- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Public Safety Officer exception on Form 5329

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Public Safety Officer exception on Form 5329

I am a newly retired public safety officer. I have made withdrawals from my qualified retirement account (like a 401k), even though I am younger than 50. Because I have 25 or more years of service, I should have an exception to the early withdrawal penalty of 10%. My qualified retirement account servicer put the wrong distribution code in box 7 of my 1099-R (they put down 1, but should be a 2 to reflect I qualify for the exception). While I am attempting to have it corrected, I can also file a Form 5329 to reflect my exception (Exception #1 per the instructions) to the penalty. However, TurboTax is not recognizing that I qualify for the exception for having 25 years of service and is not calculating it correctly. None of the questions relate to Public Safety Officer years of service. How do I fix this so I can file the 5329 correctly and not be held to the 10% penalty?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Public Safety Officer exception on Form 5329

As you go through the follow-up questions in TurboTax and you see the form where you would choose the exception to use in order to eliminate the early distribution penalty, enter your distribution amount in the box labeled 'Separation From Service the Year During or After Age 55...'

The TurboTax help content show below indicates that is the input to use for someone in your situation:

EXCEPTIONS TO EARLY DISTRIBUTION TAX

There are several reasons why an early distribution might not be subject to the 10% (or 25%) tax. Line 2 of Form 5329 is where you enter the amount of early distribution that's excepted from this tax.

Reasons include:

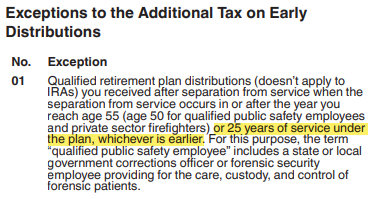

1. A distribution due to leaving your job in or after the year you reach age 55 (age 50 for qualified public safety employees and private sector firefighters). This exception doesn't apply to distributions from IRAs, annuities or modified endowment contracts. You are a qualified public safety employee if you provide police protection, firefighting services, or emergency medical services for a state or municipality, and you separated from service in or after the year you attained age 50.

Note: For distributions to qualified public safety employees, include distributions to employees with 25 years of service with the plan, distributions to firefighters covered by private sector retirement plans; and distributions to those employees who provide services as a corrections officer or as a forensic security employee providing for the care, custody, and control of forensic patients who meet the age requirement above.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Public Safety Officer exception on Form 5329

As you go through the follow-up questions in TurboTax and you see the form where you would choose the exception to use in order to eliminate the early distribution penalty, enter your distribution amount in the box labeled 'Separation From Service the Year During or After Age 55...'

The TurboTax help content show below indicates that is the input to use for someone in your situation:

EXCEPTIONS TO EARLY DISTRIBUTION TAX

There are several reasons why an early distribution might not be subject to the 10% (or 25%) tax. Line 2 of Form 5329 is where you enter the amount of early distribution that's excepted from this tax.

Reasons include:

1. A distribution due to leaving your job in or after the year you reach age 55 (age 50 for qualified public safety employees and private sector firefighters). This exception doesn't apply to distributions from IRAs, annuities or modified endowment contracts. You are a qualified public safety employee if you provide police protection, firefighting services, or emergency medical services for a state or municipality, and you separated from service in or after the year you attained age 50.

Note: For distributions to qualified public safety employees, include distributions to employees with 25 years of service with the plan, distributions to firefighters covered by private sector retirement plans; and distributions to those employees who provide services as a corrections officer or as a forensic security employee providing for the care, custody, and control of forensic patients who meet the age requirement above.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Public Safety Officer exception on Form 5329

