- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- HOW DO I REPORT THAT I QUALIFY FOR THE EXCEPTION

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401(K) early withdraw exception

I was reading a post about exceptions for early withdraws from a companies pension plan. Can you please provide a few more details " 4. Separation from service at age 55 or older (pensions & 401K but not IRAs)." and what forms are required to the IRS? Thank you

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401(K) early withdraw exception

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401(K) early withdraw exception

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401(K) early withdraw exception

Th exceptions are listed here. https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-tax-on-early-distri...

The one you may be asking about is that, for certain employer-sponsored plans, you can withdraw without the penalty if you are over 55 AND separated from service with the company. (The normal age to be exempt from the early withdrawal penalty is 59-1/2.)

When you withdraw from a retirement plan, the plan administrator sends you a 1099-R income statement by January 31 of the next year. That income is reported on your tax return. There are questions in Turbotax that will allow you to indicate if you qualify for an exemption and prepare the correct forms.

All withdrawals from tax-advantaged plans are subject to regular income tax. The exemption only applies to the additional 10% penalty for early withdrawals.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401(K) early withdraw exception

The exception applies to distributions from the plan provided by the company from which the employee separated from service during or after the year in which the employee reached age 55. If the employee separates from service from this company before the year in which they reached (or will reach) age 55, the exception does not apply.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401(K) early withdraw exception

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401(K) early withdraw exception

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401(K) early withdraw exception

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401(K) early withdraw exception

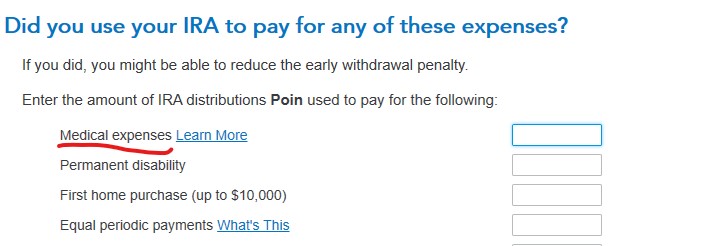

I am still looking for instructions for REPORTING my exception to the 591/2 penalty rule...…..The IRA and Pension publication lists 8 exceptions, mine is for medical expenses, but don't know how to report it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401(K) early withdraw exception

The exceptions will be in the follow up questions.

After you enter your 1099-R and hit Continue.

You will continue through several screens (most have to do with disaster withdrawals and repayments)

You will come to a screen titled Let’s See If We Can Lower Your Tax Bill

Hit Continue what you are looking for is on the next page

Note: Excludible medical expenses are those above 7.5% of your Adjusted Gross Income (AGI)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

pmichael5

New Member

mdh337

New Member

user17710264035

Returning Member

in Education

rcepuch

Level 2

DLWoodrum

Level 2