- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- How do I add my social security

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I add my social security

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I add my social security

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I add my social security

To enter Social Security income please follow these steps:

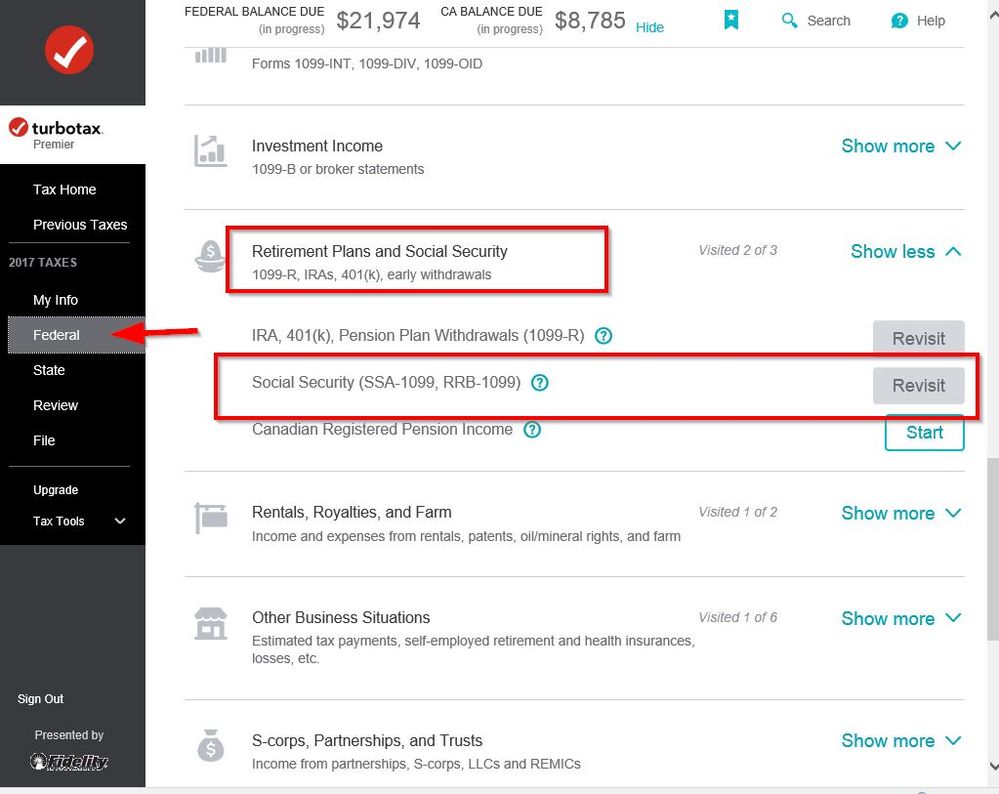

- Click on Federal Taxes > Wages & Income.

- In the Retirement Plans and Social Security section, click on the Start/Revisit box next to Social Security (SSA-1099, RRB-1099) [See Screenshot #1, below.]

- On the next screen, Social Security Benefits, mark the Yes box and click Continue. [Screenshot #2]

- On the screen Tell Us About the Benefits You Received, mark the box for Social Security benefits (Form SSA-1099). [Screenshot #3]

- A set of boxes will appear for you to enter the Social Security benefits for you and your wife. [Screenshot #4]

- Click Continue when done.

- The next screen will ask if you received any lump-sum payments. Mark the appropriate button and click Continue. [Screenshot #5]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I add my social security

I followed your instructions and my ssa earnings was not added to my total earnings?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I add my social security

Social Security is not "earnings." Social Security you entered is shown on lines 5a and 5b. Depending on how much other income you had, the SS may not be taxable. Your total income is on line 6 of your Form 1040.

TAX ON SOCIAL SECURITY

Up to 85% of your Social Security benefits can be taxable on your federal tax return. There is no age limit for having to pay taxes on Social Security benefits if you have other sources of income along with the SS benefits. When you have other income such as earnings from continuing to work, investment income, pensions, etc. up to 85% of your SS can be taxable.

What confuses people about this is that before you reach full retirement age, if you continue working while drawing SS, your benefits can be reduced if you earn over a certain limit. (For 2017 that limit is $16,920 —for 2018 it will be $17,040—for 2019 it will be $17,640) After full retirement age, no matter how much you continue to earn, your benefits are not reduced by your earnings; your employer will still have to withhold for Social Security and Medicare.

To see how much of your Social Security was taxable, look at lines 5a and 5b of your Form 1040

https://ttlc.intuit.com/questions/1899144-is-my-social-security-income-taxable

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I add my social security

yes, but I do not see any place

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I add my social security

yes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I add my social security

yes, I do not see for form to add SSA

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I add my social security

Try going to the search box and type in SSA-1099 or Social Security Benefits. That will give you a Jump To link to take you directly to it.

OR

Enter a SSA-1099, SSA-1099-SM or RRB-1099 under

Federal Taxes on the left side or top

Wages and Income

Then scroll down to Retirement Plans and Social Security

Social Security (SSA-1099. RRB-1099) - click the Start or Revisit button

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I add my social security

Have not yet mailed it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I add my social security

Yes, Don't know why it missed it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I add my social security

How do I go back to my Tax Returns to edit/add income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I add my social security

If you haven't efiled or mailed your return or it rejected you can go back in and change anything you want. Do not click on Amend!

Click on Add a State to let you back into your return.

From Tax Home (the first screen you see after you sign in), scroll down to Your tax returns & documents. You may have to select Show to open the drop down.

Select 2020, and then select Add a State (you're not actually adding a state, this is just the workaround).

Then when you are ready to file you can try to switch to efile.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

cabg

New Member

uniformgc1177

New Member

mcr12121212

New Member

Wendylynn21

New Member

jagunlabi

New Member