- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- On return, I’m trying to determine how TurboTax calculated Line 8-Schedule 1 ($1407). It indicated earlier that the other taxable income from QTP was $1178. Can you help?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On return, I’m trying to determine how TurboTax calculated Line 8-Schedule 1 ($1407). It indicated earlier that the other taxable income from QTP was $1178. Can you help?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On return, I’m trying to determine how TurboTax calculated Line 8-Schedule 1 ($1407). It indicated earlier that the other taxable income from QTP was $1178. Can you help?

look at Form 1098-T.... subtract Box 1 from Box 5...... is your scholarship greater than the payments?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On return, I’m trying to determine how TurboTax calculated Line 8-Schedule 1 ($1407). It indicated earlier that the other taxable income from QTP was $1178. Can you help?

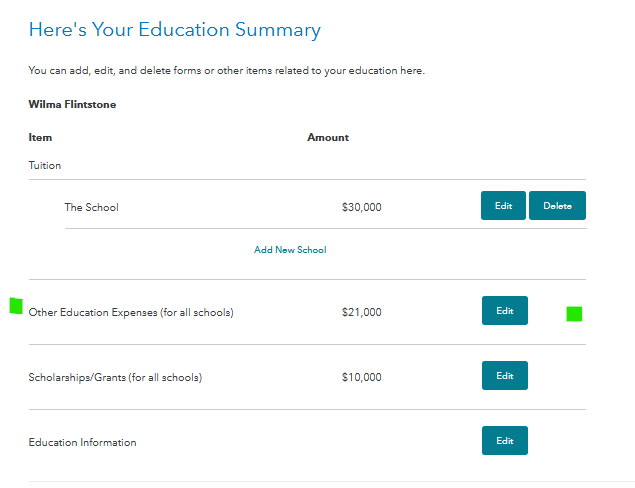

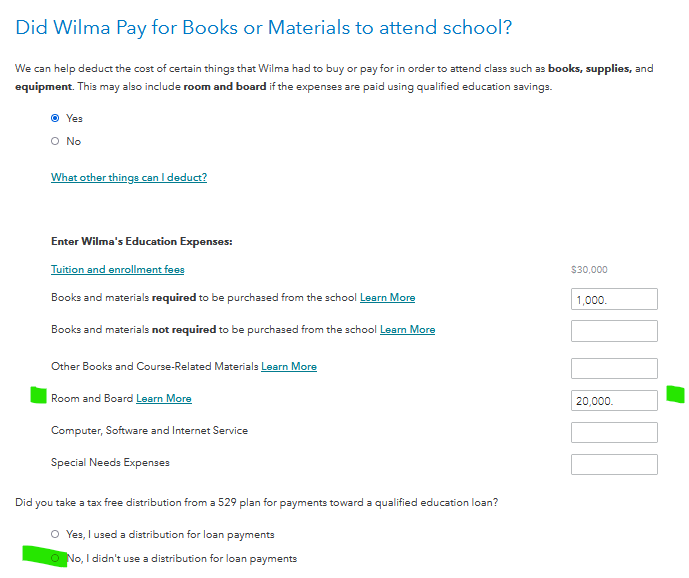

I am seeing a similar amount. My payments are $40K more than line 5. In the worksheet under Qualified Tuition Program (QTP) Computation of Taxable Distribution, line 1 is the amount of distributions from my 1098-Q. And then there is a line 2c--adjusted qualified higher education expenses--that is about $10K less than my payments. What is the basis for that adjustment?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On return, I’m trying to determine how TurboTax calculated Line 8-Schedule 1 ($1407). It indicated earlier that the other taxable income from QTP was $1178. Can you help?

IIf this does not completely solve the problem, please let us know which screen and field seems to be having difficulty, so we may better assist you.t is important to enter all the income, then the Form 1099-Q, and then the Expenses and Scholarships ( Form 1099-T section.

If it is entered out of order, the system may be reserving $10,000 of educational expenses toward an education credit, either American Opportunity Credit or Lifetime Learning Credit. You may want to see if that leads to qualify for a credit, but if it does not, or if it will cause part of your 529 distribution to become taxable, then yes, it is fine to change that field to zero.

If room and board were paid from the 529 distribution, please go back through the Education Credit section and be sure those were entered. That is not a qualifying expense for the Education credits but can be used with 529 funds.

If this does not completely solve the problem, please let us know if you are using TurboTax Online or Desktop/Download, so we may better assist you.

@mwgsvz

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On return, I’m trying to determine how TurboTax calculated Line 8-Schedule 1 ($1407). It indicated earlier that the other taxable income from QTP was $1178. Can you help?

Thank you for your reply. It did not solve the problem. I deleted and then re-entered forms Q and T in the suggested order. All values remain the same. And I can't find a way to change any of the fields to zero. I am using desktop/download.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On return, I’m trying to determine how TurboTax calculated Line 8-Schedule 1 ($1407). It indicated earlier that the other taxable income from QTP was $1178. Can you help?

Just re-entered everything from scratch. Identical result. And no way to zero out anything. How do I get a refund?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On return, I’m trying to determine how TurboTax calculated Line 8-Schedule 1 ($1407). It indicated earlier that the other taxable income from QTP was $1178. Can you help?

One more try. You are using Desktop/CD etc. You can go to forms mode to see each and every entry on each form. You can adjust any entry in Forms Mode. Have you tried that? I must warn that any override that you make may cause your accuracy guarantee to become void.

OK if you have tried that already and still want a refund, here's how. Finally, our customer support phone number is 1-800-4INTUIT (1-800-446-8848).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17557017943

New Member

sonia-yu

New Member

dougiedd

Returning Member

SB2013

Level 2

user17539892623

Returning Member