- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- If the wrong state income tax was withheld from your 1099...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received 1099R with wrong state tax withheld.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received 1099R with wrong state tax withheld.

If the wrong state income tax was withheld from your 1099-R, you will have to file a nonresident income tax return for that state, to get that money back.

The first thing you want to do is make sure you've filled out the Personal Info section correctly:

- With your return open, click the first tab, Personal Info.

- Continue to the Your Personal Info Summary screen.

- Scroll down to the last section, Other State Income, and click Edit.

- At the Did you make money in any other states? question, answer Yes and make sure your nonresident state(s) are selected from the drop-down.

- Click Continue to return to the Your Personal Info Summary screen.

After you finish your federal return, you'll automatically move to the State Taxes tab, where you'll see your nonresident state(s) listed in addition to your resident state.

To ensure accurate calculations, we strongly recommend preparing your nonresident state return before you prepare any resident or part-year state returns. More tips:

- Select the long form (if the option is available) even if TurboTax defaults to the short form.

- Only report the income attributable to the nonresident state.

- If preparing a nonresident return solely to recover erroneous tax withholdings, enter 0 on the screen that asks for the amount of income earned in that state. This will eliminate your tax liability for that state, resulting in a full refund.

- If you live in a reciprocal state, consider submitting an exemption form to your employer so you don't have to file a nonresident return next year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received 1099R with wrong state tax withheld.

On the Indiana return, the withholdings form 1099-R, line 11 on the Tax Payment worksheets shows the amount correctly. This was the amount the IRA company sent to Indiana in error. However, the end result is $0 refund. Shouldn't it be the full amount on the 1099-R?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received 1099R with wrong state tax withheld.

Not necessarily, Indiana taxes non-resident income earned from Indiana sources.

You need to make sure that you are doing the Indiana return first, before you do your home state return. If you did it out of order delete them both and then start over.

Indiana has reciprocal agreements with several states and if yours is one of them (Kentucky, Michigan, Ohio, Pennsylvania or Wisconsin) then you may not have to pay any taxes in Indiana at all.

Either way if you do have to pay taxes to Indiana for the income that you earn there then your home state will give you a credit on your state tax return for the amount that you pay Indiana. That's why you want to do the Indiana return first.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received 1099R with wrong state tax withheld.

I deleted both Wisconsin and Indiana states from turbotax and did Indiana first.

NO change. Still shows $0 refund from Indiana.

Again, I did not earn any money from Indiana employment. TD Ameritrade paid Indiana over $1000 in state withholding by error. Their error and they admit to the error.

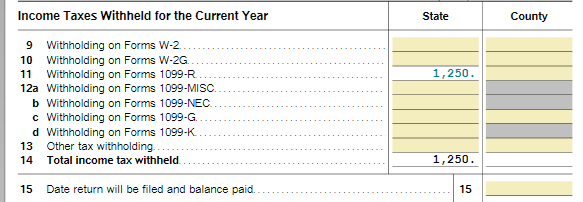

The Form screen, IN state, Tax Payments Worksheet, line 11 Withholding on form 1099-R, and line 14 Total Income Tax withheld shows the CORRECT 1099-R amount of over $1000.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received 1099R with wrong state tax withheld.

Yes, you should get the full amount of the refund. If the Indiana (IN) return is not allowing you to make an adjustment to the income you can follow the steps here to correct the tax return.

When you are in the federal section of your return and on the Form 1099-R screen, make sure your state income amount is zero (Box 16) but leave the withholding amount in Box 14.

The key is to make sure the tax returns are accurately reflected and reported. This will not create any issue for you and it will properly allocate the income and the withholding.

Please update here if you need further assistance.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received 1099R with wrong state tax withheld.

Yes. Everything is correct as you stated.

On that 1099-R the line 14 shows the correct amount and line 16 is blank.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received 1099R with wrong state tax withheld.

As I go through the Indiana (IN) return with your scenario of retirement and IN withholding you will reach the screens below. You must enter a zero where indicated and you must select the County of 'Out-of-State - WISCONSIN'. Once you reach the end you will see the IN refund of the full amount. In my example the withholding was $100.

Next, I notice at the top of the return you will see one state, then use the arrow to see the other state return result. It will also show the refund for IN when you click the arrow.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received 1099R with wrong state tax withheld.

The screens are filled out exactly like your example but my refund is still $0.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received 1099R with wrong state tax withheld.

I deleted both state returns and started from scratch.

Checked all the Federal info and went to IN.

The Tax Payment worksheet form shows the $1000+ in line 11, Withholding form 1099-R.

IN comes up as Reciprocal Nonresident. County of Employment is "Out of State - WIsconsin"

Income from Indiana Employment is $0

Refund is still $0

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received 1099R with wrong state tax withheld.

I would like you to try to clear any cache and cookies since I did not have the same issue. Also I will provide the preview and print instructions so that you can actually see the forms. You should not have to delete the state returns again.

Computers remember pieces of information that we want them to forget and sometimes this can cause nonsensical issues.

You can view your entire return or just your 1040 form before you e-file by using the steps below and we have a video at the link:

- Open or continue your return.

- Select Tax Tools in the left menu (if you don't see this, select the menu icon in the upper-left corner).

- With the Tax Tools menu open, you can then:

- Preview your entire return: Select Print Center and then Print, Save, or Preview This Year's Return (you may be asked to register or pay first).

- View only your 1040 form: Select Tools. Next, select View Tax Summary in the pop-up, then Preview my 1040 in the left menu.

- How do I preview my return in TurboTax Online before I file?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received 1099R with wrong state tax withheld.

Yes, I deleted cookies and cleared the cache. Exited TurboTax, restarted, deleted the states and started with IN first before WI, etc, etc.

I'm not sure what printing the forms will do when I can view them on the screen.

This is what is showing up on the Indiana Tax Payment worksheet, which is correct per the 1099-R that was incorrectly sent to IN instead of WI.

Yet, my refund is still showing $0 for Indiana.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received 1099R with wrong state tax withheld.

I see the sheet in the IN tax return you posted which is the Tax Payments worksheet in TurboTax CD/Download program. I have the same one in mine and it looks exactly like yours except my test amount is again, $100. You will not see a refund or balance due on this page.

You must look at the Form IT-40PNR which is the actual tax return for IN. I have added the screen images for you to review when you are in Forms in your version of TurboTax. Hopefully this will show you your refund. I have added a couple of the screen images towards the end of the IN interview.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received 1099R with wrong state tax withheld.

OK, may be on to something.

Form IT-40PNR is blank. Not in my tax forms. I searched for it, found it, it's blank.

Where in TurboTax would it trip the trigger to fill it in?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received 1099R with wrong state tax withheld.

OK, Ignore that last posting.. I do have the Form IT-40PNR in my Indiana taxes but it is NOT showing the $1025 from the 1099-R.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

chapmandebra3

New Member

sakilee0209

Level 2

girishapte

Level 2

sburner

New Member

dpa500

Level 2