- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- I am claiming my cousin as a dependent because I provided more than half his care this year, but cousin is not listed as a relative. What do i list him as?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am claiming my cousin as a dependent because I provided more than half his care this year, but cousin is not listed as a relative. What do i list him as?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am claiming my cousin as a dependent because I provided more than half his care this year, but cousin is not listed as a relative. What do i list him as?

You would list him as other for the relationship.

You can claim a cousin as a dependent if all of the following applies:

- He is not a qualifying child dependent of another taxpayer (usually parents or grandparents).

- He lived with you for the entire year

- He earned less than 4,050 dollars

- You provided more than half of his support

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am claiming my cousin as a dependent because I provided more than half his care this year, but cousin is not listed as a relative. What do i list him as?

All the above apply to me and it's still not letting me claim him the first time it said his not a family member his my first cousin then it said no all together I'm confused

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am claiming my cousin as a dependent because I provided more than half his care this year, but cousin is not listed as a relative. What do i list him as?

Cousin is not a qualified relationship in the IRS world. You would put relationship at other or none. He would also have had to live with you for the entire 12 months of 2019. Recheck your entries. If you still have a problem, I would delete him altogether and reenter him.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am claiming my cousin as a dependent because I provided more than half his care this year, but cousin is not listed as a relative. What do i list him as?

I am a legal guardian for my cousin in the court. What relationship should i choose when claiming him. When i choose ‘other’ as a relationship it does not refund anything. Can i choose foster child as i am the guardian?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am claiming my cousin as a dependent because I provided more than half his care this year, but cousin is not listed as a relative. What do i list him as?

Do not show your cousin as a foster child unless the courts specifically named you as the foster parent. Typically, foster parents need to go through classes and certifications at the state level. If the courts just made you the guardian, that doesn't necessarily qualify you as a foster parent. You will want to review your placement paperwork.

If you determine that you are NOT your cousin's foster parent, read on:

If all criteria are met, your cousin will be a qualifying relative, but not a qualifying child. This means that you will not receive the Child Tax Credit, but you may be eligible for the Credit for Other Dependents (ODC). The ODC is a non-refundable credit for up to $500. Non-refundable means that if other deductions or credits reduce your tax to zero, then you won't receive the ODC.

To determine if you received the ODC, you will want to check your forms. Here's how to look at your current year return forms:

- In the left-hand menu bar, click on Tax Tools, then click Tools.

- Under Other helpful links, click View Tax Summary.

- Your Tax Summary will be displayed. In the left-hand menu bar, you will see a new option: Preview My 1040. Click it, and this will allow you to see the forms. It is important to check your 1040 before you check your state return, as much of your entries on the 1040 will impact the state return.

- If you want to view your state entries, Click on Tax Home in the left-hand menu bar. In the center of your screen, scroll down until you see State Taxes. Click on it to review your state entries.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am claiming my cousin as a dependent because I provided more than half his care this year, but cousin is not listed as a relative. What do i list him as?

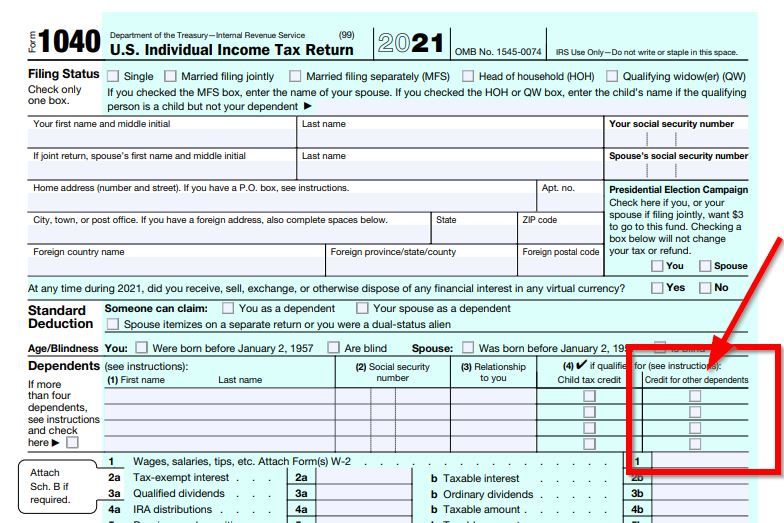

How does my 1040 form show me that I received the ODC

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am claiming my cousin as a dependent because I provided more than half his care this year, but cousin is not listed as a relative. What do i list him as?

Check your 1040 Dependents box 4 (over on the right)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am claiming my cousin as a dependent because I provided more than half his care this year, but cousin is not listed as a relative. What do i list him as?

"Credit for other dependents" boxes are checked. Does this mean I didn't claim the Child Tax Credit? Or was this criteria determined by the IRS? If I didn't check the Child Tax Credit box, am I able to still fix this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am claiming my cousin as a dependent because I provided more than half his care this year, but cousin is not listed as a relative. What do i list him as?

Q. "Credit for other dependents" boxes are checked. Does this mean I didn't claim the Child Tax Credit?

A. Yes

Q. If I didn't check the Child Tax Credit box, am I able to still fix this?

A. No. There's nothing to fix. A cousin is not a close enough relative to be a qualifying child for the Child Tax credit or the Earned Income Credit. The other dependent credit is all you can claim.

Q. Was this criteria determined by the IRS?

A. Yes. Or more accurately by Congress. It's the law.

See full dependent rules at: https://turbotax.intuit.com/tax-tools/tax-tips/Family/Rules-for-Claiming-a-Dependent-on-Your-Tax-Ret...

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sunshinejoe

Level 2

Fasi

New Member

adamsfam1121

New Member

KellyD6

New Member

tcdvs528

New Member