- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Louisiana Military Retirement

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Louisiana Military Retirement

"we noticed you entered federal employees' retirement on the previous screen"

It zeros out what I owe Louisiana to $0, but then deletes the entry on my Louisiana form and owed to La goes back to $579. Federal is marked 04e. What I'm I doing wrong? I cleared cookies and cache, same result.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Louisiana Military Retirement

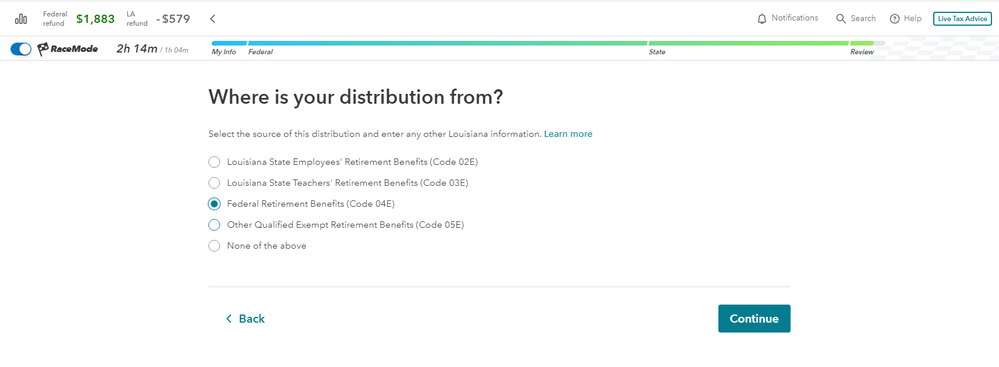

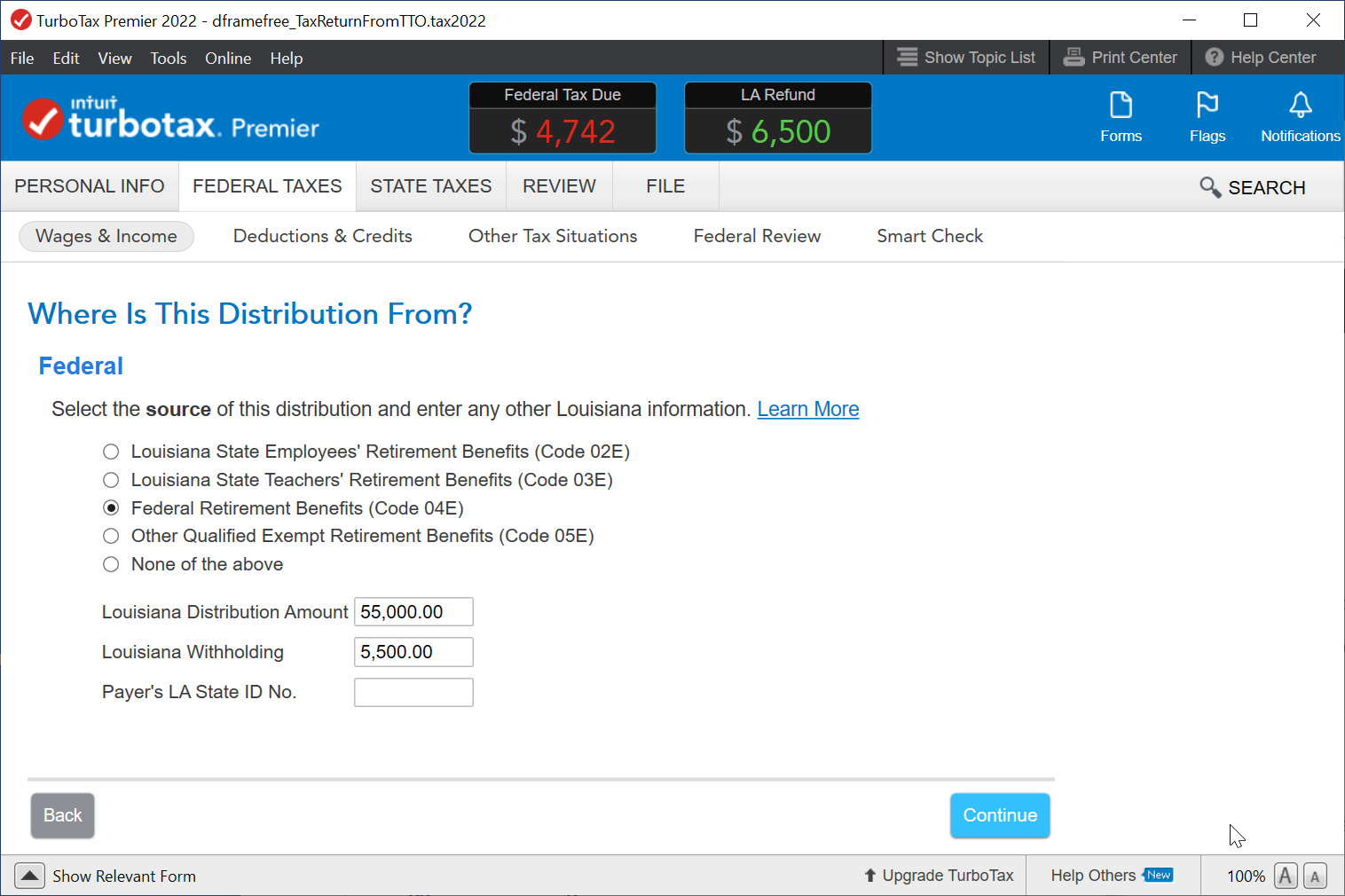

It depends. Are you trying to exclude this in your LA state return as you prepare your state return? If so, the program recognizes you are trying to exclude this twice because it has already been excluded when you entered the 1099R in the federal interview. This is what the the page should look like in the federal return.

