- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

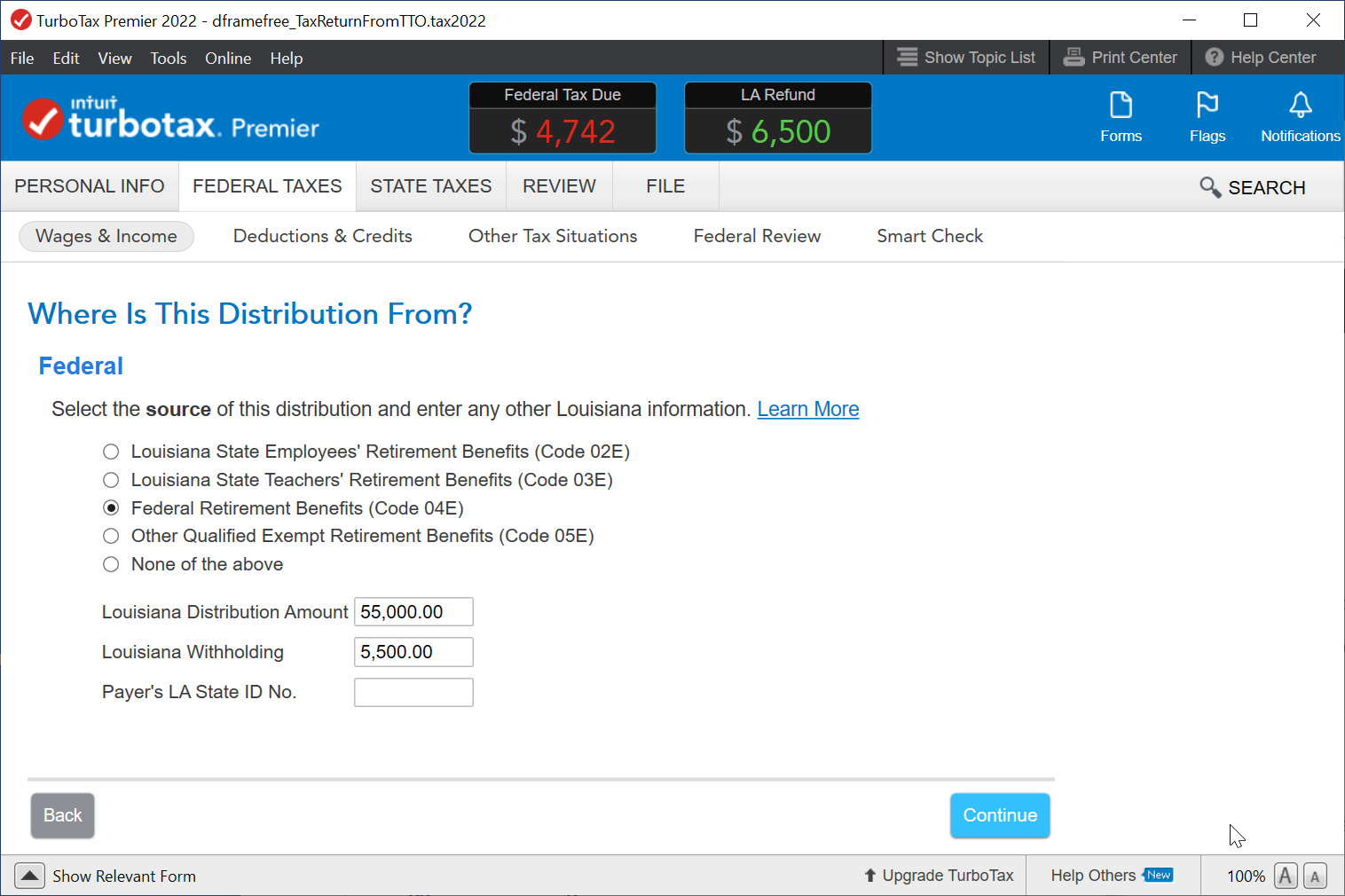

It depends. Are you trying to exclude this in your LA state return as you prepare your state return? If so, the program recognizes you are trying to exclude this twice because it has already been excluded when you entered the 1099R in the federal interview. This is what the the page should look like in the federal return.

If you entered the information correctly here, then don't enter it into the state return. Here is the screenshot of that page.

If you didn't reach this screen, revisit your navigational steps.

If you didn't reach this screen, revisit your navigational steps.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 2, 2023

7:38 PM