- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- How do I deal with a 1099-G that is taxable at the federal level but not the state?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I deal with a 1099-G that is taxable at the federal level but not the state?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I deal with a 1099-G that is taxable at the federal level but not the state?

We'd love to help you complete your tax return, but need more information. Can you please clarify your question?

What type of income is on your 1099-G and what state are your filing?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I deal with a 1099-G that is taxable at the federal level but not the state?

Thanks Julie. The State of MA made a special $500 payment in 2022 to employees deemed necessary who worked during Covid. The State has ruled this payment is not taxable on State tax return but it is taxable at the federal level. The issue is the software carries the $500 payment (1099-G) over automatically to the State return and will not allow me to over-ride it on the actual tax form if I want to e-file.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I deal with a 1099-G that is taxable at the federal level but not the state?

Massachusetts has not issued guidance on how to properly report your $500 COVID-19 Essential Employee Premium Payment.

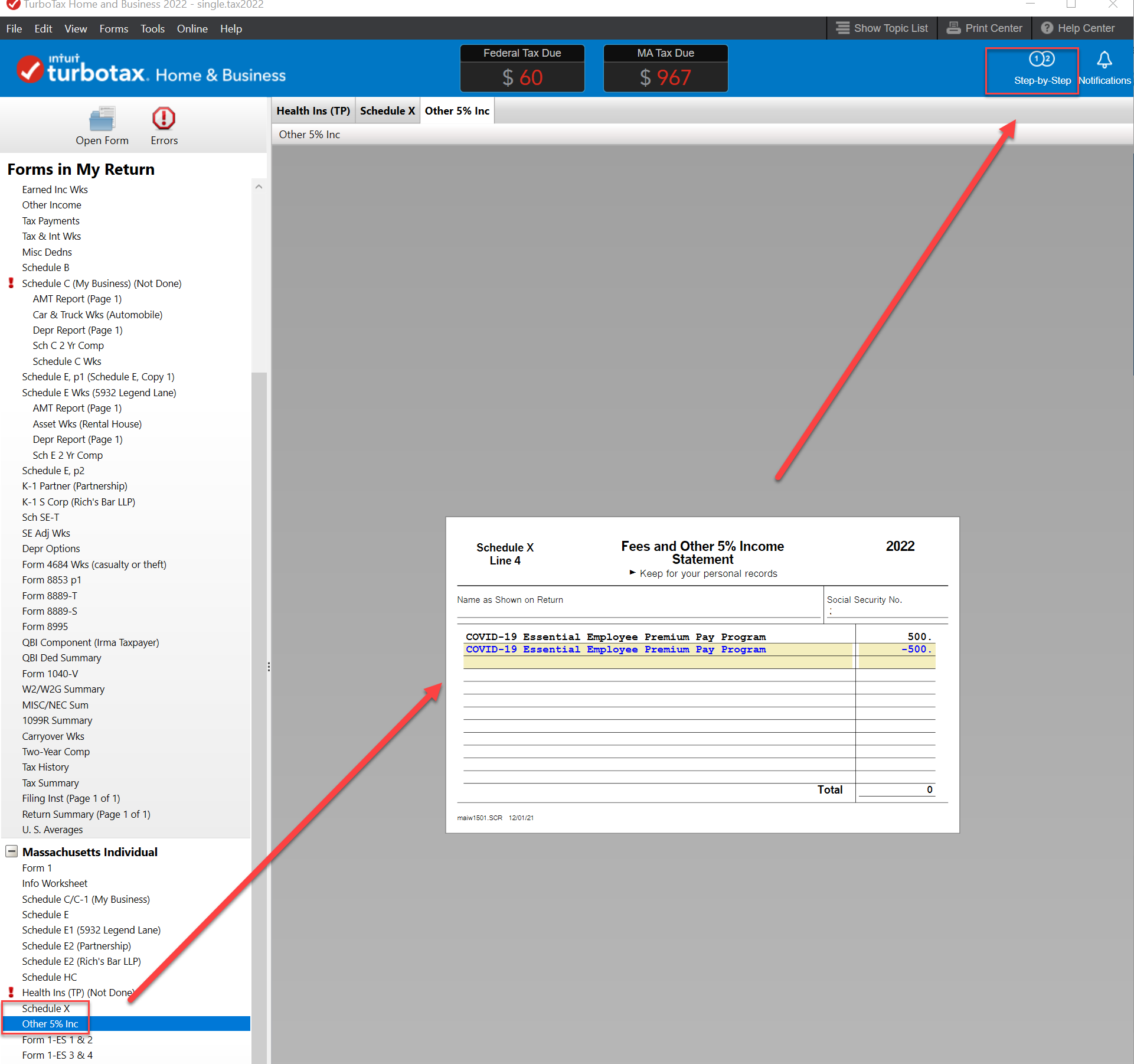

Since you mention an override, I’m assuming your are using TurboTax CD/Download. This is a workaround.

