- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- I took a distribution on the cares act, and during this process, I was asked if I wanted to pay the Taxes upfront or during Taxes. I opted upfront. How do I enter that?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I took a distribution on the cares act, and during this process, I was asked if I wanted to pay the Taxes upfront or during Taxes. I opted upfront. How do I enter that?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I took a distribution on the cares act, and during this process, I was asked if I wanted to pay the Taxes upfront or during Taxes. I opted upfront. How do I enter that?

One of the relief measures for Covid-19 is the option to spread the taxation of your retirement distribution (up to $100,000) over three years.

Please read this IRS document for more information.

If you do want to take advantage of this option and pay the taxes immediately, please follow these steps:

- Enter your form 1099-R normally.

- After entering your form 1099-R, click Continue until you reach the screen Do any of these situations apply to you?.

- Check the box which says I took out this money because of a qualified disaster (includes COVID-19).

- Click on the radio button Yes this was withdrawn due to COVID-19 and click Continue.

- Follow the interview until you arrive at the screen Was this a withdrawal due to COVID-19 or a Qualified Disaster Distribution?

- Click on the radio button Yes this was withdrawn due to COVID-19 and click Continue

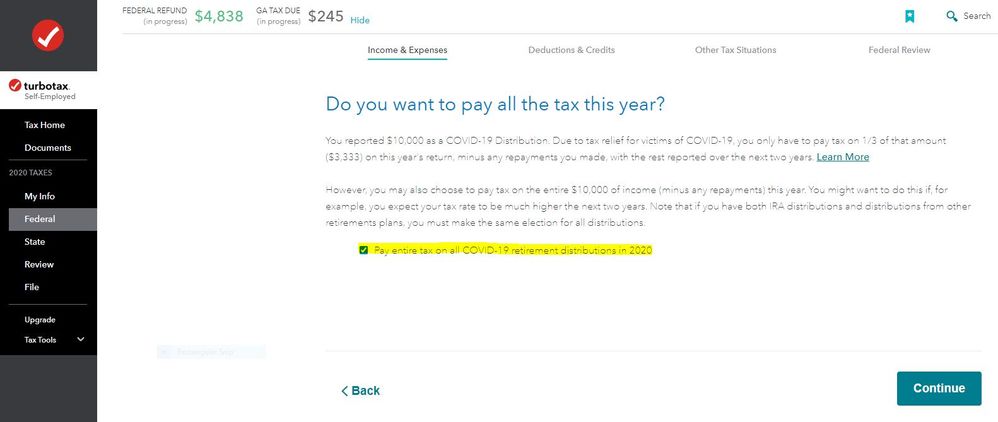

- Follow the interview until you arrive at the screen Does [name] want to pay all the tax this year?

- Check the box Pay tax on entire IRA, SEP or Roth IRA distribution in 2020

- Click Continue and the whole distribution is taxed in 2020.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I took a distribution on the cares act, and during this process, I was asked if I wanted to pay the Taxes upfront or during Taxes. I opted upfront. How do I enter that?

I enter a COVID distribution of $100,000 from a 1099-R

"until you arrive at the screen Does [name] want to pay all the tax this year?"

This question never comes up.

Worse it says my tax is zero and I qualify for the stimulus,

even when the COVID distribution was $100,000 (status single)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I took a distribution on the cares act, and during this process, I was asked if I wanted to pay the Taxes upfront or during Taxes. I opted upfront. How do I enter that?

After completing the new COVID-19 distribution questions, I'm rightly given a checkbox that says "Pay tax on entire IRA, SEP, Simple, or Roth IRA distribution in 2020." If I check this and move forward, my federal/state refund numbers do not change. If I uncheck it, numbers don't change. Paying taxes on $12k in 3 years vs. 1 year should change my 2020 taxes. is something not quite working yet?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I took a distribution on the cares act, and during this process, I was asked if I wanted to pay the Taxes upfront or during Taxes. I opted upfront. How do I enter that?

@TroyPetry2020 wrote:

After completing the new COVID-19 distribution questions, I'm rightly given a checkbox that says "Pay tax on entire IRA, SEP, Simple, or Roth IRA distribution in 2020." If I check this and move forward, my federal/state refund numbers do not change. If I uncheck it, numbers don't change. Paying taxes on $12k in 3 years vs. 1 year should change my 2020 taxes. is something not quite working yet?

What is the code in box 7 of the Form 1099-R? Was the withdrawal from an IRA and if so was it a Roth?