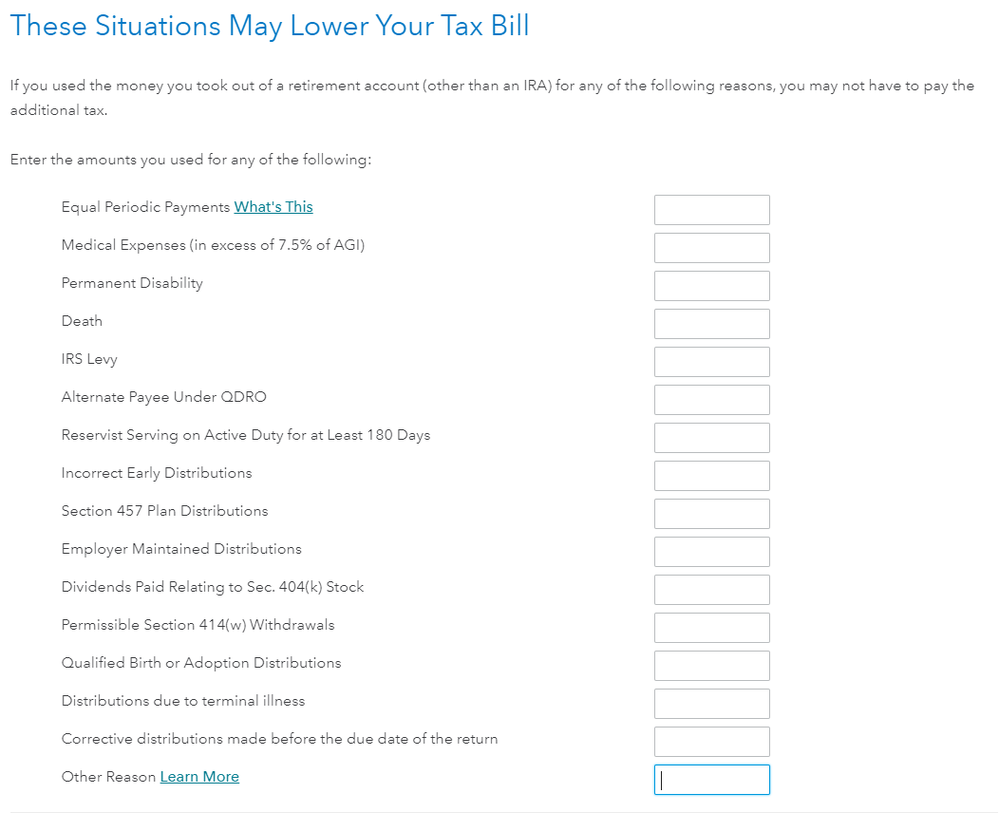

I know that is what I would choose, but none of the followup questions allow me to choose that. These are the only exceptions I can choose from (pic attached).

There is no section to enter my distribution amount in the box labeled 'Separation From Service the Year During or After Age 55...'

If I put it in the last box, "Other Reason", then it puts in a code "99" of the 5329 which is for "multiple exceptions apply" rather than the "01" for "separation from service" as it should be. I can override this field on the 5329 to input the "01" exception if I use the desktop version in Forms mode, but I shouldn't have to.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Public Safety Officer exception on Form 5329

No, you should not have to override the code in Forms mode.

When I tested the situation in the Deluxe version of the CD/downloaded TurboTax, the option described in my other answer was on the screen. I am not getting the same result on screen that you are showing.

Please share which version of TurboTax you are using and also the distribution code shown on your Form 1099-R so that I can better duplicate your situation.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Public Safety Officer exception on Form 5329

I am using Turbotax Deluxe online. I also was switched to Turbotax Deluxe desktop (for a separate State issue), that's where I was able to override the form. I am not seeing the "Separation from Service" option on either platform. I wonder if the software isn't making that choice available to me because I am not 50 years of age or older, and the platform is not recognizing the age doesn't matter if I have 25 years of public safety service (which is a relatively new change to the law, in the last year or two with Secure Act 2.0).

The 1099-R in question has a distribution code of 1. This is in error, it should be a 2, but since the administrator of the plan is working on fixing their error to issue a corrected 1099-R, I was told it was not likely a new one would be issued, just the problem fixed for next year. In the meantime, I was told to claim the exception on the 5329 by selecting 01 as the exception.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Public Safety Officer exception on Form 5329

That was it....the age. I changed my Date of Birth to something that would make me older than 50, and now that option is there for Separation from Service. So, Turbotax is not recognizing that the age doesn't matter if I have 25 years of service as a public safety officer. How do we get this fixed within Turbotax?

Not that you need it, but here is a cut/paste of the exceptions showing that 25 years of service language from the 5329 Instructions:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Public Safety Officer exception on Form 5329

Was there a final answer on this? I am having the same problem in regards to being able to select 25 years of service.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Public Safety Officer exception on Form 5329

I had to go back and change my age to something older than 50 in order for the form to allow the "Separation from Service" exception on the 5329. After making the exception selection, I went back and corrected my age and the 5329 stayed correct.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Public Safety Officer exception on Form 5329

Thank you!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Public Safety Officer exception on Form 5329

I hope an update to TurboTax is coming soon to correct for this...but this was very helpful in reducing my panic; thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Public Safety Officer exception on Form 5329

Thank you! I am in the exact situation and was stressing out but that was GREAT ADVICE to change my age then change it back afterwards. Thanks again!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sposis

New Member

bkeepnitreal

New Member

JerryDaley

Level 1

kcham2702

New Member

daka85

New Member