- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- How do I fill out the form without the babysitters social security number? She watched my child so I could work

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I fill out the form without the babysitters social security number? She watched my child so I could work

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I fill out the form without the babysitters social security number? She watched my child so I could work

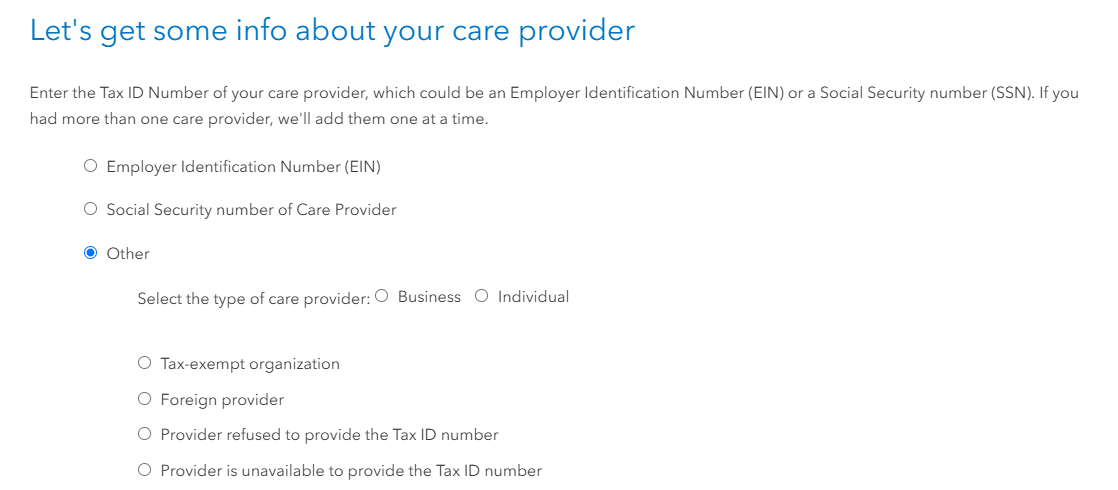

If the provider is refusing to provide this information, here is how you enter this.

When you get to the area where you enter the provider information, select other for the provider tax id number. In your situation, you would select that it is an individual, enter their name and check the box for provider refused to provide Tax id number.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I fill out the form without the babysitters social security number? She watched my child so I could work

See if she will obtain a Tax ID instead so that she does not have to give out her SSN. It is easy to get a Tax ID on the IRS site.

https://www.irs.gov/businesses/small-businesses-self-employed/how-to-apply-for-an-ein

If the problem is that the sitter does not want to pay tax on their income and will not cooperate---you have a different problem. There should have been a clear understanding when you began to use the sitter that you would need tax information and would be seeking the childcare credit on your tax return. The sitter may get upset, and you may need to seek a new sitter.

When a childcare provider will not give you a SSN or Tax ID

If they still refuse to provide an EIN or SSN, send your provider a W-10 (Request for Taxpayer Information and Identification Number). You can get a copy of the W-10 by clicking here: W-10 Form & Instructions Complete as much of the form as you can and send it via certified mail (after making copies for yourself).

If the provider does not respond within 10 business days, you can still file your return. However, you won't be able to e-file. Print and mail in your return, along with an explanation and a copy of the W-10 you sent your provider.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

cpelt006

New Member

nathan-c2423

New Member

pendicott62

New Member

Landlady J

Level 2

deejaybee727

New Member