To remove this payment from Massachusetts:

- Tap Forms in the top right corner

- In the left column, Forms in My Return, tap Schedule X in Massachusetts Individual forms

- Scroll down to line 4 (Fees and other 5% income). Your $500 payment should appear there

- Tap the box. A magnifying glass will appear.

- Tap the magnifying glass to bring up Fees and Other 5% Income Statement

- Enter -$500 on this statement

- Tap Step-by-Step in the top right corner to get back to the interview mode

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I deal with a 1099-G that is taxable at the federal level but not the state?

How do i fix the the MA tax form on the online version? I entered in the MA COVID-19 Essential Employee Premium Pay of 500.00 on the federal and now I need to correct it so that it is not taxed on the MA taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I deal with a 1099-G that is taxable at the federal level but not the state?

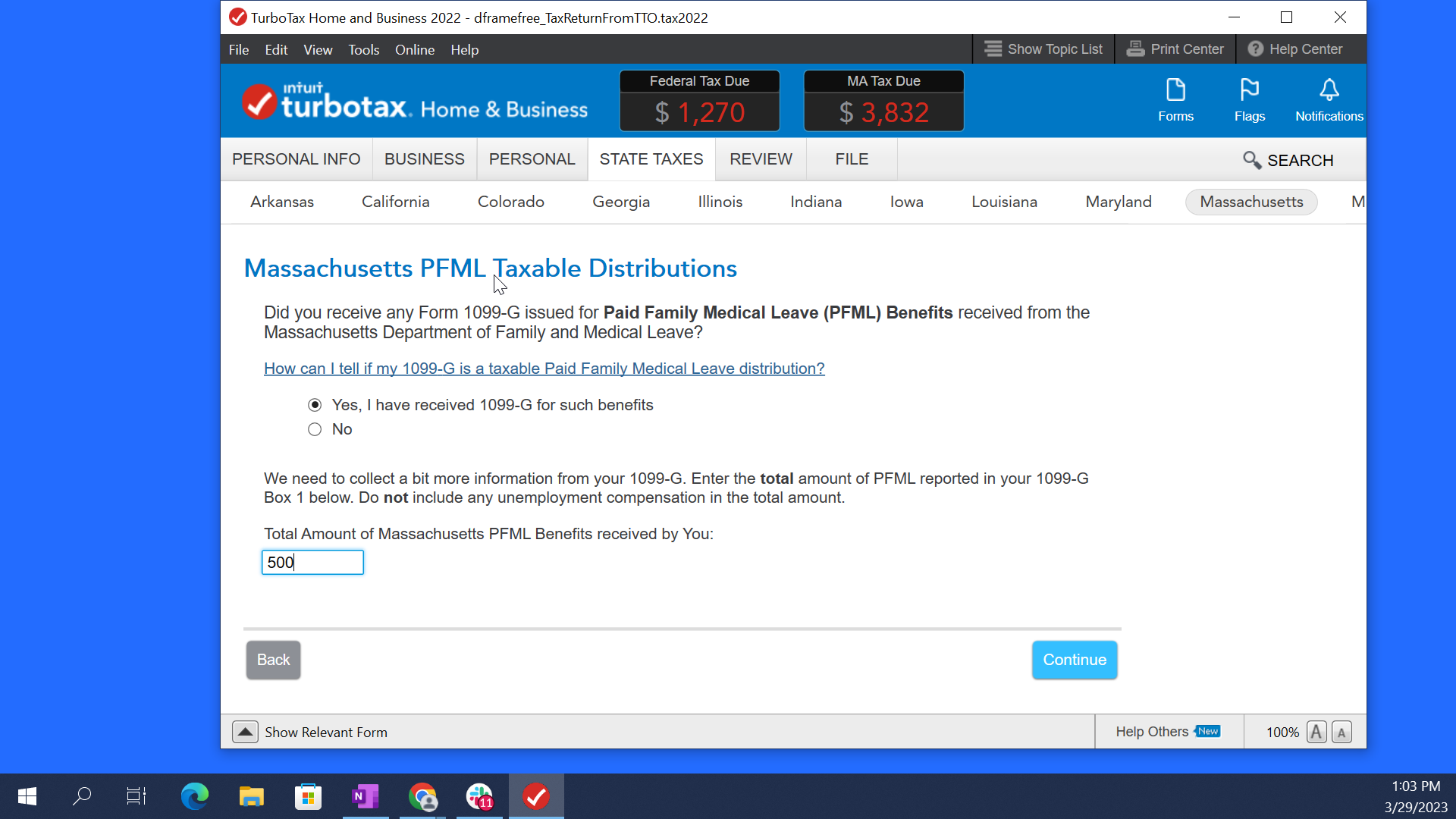

Was this issued as a Paid Family leave (PFML) benefit? if so, there is a section in your Massachusetts State Return where you report this. It is a screen that looks like this.

Select the State Taxes tab in your return to begin working on your state return in order to access this section.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

blueworm9

New Member

user17638037803

Level 1

Raph

Community Manager

in Events

Ryan_TX

New Member

mytax26

Level 2