- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- How do I get TT to include Form 5329? I filled it out in TT but it is not included when I reviewed and printed my forms prior to filing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get TT to include Form 5329? I filled it out in TT but it is not included when I reviewed and printed my forms prior to filing.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get TT to include Form 5329? I filled it out in TT but it is not included when I reviewed and printed my forms prior to filing.

Why do you need a 5329 form. That form is filled out automatically by TurboTax if needed. In some cases it must be a separate form attached to your tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get TT to include Form 5329? I filled it out in TT but it is not included when I reviewed and printed my forms prior to filing.

I need the form for the purpose it exists: to report a RMD not taken. TT has no way to know whether or not this is needed, as it it is a rare occurrance. As stated, I filled it out in TT. If I electronically submit my 1040, it looks like this form won't be included.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get TT to include Form 5329? I filled it out in TT but it is not included when I reviewed and printed my forms prior to filing.

You will need to file a 5329 form and request a waiver of the penalty. (The waiver would only be denied if there is no reasonable explanation and the missed RMD was not taken at all.)

Unfortunately this can only be done using the "forms" mode that is only available with the desktop software if you do not have a 1099-R to file.

If you do have a 2019 1099-R to report then the RMD question in the interview will go to the form 5329 waiver interview if you say that the 2019 RMD was not taken.

If you are using the CD/download version:

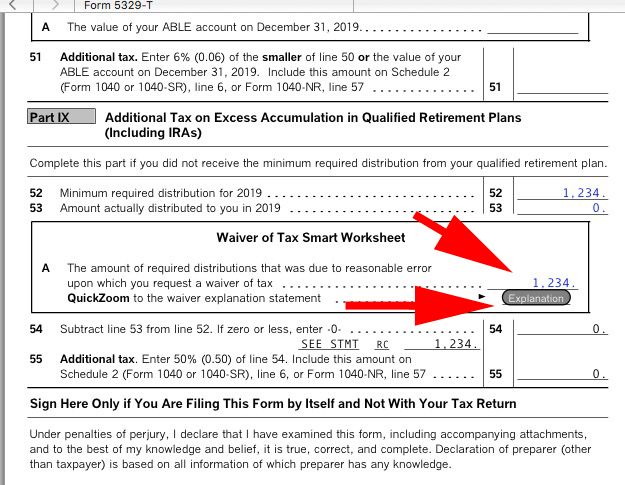

Enter the forms mode and click on open form. Type in 5329. Choose 5329-T for the taxpayer (first person listed on your tax return), or 5329-S (for spouse - 2nd person on tax return).

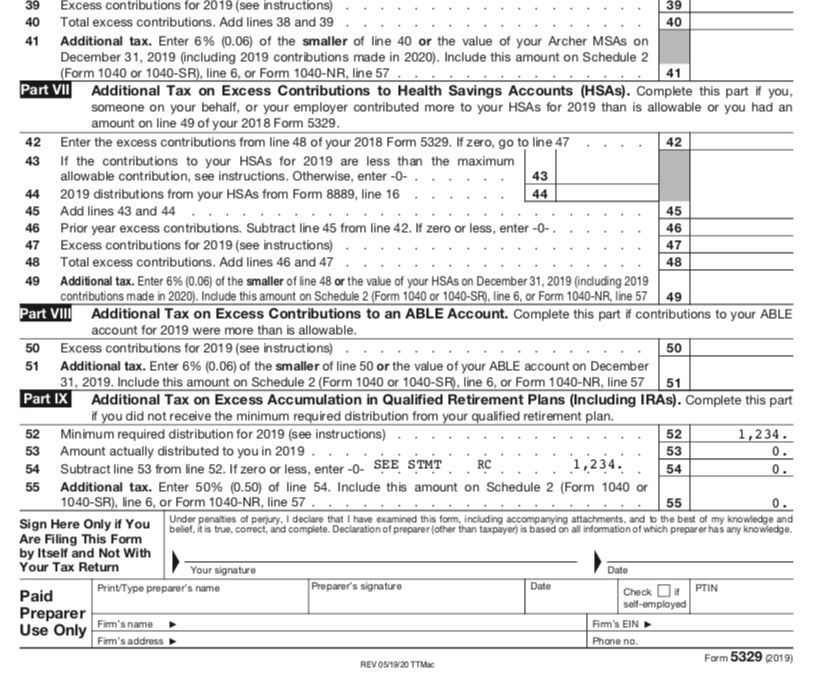

Scroll down to Part IX line 52 and enter the RMD amount that should have been taken. On line 53 enter the amount of the RMD that was actually taken (probably zero if it was missed).

