- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Pennsylvania "Type of Retirement Income" question - Code 4D on 1099-R

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pennsylvania "Type of Retirement Income" question - Code 4D on 1099-R

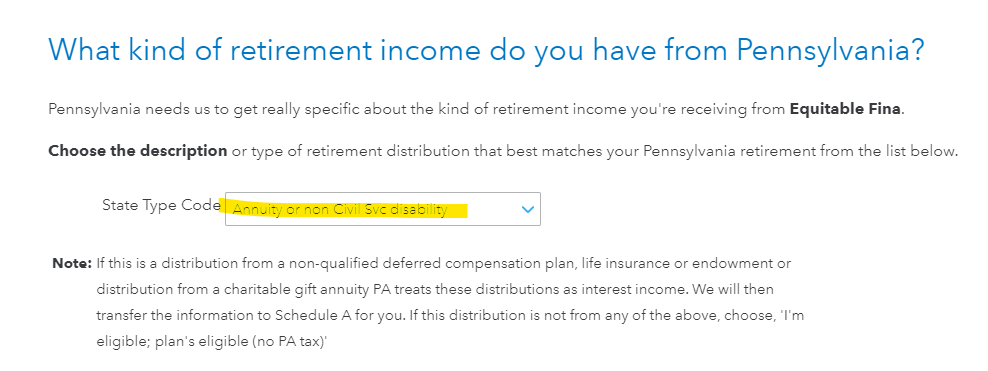

I am being asked to provide the type of retirement income for various annuities we received due to death (code 4D on the 1099-R forms) on our PA state tax return. I confirmed with the financial institution that these are all classified as annuities.

So when asked about what kind of retirement income we are getting (see below), am I choosing the correct state code "Annuity or non Civil Svc disability"? See below:

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pennsylvania "Type of Retirement Income" question - Code 4D on 1099-R

Yes, you are choosing the correct type of annuity. After you choose "Annuity or non Civil Svc disability" you will then be asked to enter your basis which would be the amount that the person you inherited it from already paid taxes on. You may be able to get this information from the institutions that have distributed the annuities to you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pennsylvania "Type of Retirement Income" question - Code 4D on 1099-R

Yes, you are choosing the correct type of annuity. After you choose "Annuity or non Civil Svc disability" you will then be asked to enter your basis which would be the amount that the person you inherited it from already paid taxes on. You may be able to get this information from the institutions that have distributed the annuities to you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pennsylvania "Type of Retirement Income" question - Code 4D on 1099-R

Thank you so much!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

grohn-me

New Member

Bmck345

Level 2

gthorne8

New Member

mysert

Level 1

CRAM5

Level 1