- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- I opened a bank account and received $150 as a promotion. Is this taxable income?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I opened a bank account and received $150 as a promotion. Is this taxable income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I opened a bank account and received $150 as a promotion. Is this taxable income?

Does it apply for credit card bonus as well? It was credited in my statement.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I opened a bank account and received $150 as a promotion. Is this taxable income?

No, credit card statement credits are not taxable. The IRS will treat the statement credit as a discount and not interest earned.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I opened a bank account and received $150 as a promotion. Is this taxable income?

follow up to this question. What if the terms on the bonus are not met and they revoke the bonus but you already had to claim the bonus as interest? Is the financial institution obligated to send a corrected 1040?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I opened a bank account and received $150 as a promotion. Is this taxable income?

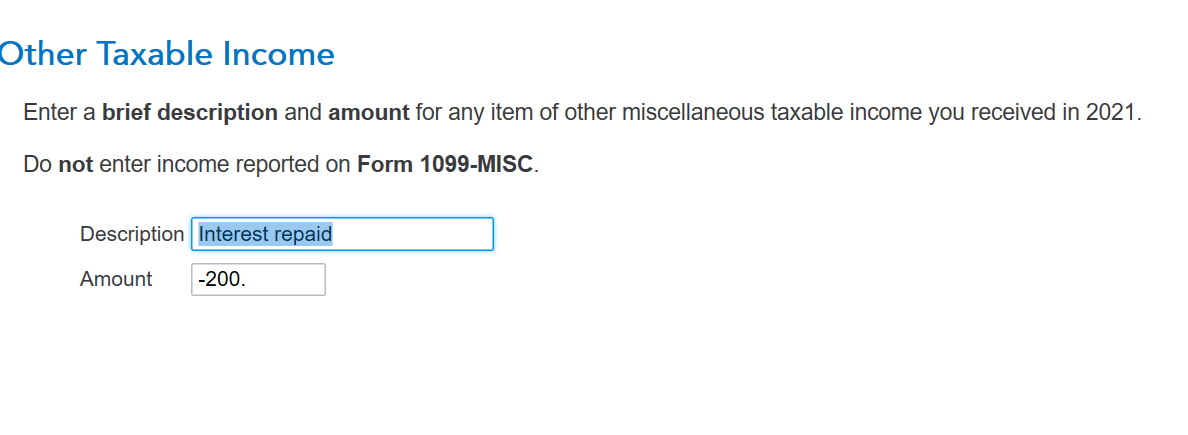

Yes, they are correct. They do not need to send you any type of tax documents for the correction.

If they revoke the bonus that you already claimed on your return, you would take the following steps:

- Federal

- Income

- Show more next to Misc Income

- Start next to Other Income

- Start next to Other Miscellaneous Income

- Enter your interest that you paid back as a negative amount with a description of interest repaid.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I opened a bank account and received $150 as a promotion. Is this taxable income?

thank you

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17539892623

Returning Member

anonymouse1

Level 5

in Education

rodiy2k21

Returning Member

Th3turb0man

Level 1

bruce-carr49

New Member