If you entered the information correctly here, then don't enter it into the state return. Here is the screenshot of that page.

If you didn't reach this screen, revisit your navigational steps.

If you didn't reach this screen, revisit your navigational steps.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Louisiana Military Retirement

Here is my screen on federal, it doesn't have the Louisiana line

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Louisiana Military Retirement

I see you are using TurboTax Online. Your original post said you were using TurboTax Basic CD/Download, so your screens will be different.

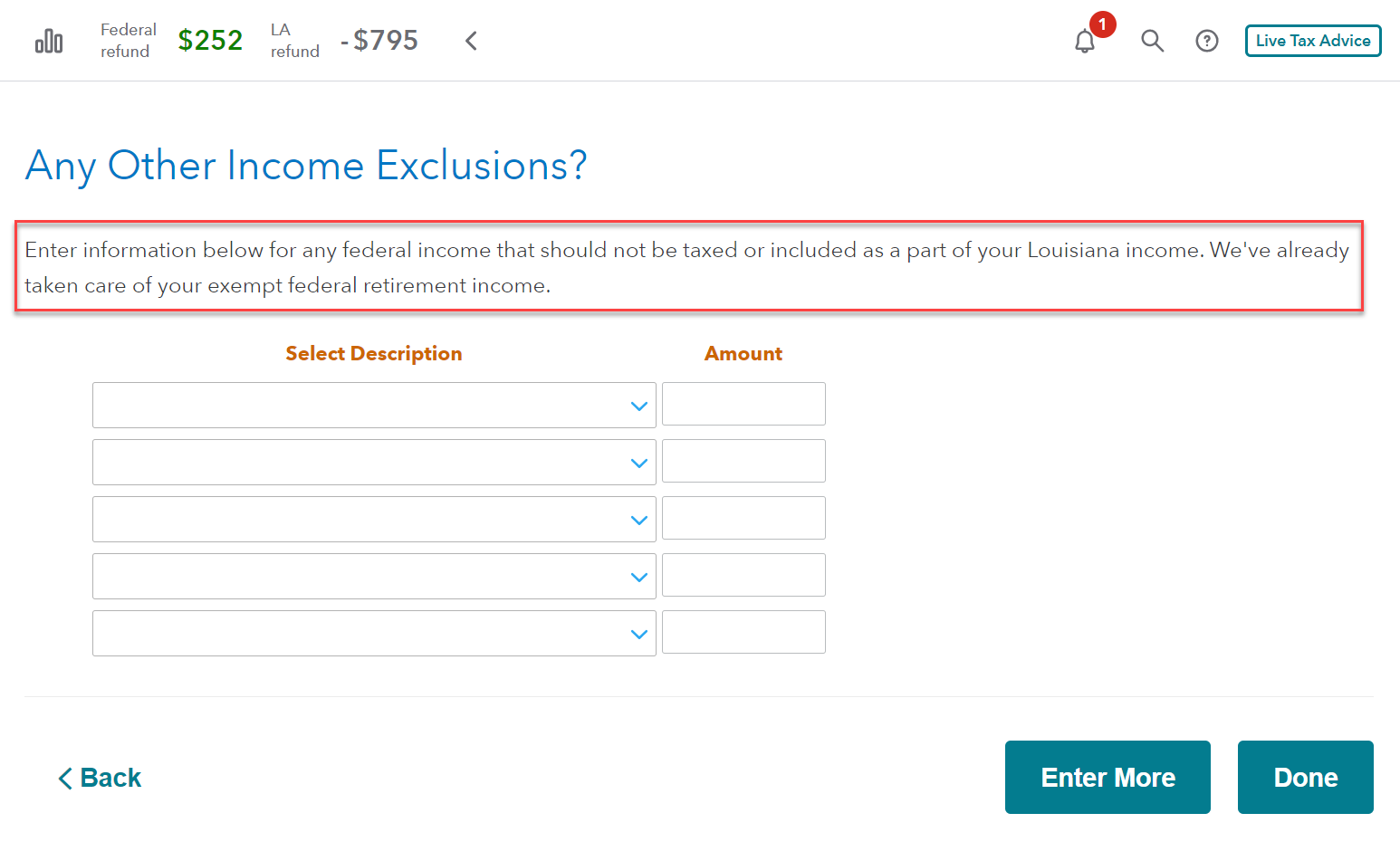

You are on the correct screen. You will not see a Louisiana distribution amount and withholding in TurboTax Online.

Do not fill any information on the Louisiana screen “Any Other Income Exclusions?” Leave that blank. It should say “We’ve already taken care of your exempt federal retirement income.”

Enter your retirement date on the next screen.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Louisiana Military Retirement

It is still saying I owe Louisiana income tax on my military retirement with 04 checked on federal and state form left blank. I'm stumped.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Louisiana Military Retirement

Try this workaround.

If you are not getting the correct exemption amount, enter the same amount from box 2 of the 1099R for the state distribution in box 16.

In a subsequent screen where it is asked "Where is this distribution from " click on the appropriate code selection which exempts the amount in box 16 from being taxed.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Shonda47

New Member

majorhin

New Member

CzarSosa

Level 2

tonilam

New Member

megannewberry0317

New Member