- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- How do I enter my Massachusetts Paid Family Leave (Form 1099) as non-taxable in Turbo-Tax? IRS hasn't provided any guidance and I believe it should not be deemed taxable

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter my Massachusetts Paid Family Leave (Form 1099) as non-taxable in Turbo-Tax? IRS hasn't provided any guidance and I believe it should not be deemed taxable

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter my Massachusetts Paid Family Leave (Form 1099) as non-taxable in Turbo-Tax? IRS hasn't provided any guidance and I believe it should not be deemed taxable

@ateeven - if you believe it is not taxable, then why would you enter it into your tax return?

however, note that the 1099-G form you have will probably be reported to the IRS by the State in any event

As the MASS website states, you should consult with a local tax professional to determine your approach.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter my Massachusetts Paid Family Leave (Form 1099) as non-taxable in Turbo-Tax? IRS hasn't provided any guidance and I believe it should not be deemed taxable

General rule: A for 1099 is not issued for non-taxable income. 2nd general rule: if you got a 1099, the IRS is going to expect to see that income on your tax return.

If you received an erroneous 1099-Misc, you have several choices:

- Ideally, you get a corrected 1099-misc from the payer

- Don't report it on your return. Attach a copy of the 1099 and a statement explaining the circumstances. You can't e-file. From the IRS instructions for form 1099-Misc: Form 1099-MISC incorrect? If this form is incorrect or has been issued in error, contact the payer. If you cannot get this form corrected, attach an explanation to your tax return and report your income correctly.

- Report the income (enter in TurboTax at the appropriate1099 screen ). Then enter a line 8z, Schedule 1, deduction, for the same amount. In TurboTax (TT), enter at:

- Federal Taxes tab

- Wages & Income

Scroll down to:

-Less Common Income

-Misc Income, 1099-A, 1099-C

- On the next screen, choose – Other reportable income - Answer yes to Any other Taxable Income -On the next screen, Enter the number with a minus sign (-) in front. Briefly explain at description. Call it something like "erroneous 1099 received" - Do nothing and hope you can explain it away when & if the IRS contacts you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter my Massachusetts Paid Family Leave (Form 1099) as non-taxable in Turbo-Tax? IRS hasn't provided any guidance and I believe it should not be deemed taxable

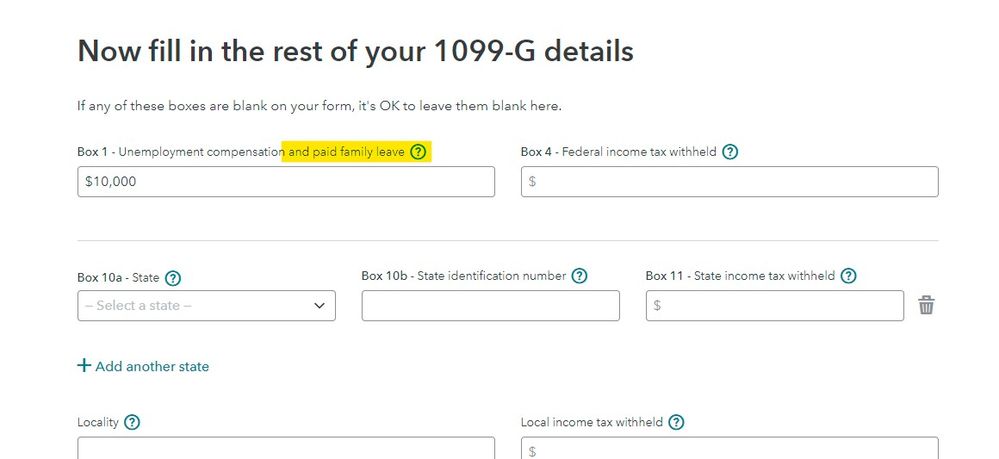

It may not be taxable to the state but the feds will expect the income on the return since a tax reporting form was issued. If the state doesn't tax it then it will be taken care of in the state interview ... pay attention to the screens.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter my Massachusetts Paid Family Leave (Form 1099) as non-taxable in Turbo-Tax? IRS hasn't provided any guidance and I believe it should not be deemed taxable

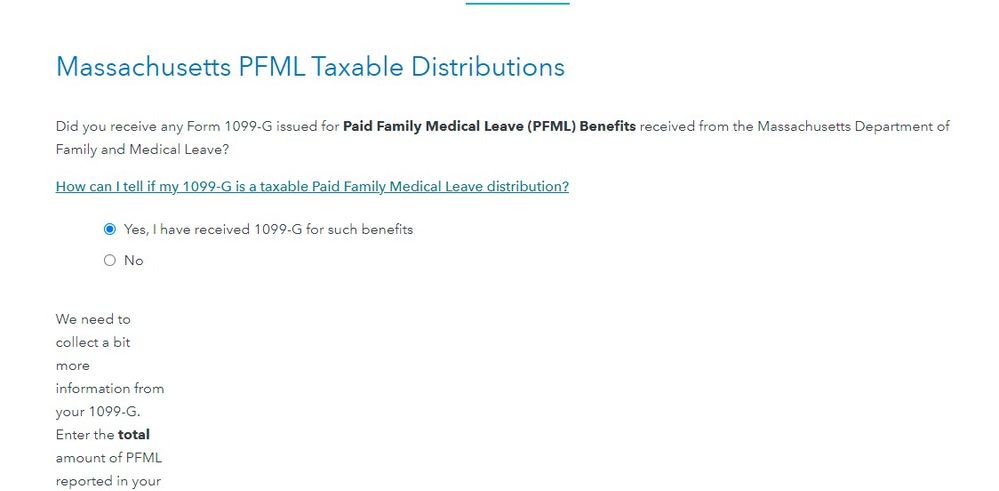

@Critter-3 @Hal_Al - FYI only look at what the MASS website states: that is what is creating the confusion

Taxes on benefits

During your application, you have the option to have state and federal taxes withheld from your weekly benefit. This preference cannot be changed once your application has been approved. If you choose to have taxes withheld, we will withhold 5% for state taxes and 10% for federal taxes.

The IRS has not yet ruled on if your Massachusetts PFML benefits are considered “taxable income.” Without specific guidance from the IRS, the Department cannot provide you with any tax advice or additional guidance. Our recommendation is that you consult with a tax professional. However, you can learn more about how we're preparing for reporting benefits here.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter my Massachusetts Paid Family Leave (Form 1099) as non-taxable in Turbo-Tax? IRS hasn't provided any guidance and I believe it should not be deemed taxable

This must be something relatively new ... so the user can either wait for direction from the feds or file now and amend later.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Vocstra

Level 3

hwilliams7

Employee Tax Expert

tax20181

Level 2

shiyi11

Level 3

BMC763

Level 1