- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- IRA Deduction - Multiple States?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA Deduction - Multiple States?

However, in 2016 I was a partial resident of Hawaii and California, and worked as a Hawaii resident in Colorado for a few months before moving to California.

How do I allocate the $5500 IRA deduction among these states? Do they each get the full $5500 deduction, or is it proportionate between them according to the portion of money made in each location?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA Deduction - Multiple States?

It depends.

You will allocate the deduction based on the state you were a resident of when the IRA contribution was made. Please note you will only allocate the deduction to resident states so no allocation to CO since you were an HI resident while working in CO (nonresident CO state filing for your CO sourced income).

For example, if you contributed $2,000 while a HI resident and $3,500 while a CA residence then allocate those amounts to each state. If you contributed the full amount while a resident of CA, then the full amount will be allowed to your CA part-year resident state income tax return. Just make sure that the total allocated to all states does not add up to more that your full IRA contribution of $5,500.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA Deduction - Multiple States?

It depends.

You will allocate the deduction based on the state you were a resident of when the IRA contribution was made. Please note you will only allocate the deduction to resident states so no allocation to CO since you were an HI resident while working in CO (nonresident CO state filing for your CO sourced income).

For example, if you contributed $2,000 while a HI resident and $3,500 while a CA residence then allocate those amounts to each state. If you contributed the full amount while a resident of CA, then the full amount will be allowed to your CA part-year resident state income tax return. Just make sure that the total allocated to all states does not add up to more that your full IRA contribution of $5,500.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA Deduction - Multiple States?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA Deduction - Multiple States?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA Deduction - Multiple States?

What happens if I don't see an option to allocate my IRA contributions? I am filing for IN and IL, and TurboTax automatically allocated my IRA contributions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA Deduction - Multiple States?

I am also wondering about allocating traditional IRA deductions. I lived in two states, IL (6.5 months) and FL (5.5 months). I made the contribution ($6,000) while in FL, but FL does not have income tax, therefore would not benefit me as a deduction.

It seems that TurboTax might have split it evenly between the two states without asking me to define allocation. Is it illegal to allocate all and thus deduct all from IL, since I am not double deducting, but simply maximizing my deduction? Is it really possible that since I made the contribution while in FL I cannot use this as a state deduction, but only benefit from it on my federal taxes?

If someone could point me to the IRS.gov publication that outlines this I would be greatly appreciative!

Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA Deduction - Multiple States?

Hello ecg7,

Did you ever get a response to your question? I have the exact same situation (with different states) and am wondering which state to allocate the IRA deduction to. What did you do last year?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA Deduction - Multiple States?

If you can identity which state you lived in when you made the contribution, you must allocate it to that state. If the contributions were even (like a monthly draw) then you could use the percentage of time. In ecg7's example, he was trying to allocate all the contribution to the taxing state to get an advantage. If Illinois chose to audit him, he would lose.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA Deduction - Multiple States?

Hi MaryK1101!

Would appreciate if you could help me with a similar question I have.

Suppose person has annual salary of $60,000. They live 5 months in California and then move to Washington for the rest of the year. AFTER moving to WA, they make a maximum allowed ($19,500) 401(k) contribution.

Now what they have in W2:

– Federal taxable income is $60,000 – $19,500 = $40,500.

– California taxable income is full $25,000 (5 months).

1) Is it all correct? California would not take into account 401(k), which were made after moving to a different state?

2) Does it mean that only if the person maxed out 401(k) contributions while still in California, their taxable CA income would be $25,000 – $19,500 = $5,500, and the person would benefit not only from Federal deduction, but from the state deduction as well?

Thank you so much!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA Deduction - Multiple States?

Allocating earned income is easy if you stopped working for an employer in one state and started working elsewhere after you moved. All you need to do is look at your W-2 or 1099-MISC. Allocate the income from your former job to your former state and your income from the new job to your new state. This will work in your situation if the person worked in CA for the first 5 months and then worked in WA for the remaining 7 months. Allocate the income to the state you were physically in when you earned the income.

What if you continue working at the same job while living in 2 different states? Some companies will send you a W-2 with the state totals listed, others will send you two separate W-2s for each state. If not or they didn't change the withholding to the second state (or top withholding in your case), then you’ll have to estimate how much income you earned as a resident of one state versus the other. Here are a few ways to do that.