Are you making a contribution to an IRA in 2020?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I took a distribution on the cares act, and during this process, I was asked if I wanted to pay the Taxes upfront or during Taxes. I opted upfront. How do I enter that?

Box 7 code was 1: early distribution. Is there another option available that my provider should have indicated?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I took a distribution on the cares act, and during this process, I was asked if I wanted to pay the Taxes upfront or during Taxes. I opted upfront. How do I enter that?

sorry, I only answered 1 question, and you asked a couple others.

It was distribution from 401k and reinvested in IRA because 401k provider didn't accept repayments (former employer).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I took a distribution on the cares act, and during this process, I was asked if I wanted to pay the Taxes upfront or during Taxes. I opted upfront. How do I enter that?

@TroyPetry2020 wrote:

sorry, I only answered 1 question, and you asked a couple others.

It was distribution from 401k and reinvested in IRA because 401k provider didn't accept repayments (former employer).

Reinvested in an IRA?

That sounds like you had a withdrawal from the 401(k) and rolled the withdrawal over to an IRA. Then you made a withdrawal from the IRA? Is this what happened?

Did you receive two Form 1099-R's? Was the IRA/SEP/SIMPLE box checked on the 1099-R that you received?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I took a distribution on the cares act, and during this process, I was asked if I wanted to pay the Taxes upfront or during Taxes. I opted upfront. How do I enter that?

No. I did COVID-19 distribution of $90k from 401k (former employer), and then reinvested $78k of that in my IRA, as my former employer would not accept repayments/deposits since I am no longer an employee. Therefore, I have $12k of taxable income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I took a distribution on the cares act, and during this process, I was asked if I wanted to pay the Taxes upfront or during Taxes. I opted upfront. How do I enter that?

@TroyPetry2020 wrote:

No. I did COVID-19 distribution of $90k from 401k (former employer), and then reinvested $78k of that in my IRA, as my former employer would not accept repayments/deposits since I am no longer an employee. Therefore, I have $12k of taxable income.

Right...Tried using the numbers you provided and the amount rolled over to the IRA, I can only see the entire $12,000 as taxable income regardless of how this is designated, pay the same year or over 3 years.

I will page a couple of other users who may have an explanation of why you are seeing only the entire amount as taxable in 2020. @macuser_22 or @dmertz could you review this please.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I took a distribution on the cares act, and during this process, I was asked if I wanted to pay the Taxes upfront or during Taxes. I opted upfront. How do I enter that?

If there is any amount in box 5 (the nontaxable portion of this distribution) of this Form 1099-R, the taxable amount is less than $12,000 because the repayment is applied first to the taxable portion. Examine Form 1040 line 5b to see how much is being included in income.

Assuming that there is nothing in box 5 of the Form 1099-R, depending on your other income and your filing status, your income tax liability might be zero no matter if the $12,000 is applied entirely to 2020 or as $4,000 in each of 2020, 2021 and 2022. Examine Form 1040 line 22 to see your income tax liability each way.

If you have no tax liability with the entire $12,000 applies to 2020, it wouldn't make sense to spread it out over three years.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I took a distribution on the cares act, and during this process, I was asked if I wanted to pay the Taxes upfront or during Taxes. I opted upfront. How do I enter that?

I did these steps but Turbo Tax only calculated a third for tax purposes. How do I fix this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I took a distribution on the cares act, and during this process, I was asked if I wanted to pay the Taxes upfront or during Taxes. I opted upfront. How do I enter that?

To reach the page that asks if you want to pay all of tax in 2020, click the Continue button on the page that lists the 1099-R forms that you have entered. Once you reach that page, mark the box to indicate that you want to pay the entire tax on all COVID-19 retirement distributions in 2020.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I took a distribution on the cares act, and during this process, I was asked if I wanted to pay the Taxes upfront or during Taxes. I opted upfront. How do I enter that?

@teamdk wrote:

I did these steps but Turbo Tax only calculated a third for tax purposes. How do I fix this?

Screenshot

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I took a distribution on the cares act, and during this process, I was asked if I wanted to pay the Taxes upfront or during Taxes. I opted upfront. How do I enter that?

Thanks, now I realize that it looks like Turbo Tax double counted the amount of money I returned to my IRA in 2020, due to the CARES Act, allowing us to return money beyond the 90 days.

For ease of review. I took out $160,000 and put back $60,000. All due to COVID - it Turbo Tax shows that $40,000 is taxable instead of $100,000. How can this be?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

SmallBusinessSurvivor

Level 2

xiaochong2dai

Level 3

flin92

New Member

naewhitehead

New Member

noah-upton2001

New Member