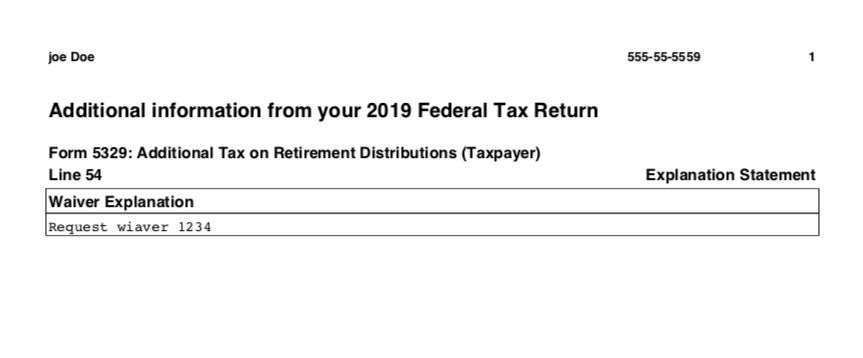

Then in the box right under line 53 "Waver of Tax Smart Worksheet" enter the same amount as line 52 (the RMD amount). Then click the "Explanation" button and enter the reason for missing the RMD and your statement requesting a waver.

You will not pay any penalty now until the IRS determines if it will grant the waver, then they will inform you if you owe the penalty.

OR - if using the Online version and have no 2019 1099-R to file, you will have to prepare the 5329 manually .

Download the 5329 form from the IRS website and fill it out the same as above. Print and mail your return with the 5329 form and explanation attached as described in the 5329 instructions.

The 2019 5329 must be attached to your printed and mailed 2019 tax return and cannot be e-filed.

[NOTE: You can only use this method if you are requesting a waver of the penalty and there is no taxable amount on the 5329 form line 55 that must be transferred to the 1040 form]

From 5329 instructions:

Quote:

"Waiver of tax. The IRS can waive part or all of this tax if you can show that any shortfall in the amount of distributions was due to reasonable error and you are taking reasonable steps to remedy the shortfall. If you believe you qualify for this relief, attach a statement of explanation and file Form 5329 as follows.

1. Complete lines 52 and 53 as instructed.

2. Enter “RC” and the amount of the shortfall you want waived in parentheses on the dotted line next to line 54. Subtract this amount from the total shortfall you figured without regard to the waiver, and enter the result on line 54.

3. Complete line 55 as instructed. You must pay any tax due that is reported on line 55.

The IRS will review the information you provide and decide whether to grant your request for a waiver. "

Download blank 2019 5329 form here:

Form: http://www.irs.gov/pub/irs-pdf/f5329.pdf

Instructions: http://www.irs.gov/pub/irs-pdf/i5329.pdf

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get TT to include Form 5329? I filled it out in TT but it is not included when I reviewed and printed my forms prior to filing.

Thank you for the detailed reply. I have filled out the form, but there's nothing in TT that indicates that I can't file electronically because I need to file this form. Thank you for the clarification. I went all the way through the process of filing electronically, with no notice from TT that I have to file through the mail. Basically, TT would have filed my taxes electronically omitting this form. Another reason that it's important to review the return before finalizing your efiling! TT should address this issue however. In the past, TT has informed me that I couldn't efile due to forms included in my return. This needs to happen with returns that include form 5329.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get TT to include Form 5329? I filled it out in TT but it is not included when I reviewed and printed my forms prior to filing.

*How* did you fill out the form? There is no way in the online versions that you can do that if you do not have a 1099-R to enter.

If you are using the CD/download desktop version then you can switch to the forms mode and view the form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get TT to include Form 5329? I filled it out in TT but it is not included when I reviewed and printed my forms prior to filing.

I cannot get TT to print form 5329 or the explanation I filled in. I've tried opening the form and then selecting print active form. Every time I do that, I get the message that TT cannot print my return. I've saved my return as a PDF, which still doesn't include form 5329. Any suggestions?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get TT to include Form 5329? I filled it out in TT but it is not included when I reviewed and printed my forms prior to filing.

Try deleting the 5329 form and enter it exactally as I stated:

Enter the forms mode and click on open form. Type in 5329. Choose 5329-T for the taxpayer (first person listed on your tax return), or 5329-S (for spouse - 2nd person on tax return).

Scroll down to Part IX line 52 and enter the RMD amount that should have been taken. On line 53 enter the amount of the RMD that was actually taken (probably zero if it was missed).

Then in the box right under line 53 "Waver of Tax Smart Worksheet" enter the same amount as line 52 (the RMD amount). Then click the "Explanation" button and enter the reason for missing the RMD and your statement requesting a waver.

I will attach a couple of screenshots. The first is where I entered the data and explanation statement button.

The next two are the tax return printed for filing 5329 and explanation statement.

I works fine for me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get TT to include Form 5329? I filled it out in TT but it is not included when I reviewed and printed my forms prior to filing.

Thanks. It seems to be another TT glitch. Once I closed TT and reopened the program, I was able to print the form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get TT to include Form 5329? I filled it out in TT but it is not included when I reviewed and printed my forms prior to filing.

I don't know that that helped, but as long as it works now that's good.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get TT to include Form 5329? I filled it out in TT but it is not included when I reviewed and printed my forms prior to filing.

They were 3 dates late and they didn't send me the form 1099-R but they sent me the form 5329. I did get the money sent to me. How do I handle getting the money?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get TT to include Form 5329? I filled it out in TT but it is not included when I reviewed and printed my forms prior to filing.

@Ralph Blythe Your 1099-R may still be in the mail on its way to you. Please give it another day or two.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mg_melinda

New Member

jfreberg

Returning Member

dennis81

New Member

rmurphy65

New Member

lisaplunkett1128

New Member