If the 401K is reported on the W-2, you are not going to be asked to allocate the contribution. It will be included on the federal return and it will transfer to the CA return. The California return starts with the federal AGI number, then based on the income allocated to CA, a percentage will be calculated and that percentage of your total income and deductions will be applied to the CA return. So, a portion will be included in your CA return. In this case, it would not matter where you maxed out the 401K - the reduction in income is based on the percentage of CA income to total income. In your example, 25K/60K = 42% of income belongs to CA, so you will get 42% of the deductions available on the CA return. You won't allocate the deductions on the W-2, only the income gets allocated. For more information on allocating income on a part-year return, see the link above.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA Deduction - Multiple States?

Hello, We owned and sold a rental property in CA while we are full time ID residents. Because the property, we have to file the CA state tax return.

Now, while in CA state tax return, Turbo Tax is asking about the income allocation to CA. Since my husband is working in ID as self-employed and the client is in CA, so I think all the income sources are from CA. How about the self-401k contribution? should I allocate all to CA, since it is the income from CA to contribute or should I allocate to ID since we live in ID full time?

Thank you so much!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA Deduction - Multiple States?

The rental property definitely belongs on a nonresident CA return. The rest of it depends.

You said your husband was self-employed in ID but performed work for a CA client. Did he perform the work in CA or in ID? If he performed it in ID, even if for a CA client, it is only taxable in your home state. If he traveled to CA to perform the work, he would be taxed on the amount he earned in CA. He would allocate his self-employment income based on the days worked in California and the days worked in Idaho.

The 401(k) contribution would be reported as part of your federal AGI which impacts your California tax. However, it would not be reported as California sourced.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA Deduction - Multiple States?

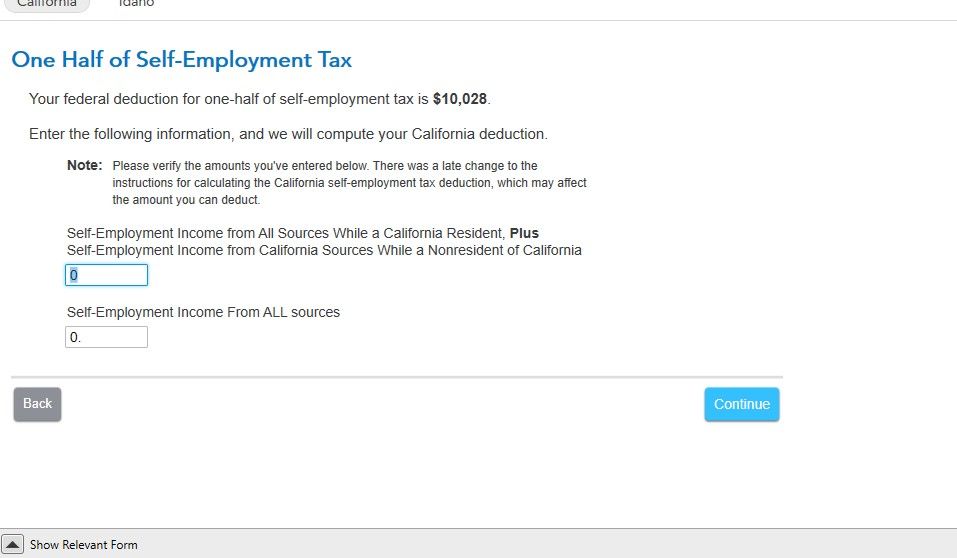

Thank you @RaifH , yes, all the work are done from home state in ID. when asked in Turbo Tax (picture below) I would enter Zero? since all the work were preform in ID, no self-employment tax deduction can be taken. Is that right? What confused me is it says, " self-employment income from CA sources while a nonresident of CA"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA Deduction - Multiple States?

Yes, you would enter 0 in that first field. The second field should have all your self-employment income. Your confusion is totally understandable, and to make it worse different states have different rules for what is considered sourced in their state. For California purposes, a nonresident has California sourced income from:

- Services performed in California

- Rent from real property located in California

- The sale or transfer of real California property

- Income from a California business, trade or profession (as in a business based in California)

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mwilcox1

Level 3

anonymouse1

Level 6

sacherich20

New Member

BRANDONKENNY310

New Member

user17709997215

Level 1