- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- I need to report an excess traditional IRA contribution carryover. where do I do that in turbotax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to report an excess traditional IRA contribution carryover. where do I do that in turbotax?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to report an excess traditional IRA contribution carryover. where do I do that in turbotax?

Open your return in TurboTax:

- Click on Deductions & Credits

- Scroll down to Retirement and Investments

- Click on Traditional and Roth IRA Contributions

- Click on Traditional IRA

- Click yes or no if that you contributed to a traditional IRA in 2019

- Next screen asks if you contributed more money to your IRA than was allowed in 2018 or previous year

- Click Yes

- Next screen enter the excess contribution amount

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to report an excess traditional IRA contribution carryover. where do I do that in turbotax?

Hello,

I have a similar case. I had an excess traditional IRA contribution for 2018. TurboTax generated Form 5329 and paid the 6% penalty for 2018 tax return. I realized the excess IRA contribution when I'm filing my 2019 tax return. I requested a withdrawal of the excess amount of $2,000 and received $1,950 on April 20, 2020.

In TurboTax, to the Question -

Excess Contributions Withdrawn

Did you withdraw any excess contributions made to a traditional IRA after the due date (including extensions) of last year’s return?

My answer should be YES. And then TurboTax removed 6% penalty on the excess IRA contribution.

Am I right?

Thanks!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to report an excess traditional IRA contribution carryover. where do I do that in turbotax?

I also have a similar case.

I have an Excess Traditional IRA Contribution from 2021

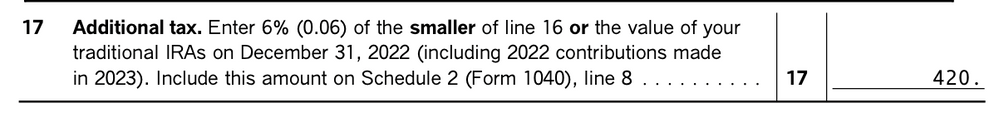

Form 5329 2022 like 17 shows the same amount of tax that I paid last year.

Do I have to ask my Financial Institution to withdraw my 2021 $7000 Traditional IRA Contribution, so that it will stop the 6% tax on line 17?

Then if I want to contribute $7000 for 2022, does that mean a separate transaction at my Financial Institution?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to report an excess traditional IRA contribution carryover. where do I do that in turbotax?

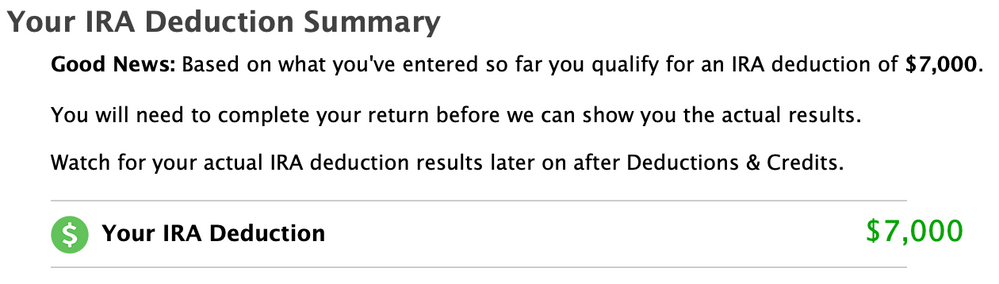

You have one of two choices, you may withdraw the 7,000 so that it will stop the 6% penalty. Or you may transfer the 7,000 to 2022. You will still incur the 6% penalty for 2021 but atleast you won't have it anymore in 2022 as long as that amount is not in excess for 2022. You will need to contact your financial institution to issue you a corrected 5498 at the end of 2021. Bear in mind that if you withdraw the excess ccontribution, you will be issued a 1099R from your financial institution for the amount of excess withdrawn even if it was for a prior year

On your 1099R input, you will enter Box 1 gross amount, Box 2 taxable amount, Box 7 you will enter codes P and 2.

See HERE on how this works. Note that the same conditions apply for a regular IRA. Bear in mind that the taxable amount included in Box 2A will only be the earnings that accumulated on that excess from the time the excess contribution was made up untill the time of the distribution. NOT, the 7,000 excess

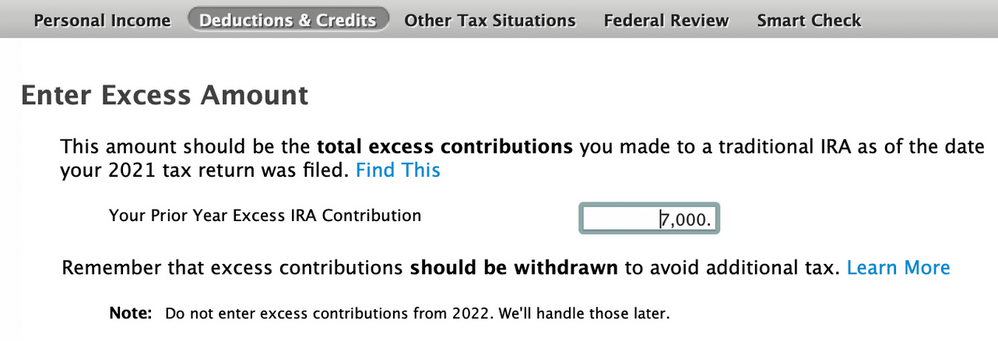

However, If you decide to rollover the excess to the following year, you would do this on this screen

Under deductions and credits

Traditional IRA/ next screen Is this a repayment of a retirement plan, hit no

then amount you contributed

then Did you change your mind, no, then Retirement plan coverage, no

then this screen

then to screen shown above.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tianwaifeixian

Level 4

tianwaifeixian

Level 4

tcondon21

Returning Member

simoneporter

New Member

curlytwotoes

Level 2