues between many brokerage firms' statements and numerous tax preparation software systems this year. The "word on the street", so to speak, is that they are aiming for some form of reconciliation of this issue by mid-March. My assumption, and only that given experience, is that since March 15th is Corp Tax Due Date that they are hoping to get this resolved before then. Frustrating, I am sure.

I have only one suggestion for you given that the IRS really only cares about S/T gains/<losses> and L/T gains/<losses>.....separate out the ones with "various" as purchase date (assuming this is where you have the various as it is rare to have "various" tagged as the sale date), and just be sure to select a purchase date that makes it fall into the correct category. Fill out the 8949 and just double check to make sure that everything flows properly to the Schedule D. ALSO, remember that upon notification of acceptance of return by the IRS, you have three days with which to mail your brokerage statement(s), Copy of 8949, and Copy of Schedule D to the IRS (whichever location is your mailing site).

BE SURE OF 2 THINGS:

1. Sign and date each document (last page of brokerage stmt. should suffice), AND

2. Mail out "Certified/Return Receipt Requested" as this will be your proof of mailing date as well as receipt from the IRS that they have

received your documents. The "green card" that you will fill out and affix to your package is what the IRS Agent will sign and mail

back to you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B stock has the Box 1b as "Various (or more than one date)" But I try to review all my taxes and it gives me a "Check This Entry" for it that will only allow a date?

I checked back in this month and the glitch had been fixed, I appreciate it.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mc-hubby1998

New Member

vamsi-bonthu1991

New Member

renataserra99

New Member

gabeferris56

New Member

booba75018

New Member