- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

The exceptions will be in the follow up questions.

After you enter your 1099-R and hit Continue.

You will continue through several screens (most have to do with disaster withdrawals and repayments)

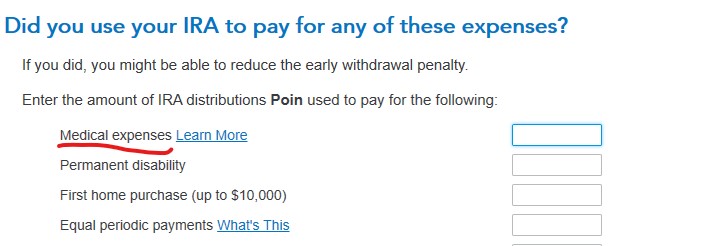

You will come to a screen titled Let’s See If We Can Lower Your Tax Bill

Hit Continue what you are looking for is on the next page

Note: Excludible medical expenses are those above 7.5% of your Adjusted Gross Income (AGI)

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 12, 2020

11:07 AM