- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

Try deleting the 5329 form and enter it exactally as I stated:

Enter the forms mode and click on open form. Type in 5329. Choose 5329-T for the taxpayer (first person listed on your tax return), or 5329-S (for spouse - 2nd person on tax return).

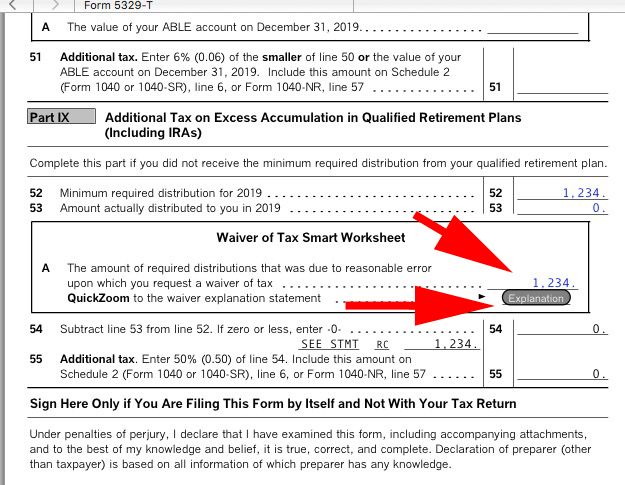

Scroll down to Part IX line 52 and enter the RMD amount that should have been taken. On line 53 enter the amount of the RMD that was actually taken (probably zero if it was missed).

Then in the box right under line 53 "Waver of Tax Smart Worksheet" enter the same amount as line 52 (the RMD amount). Then click the "Explanation" button and enter the reason for missing the RMD and your statement requesting a waver.

I will attach a couple of screenshots. The first is where I entered the data and explanation statement button.

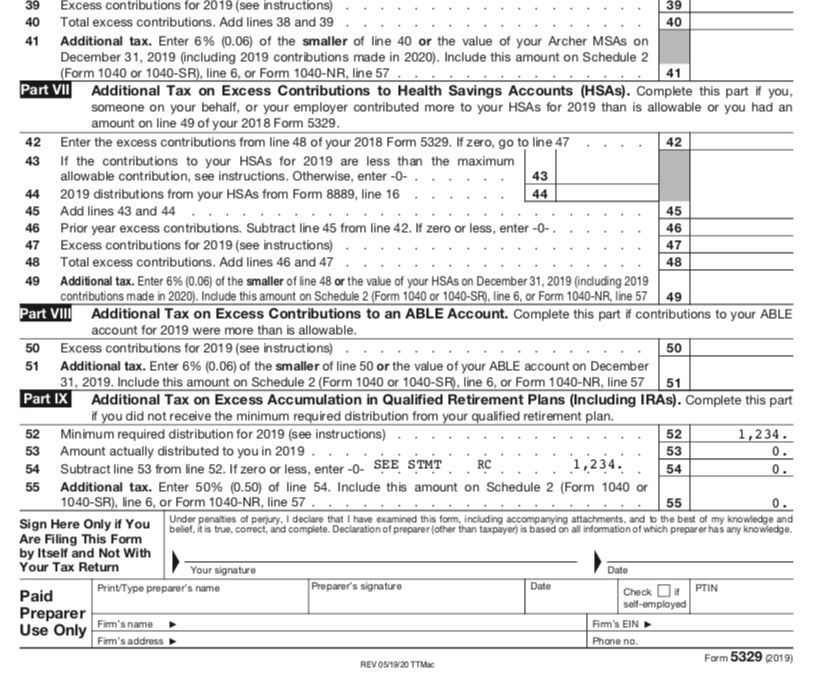

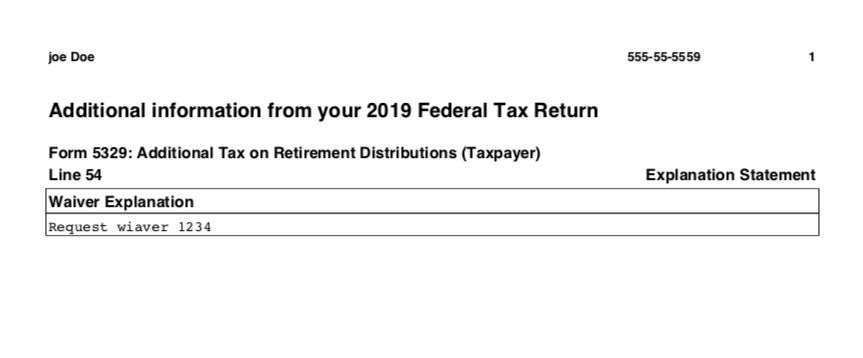

The next two are the tax return printed for filing 5329 and explanation statement.

I works fine for me.