- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

It depends. Did you receive a 1099-R or RRB-1099? The railroad retirement board is entered in its own section.

For the Form RRB-1099-R, you may be referring to the screen where they are asking you to identify the source of the income. If you select none of the above, then TurboTax would set it to all taxable.

The details for how to answer will depend on your circumstances.

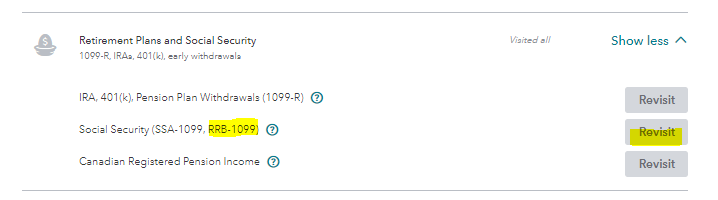

Otherwise, if this is from Form RRB-1099, then from the retirement plans and social security section, select RRB-1099.

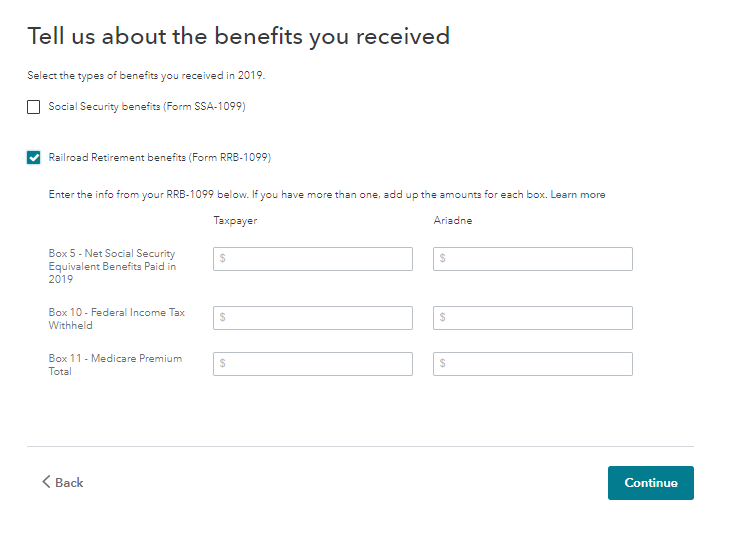

Then select Yes at the screen Did you receive Social Security or Railroad Retirement benefits in 2019?

Enter your details next.

April 12, 2020

10:01 AM