- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Railroad Retirement Board form RRB1099-R question

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Railroad Retirement Board form RRB1099-R question

what do I select on the page that says "where is this distribution from"?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Railroad Retirement Board form RRB1099-R question

It depends. Did you receive a 1099-R or RRB-1099? The railroad retirement board is entered in its own section.

For the Form RRB-1099-R, you may be referring to the screen where they are asking you to identify the source of the income. If you select none of the above, then TurboTax would set it to all taxable.

The details for how to answer will depend on your circumstances.

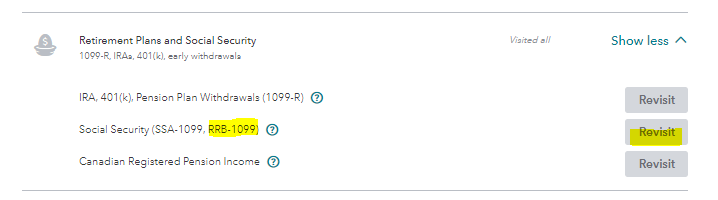

Otherwise, if this is from Form RRB-1099, then from the retirement plans and social security section, select RRB-1099.

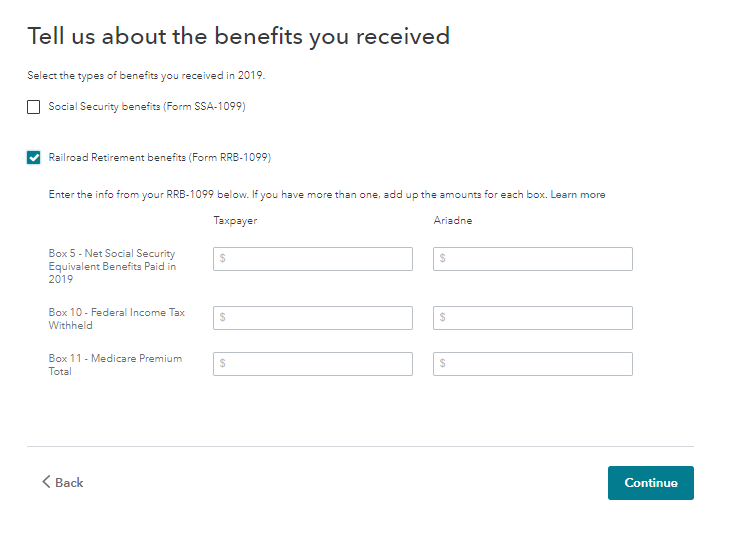

Then select Yes at the screen Did you receive Social Security or Railroad Retirement benefits in 2019?

Enter your details next.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Railroad Retirement Board form RRB1099-R question

Thanks for the information.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

HollyP

Employee Tax Expert

HollyP

Employee Tax Expert

kizeim

New Member

Raph

Community Manager

in Events

blrhoden

New Member