- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

I also have a similar case.

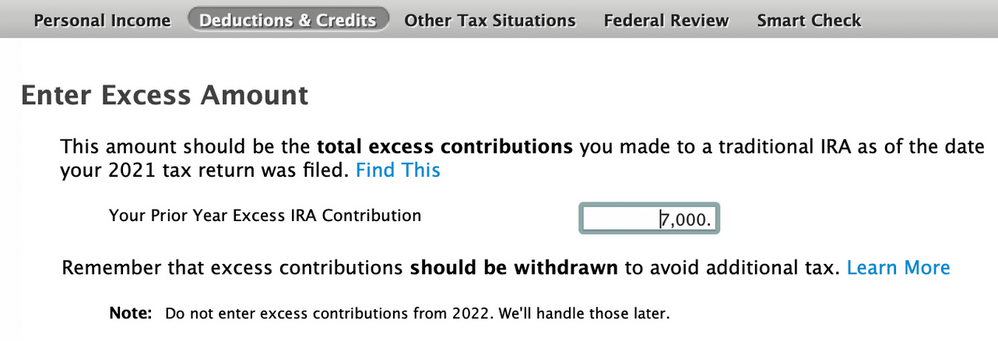

I have an Excess Traditional IRA Contribution from 2021

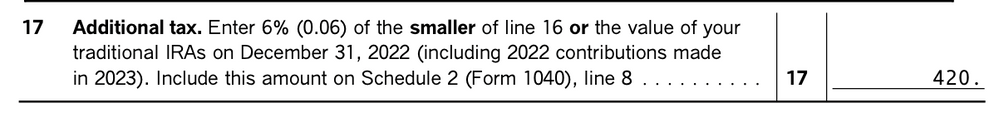

Form 5329 2022 like 17 shows the same amount of tax that I paid last year.

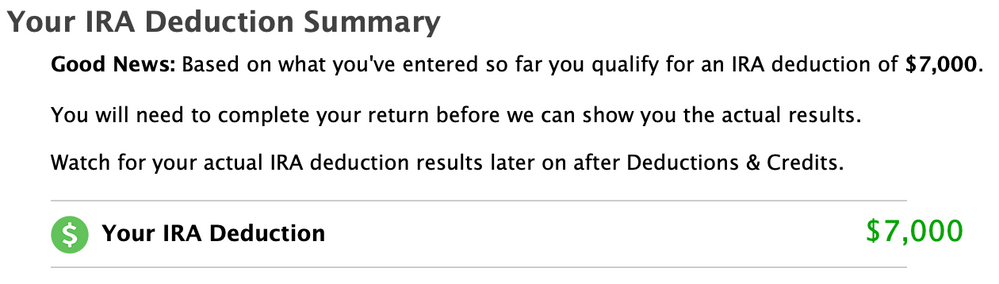

Do I have to ask my Financial Institution to withdraw my 2021 $7000 Traditional IRA Contribution, so that it will stop the 6% tax on line 17?

Then if I want to contribute $7000 for 2022, does that mean a separate transaction at my Financial Institution?

April 3, 2023

9:39 PM